- Bitcoin ETFs from BlackRock, Fidelity and other giants would force crypto players to adapt, says Matteo Dante Perruccio of Wave Digital Assets.

- Regulatory crackdown provides finance giants with a competitive advantage thanks to decades of compliance, says Itay Tuchman, an ex-Citigroup executive.

- Coinbase, Binance and other crypto players may need to morph into service-providers for Wall Street firms, says Florian Rais, an ex-Pictet executive.

There’s no reason to fear traditional finance.

This has been a common refrain among crypto founders ever since Fidelity Investments, BlackRock and other Wall Street giants started pushing into the sector. With their millions of clients and asset management platforms, these players will create more volume, grow “the pie,” and ultimately benefit everybody in the industry. That’s been the idea.

But finance veterans who now work at crypto firms reject that argument. They warn that digital assets companies should be wary of being outmuscled by financial giants that are better resourced and more widely trusted by both investors and regulators.

Companies that will suffer

Matteo Dante Perruccio, a former board member at British fund giant Jupiter Asset Management, told DL News the trend among asset managers to launch crypto exchange-traded funds (ETFs) may see smaller firms “fall by the wayside”.

“Who in their right mind would buy spot exposure to Bitcoin from a relatively unknown crypto-native provider if BlackRock has the same product at the same price?” said Perruccio, who is now president international at crypto asset manager Wave Digital Assets.

“The companies that will suffer are the ones that have built a business model simply on access,” he continued. “That is becoming less of a premium, and less of a unique capability. If you don’t have scale, you are going to struggle making any money doing it.”

‘Who in their right mind would buy spot exposure to Bitcoin from a relatively unknown crypto-native provider if BlackRock has the same product at the same price?’

— Matteo Dante Perruccio

BlackRock, Invesco and WisdomTree have all launched applications for spot Bitcoin exchange-traded funds this summer. These products, known as ETFs, track securities such as stocks and bonds, and indexes of those securities. Even better, they are super-cheap to buy and trade.

Crypto ETFs are designed to track the price of digital assets such as Bitcoin or Ether and give investors exposure to tokens without having to directly own and store the asset.

NOW READ: How arrival of Ethereum futures ETF may trigger ‘brutal fee competition’ between fund providers

They are part of a wave of traditional giants pushing into crypto. Deutsche Bank, Citadel Securities, Charles Schwab and Fidelity’s crypto exchange EDX Markets went live on June 20.

And many of the world’s biggest investment banks, including Goldman Sachs, JPMorgan Chase, and Nomura have hundreds of people working on digital assets-based offerings.

The crypto land grab by traditional financial institutions is setting up a contest for market share in the months to come. And would-be crypto ETF providers will have to counter the sheer scale of the finance industry with innovation, Perruccio said. For example, funds may try to introduce new products that offer exposure to staked Ether and its potential yields.

As a player versed in the businesses of both traditional and crypto-native outfits, Peruccio said the next phase of the digital assets story is going to be fraught with drama.

“There is some truth to [the ‘pie’ argument],” he said. “If BlackRock gets this product approved and it becomes available to a wide range of investors, volume will increase and prices will go up. That will allow companies to do a lot of other things. But it would be foolish to think that there will not be losers.”

Competitive advantage

And while crypto giants such as Coinbase and Binance decry the regulatory crackdown that has ensnared them in litigation with US authorities, Wall Street has been complying with existing regulations for decades.

