As some $1.85 billion worth of Bitcoin options contracts are set to expire tomorrow, bearish and bullish traders are almost evenly pitted against each other.

The tug of war between the optimistic bets – or calls, and pessimistic ones – or puts, “looks neutral” as the expiry date of the derivatives nears, Darius Tabatabai, co-founder of decentralised exchange Vertex Protocol and a former Credit Suisse trader, told DL News.

Bitcoin options are a type of derivative contract that grant the purchaser the right, but not the obligation, to buy Bitcoin at a predetermined price at a future date.

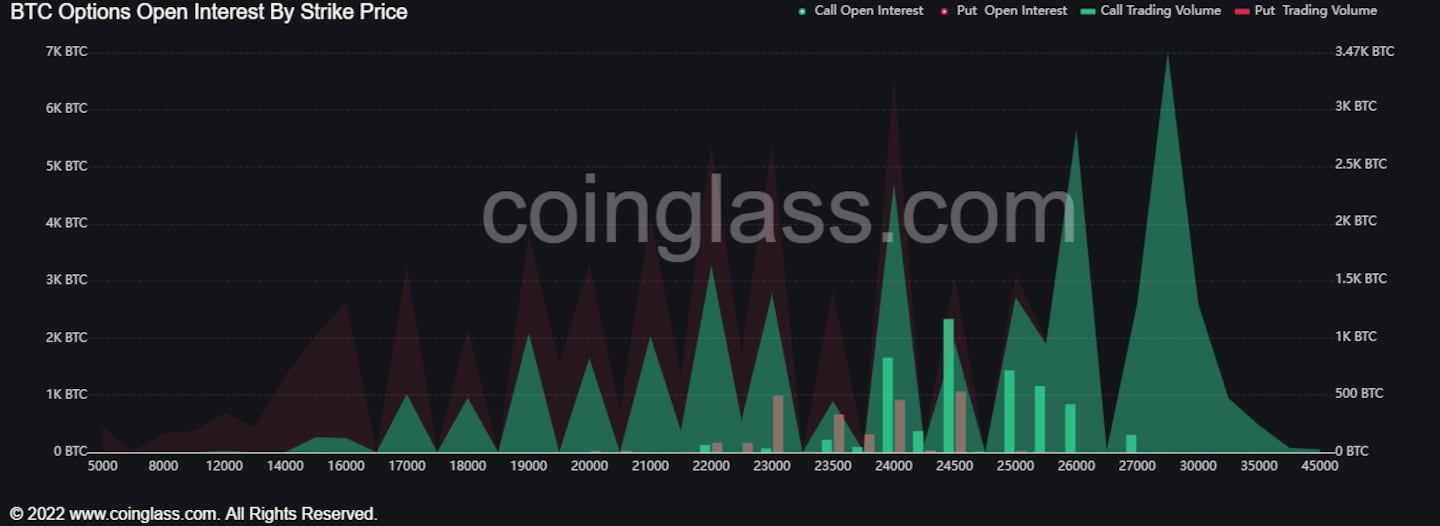

Bitcoin bears have been piling into bets that recent regulatory pitfalls will act as a drag on the crypto’s price. Bulls will win out should that regulatory crackdown look overly pessimistic. Tabatabai explained that because calls and puts are relatively balanced, market makers could keep the top cryptocurrency pinned close to the current $23,500 to $24,500 trading range.

Bitcoin’s put-to-call ratio – derived by dividing the number of traded put options by the number of traded call options – sits at 0.67 for the February 24 expiry, indicating only a slight bullish bias. Because traders typically buy more calls than puts, a ratio of less than 0.7 is usually considered bullish, as it means significantly more calls were bought versus puts.

However, despite the neutral outlook, bears may try to push Bitcoin’s price toward its “max pain” level at $22,000.

Each option contract has a strike price. Only when the price of the underlying asset moves above this price for call options or below for puts does the contract make money.

Max pain, or the max pain price, is the strike price at which the largest number of options contracts expire at no profit. It suggests that the price of an underlying asset tends to gravitate towards its max pain strike price as market makers hedge their positions to remain neutral.

Currently, Bitcoin call options skew toward the $26,000 and $28,000 strikes, with another spike at $24,000. While puts are more distributed, there is also a large spike in volume at the $24,000 strike, making it a battleground price.