- Bitcoin fell 4% on Monday.

- A bigger price correction may be on the horizon.

- AI arms race sends ripples through the market.

Bitcoin’s price took a dip on Monday, briefly falling below the $100,000 mark before recovering. Despite regaining its footing, the top cryptocurrency remains down 4% over the past 24 hours amid broader investor unease.

Analysts pointed to the buzz surrounding DeepSeek, a Chinese artificial intelligence startup, and its AI model that operates at a massive discount to its US rivals, including Sam Altman’s OpenAI.

Carlos Guzman, analyst at crypto market maker GSR, told DL News that China’s AI push has given investors pause over the sector’s valuation and the primacy of US companies in the emerging market.

“The market has taken this as a potential negative sign for the valuation of the top US technology companies, particularly Nvidia, whose valuations have reflected an AI premium,” Guzman told DL News.

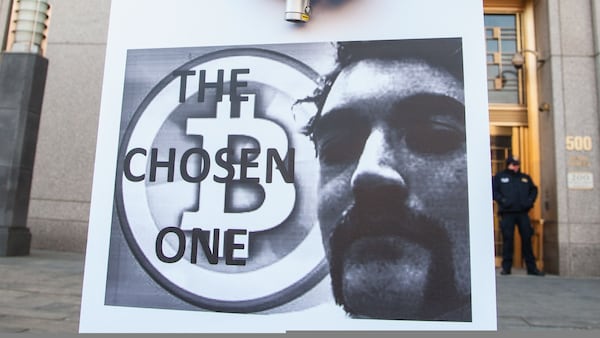

BitMEX co-founder Arthur Hayes predicted that Bitcoin could be heading for a massive price correction, at least in the short term.

“I am calling for a $70,000 to $75,000 correction in Bitcoin, a mini financial crisis, and a resumption of money printing that will send us to $250,000 by the end of the year,” Hayes said on X on Monday.

Hayes, who is the chief investment officer at investment fund Maelstrom, previously predicted that Bitcoin would follow a similar pattern to last year’s price movements. His analysis forecasted Bitcoin reaching a new peak in the year’s first quarter, followed by summer doldrums and a return to the bull market in the latter half of the year.

Monday’s slump is the latest entry in Bitcoin’s volatile start to the year.

Still, analysts say the asset will double in price this year even if investors endure some short-term pain.

AI-driven market jitters

Bitcoin’s slump on Monday tracked a massive plunge in the US stock market as technology companies saw their stock prices slide.

Chip-making giant Nvidia’s stock price has fallen 11.4% in the last 24 hours amid a broader rout in technology stocks.

“It seems clear that we are now in an aggressive AI arms race,” Sebastian Pfeiffer, managing director of decentralised cloud platform Impossible Cloud Network, told DL News.

Despite the negative market reaction to the emerging AI competition from China, crypto market analysts say digital assets will bounce back quickly.

According to Kevin Rusher, founder of real-world asset tokenisation platform RAAC, the market turmoil is unlikely to hurt crypto for much longer.

“Crypto will probably be one of the biggest beneficiaries of growth in AI, where it comes from,” Rusher told DL News.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please contact him at osato@dlnews.com.