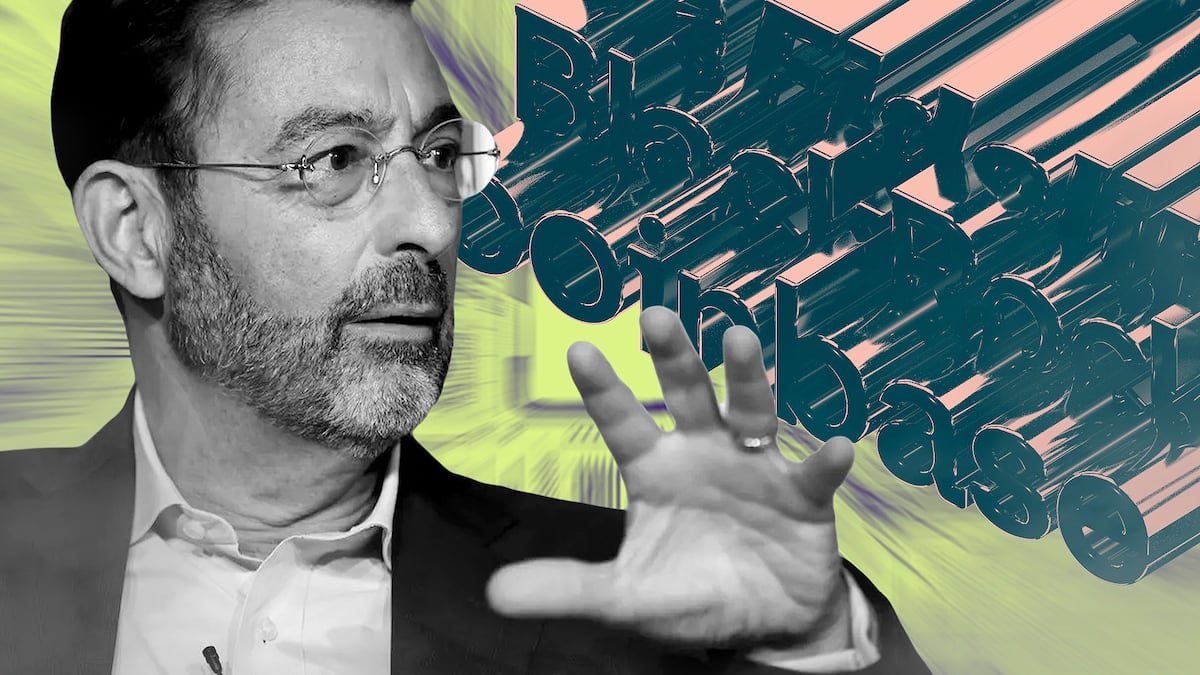

That could be a competitive advantage, said Itay Tuchman, former global head of foreign exchange at Citigroup.

“When robust regulatory standards start to apply, the cost required to adhere to those will be very meaningful for crypto firms,” said Tuchman, who became chief executive of Consello Digital, a digital assets advisory firm, in February 2023.

NOW READ: Coinbase and Binance crank up lobbying push as Congress prepares to debate crypto bills

Those costs include hiring more people across compliance and policy departments to keep up with the regulatory environment.

“That may tilt the balance in favour of very large, well-capitalised organisations that understand the standards required by these regulations,” Tuchman said. “They already live in that world every second of every day.”

‘Some of the more innovative, younger firms have an advantage in technology, technical capability and speed of build.’

— Itay Tuchman

The European Union has already approved its landmark Markets in Crypto Assets law (MiCA) and its member states are now implementing its rules and regulations across the bloc. At the same time, the UK, Singapore and several Middle Eastern countries are moving at pace towards establishing similar rule books.

Even though the Biden Administration has taken a hard line by demanding that crypto firms comply with existing securities laws, there are a number of crypto bills under consideration in Congress. Tuchman said a new framework may eventually fall into place.

PayPal stablecoin

Still, crypto firms do have one advantage over their older and bigger rivals: technological innovation. Echoing Perruccio, Tuchman said this is an area where crypto firms might outpace traditional finance.

“Some of the more innovative, younger firms have an advantage in technology, technical capability and speed of build,” Tuchman said. “If this evolves in the way that other financial services technologies have evolved, there will be some new companies that succeed.”

History is rife with examples. In the early 2000s, PayPal elbowed its way into the crowded payments sector and built a world-beating franchise. As it happens, PayPal recently said it was launching its own stablecoin, which may be integrated into its payment platform in some form.

NOW READ: Coinbase secures approval for futures trading as spot volumes fall to multi-year lows

Meanwhile, digital assets firms may be in for a wave of consolidation in the coming years as big finance firms get more of a foothold in the sector.

“Some traditional players may look to buy some of these crypto native players and embed their resources with [digital assets firms’] technological know-how,” Tuchman said.

Small cogs, big machine

Florian Rais, chief executive of Criptonite Asset Manager, said even the largest crypto players like Coinbase and Binance may struggle to compete as full-service operations as finance firms grow their digital assets offerings.

He sees a potential scenario in which those exchanges wind up providing blockchain-based services such as listing tokens and managing crypto trading for the likes of BlackRock and Goldman.

‘The crypto companies will need to evolve into a model that embraces the large asset managers and banks, and provide them with services.’

— Florian Rais

Already, BlackRock has a partnership with Coinbase which allows the asset manager’s clients to access crypto via its Aladdin investment management platform, announced in August 2022.

Rais was formerly chief operating officer at the foreign exchange firm London Capital Group, and before that was a senior investment manager at Swiss asset manager Pictet.

He said many crypto firms would not like being relegated to a service provider status for large financial institutions. “Crypto was invented by people who wanted to be completely detached from the financial system in general,” he said.

Now the stakes have changed. Crypto companies will need to evolve into a model that embraces the large asset managers and banks, and provide them with services like trading, listing tokens, managing airdrops, Rais told DL News.

“This is the pocket of business where they have a significant advantage. It’s not a one way street,” he said.

It’s going to take time

However, that time may be some way off. Rais said many people in crypto still have little knowledge of how things work at large banks, asset managers and pension funds — the organisations that account for much of the institutionally managed money in the world — which typically take years to make decisions about reallocation of funds.

“They do not appreciate the amount of history, rules and internal regulations that go along with these firms, or how long it actually takes them to introduce a new asset class,” he said.

“They think that just because someone at the top of a large TradFi has decided that crypto is interesting, they will allocate 5% of their funds to Bitcoin tomorrow. That simply isn’t going to happen.”