- FDUSD has crossed $1 billion in total value in circulation.

- Binance has pushed the stablecoin as an alternative to BUSD.

- FDUSD is the sixth-biggest stablecoin.

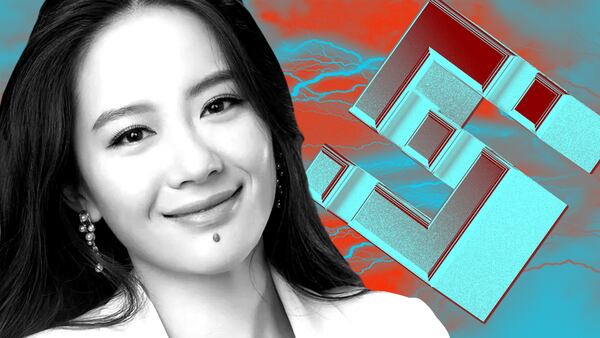

FDUSD, a dollar-pegged stablecoin issued by Hong Kong-based finance outfit First Digital Limited, has exceeded $1 billion in value in circulation for the first time.

The milestone comes after a Binance campaign encouraging users to swap the exchange’s BUSD stablecoin for other stablecoins. Binance has told users that they can convert BUSD to FDUSD for free on the exchange.

To further encourage FDUSD adoption, Binance launched zero-fee trading for six FDUSD trading pairs on Monday. Exchange users can now trade between First Digital’s stablecoin and six other crypto assets: BNB, Dogecoin, Ether, Chainlink, Solana, and Ripple.

They can trade in both spot and margin trading markets and pay no fees.

The exchange also offers users a 10% annualised yield on FDUSD deposits.

A BUSD alternative

Binance has gradually withdrawn support for BUSD after the New York Department of Financial Services ordered BUSD issuer Paxos to stop minting the tokens in February.

BUSD holders have until a February deadline to exchange their stablecoins. After that date, Paxos may no longer honour redemptions.

In addition to problems with the NYDFS, the US Securities and Exchange Commission has also threatened to sue Paxos on the grounds that BUSD is an illegal securities offering.

Before its regulatory problems, BUSD was the third-biggest stablecoin. Its circulation reached a peak value of over $23 billion in November last year, but has since dropped to just $1.6 billion.

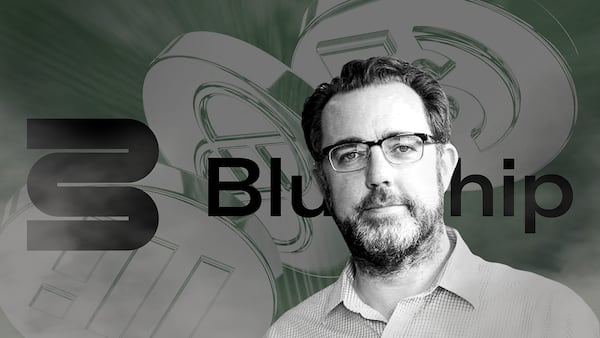

Despite its regulatory woes, BUSD is the highest-rated stablecoin along with Liquity’s LUSD, according to Bluechip, a non-profit agency that rates stablecoins. BUSD received an A grade, the second-highest grade, and is described as “one of the safest stablecoins to hold.”

Bluechip based its rating for BUSD on the fact that it is issued by Paxos, a New York-regulated entity, among other factors.

Conversely, FDUSD only received a C rating as it is not issued by a regulated entity. Bluechip also said that the reserve backing for FDUSD was not “bankruptcy remote,” meaning that if First Digital were to declare bankruptcy, FDUSD could lose its backing.

Tether, the largest stablecoin with a $89 billion market capitalisation, received a D rating from Bluechip.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.