- Bitcoin miners are starting to build their own AI fleets.

- They may soon start leasing their services to tech giants like Google.

- The strategy opens a new revenue stream for miners that isn’t dependent on Bitcoin’s price.

Artificial intelligence — and the business behind it — is presenting new opportunities for Bitcoin miners.

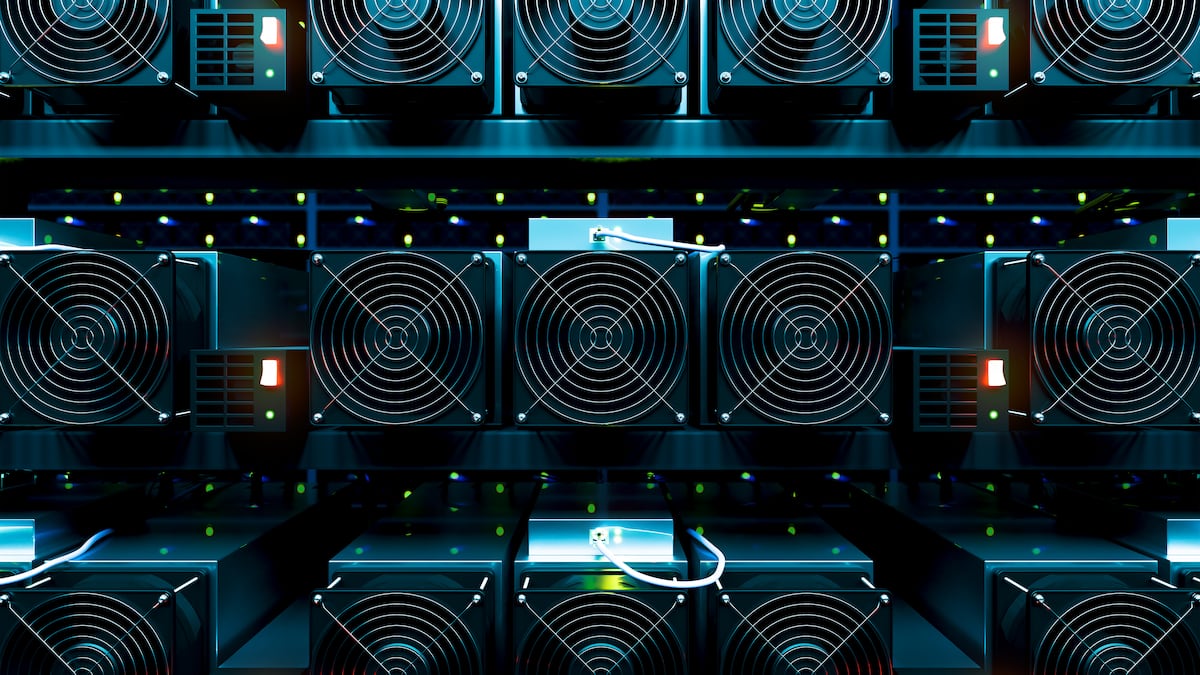

While miners have traditionally relied on Bitcoin rewards as their first and foremost source of income, some firms have recently allocated resources to building their own AI fleets.

By leasing their computing power to tech companies that are developing AI tools, these miners can make sizable and, most importantly, predictable returns. The strategy therefore opens a new revenue stream for miners — one that doesn’t depend on Bitcoin’s volatile price.

“Miners are going to have a huge opportunity moving forward with AI compute,” Brian Dixon, CEO of crypto hedge fund Off The Chain Capital, told DL News.

“Most of these miners can redirect a substantial amount of their computers to basically service Google, Microsoft, Amazon, all these big companies,” Dixon said. “We’re going to see some of these big tech companies do major partnerships with Bitcoin miners.”

Hybrid approach: Hive and Hut 8

At least two major mining companies have begun that process: Hut 8 and Hive Digital Technologies.

Hive CEO Aydin Kilic told DL News that the company’s AI fleet is already operational. Of the firm’s 38,000 graphics processing units, or GPUs — computers that can perform high-speed calculations — a little more than 10% have been repurposed for AI computing tasks.

And Hive is actively looking for more opportunities. “Our ambitious goal is to expand our AI business to achieve an annual revenue exceeding $100 million by 2025,” Kilic said. Hive had $121 million in total revenue in 2023.

Kilic emphasised the resilience that AI computing would bring to the company’s balance sheet — especially in an industry as unforgiving as Bitcoin mining.

Hut 8 chief strategy officer Mike Ho, meanwhile, told DL News that AI computing also presents potentially higher returns than Bitcoin mining does.

While Hut 8′s fleet isn’t operational yet, the firm expects to be diversifying “imminently,” Ho said, pointing to the company’s $40 million purchase of GPUs in October 2023.

Hut 8 also said that it wouldn’t repurpose any of its existing Bitcoin fleet toward AI — instead preferring “deploying the latest generation technology” for that purpose.

Competing industries

The mining industry has been bumping shoulders with the AI industry for a while.

The reason: Miners and AI manufacturers both need a huge number of high-performing processing chips. Miners need high computational power to maintain the Bitcoin blockchain, while AI models are trained on colossal amounts of data.

“Bitcoin ASIC chips have had to compete with strong AI chips demand this cycle, and thus manufacturers have been keen on bulk contracts/purchase options with miners who are flush with cash,” analysts at research firm Bernstein wrote in a recent report. ASIC refers to application-specific integrated circuits, which are chips that can be customised for a specific use.

Not only are miners and AI data centres competing over chips, they’re also looking to acquire similar land sites — sites with low electricity prices in friendly jurisdictions that preferably use renewable energy, like Texas.

Miners have also voiced concerns that AI data centres may be willing to pay higher energy costs than miners. This has led leading mining companies to secure long-term power contracts, Bernstein said.

Acquisitions

Ultimately, Bitcoin miners’ foray into AI could tempt big tech companies such as Google and Amazon to make offers to acquire the miners’ AI clusters, according to Dixon.

“If you’re one of these big tech companies, you have basically two options: You find somebody like a Bitcoin miner that you can retain to do the AI compute, or you buy data centres,” Dixon said. “You can’t build them fast enough.”

“It’s possible we’ll see some of them start buying the mining companies outright,” Dixon added. “Amazon, Google, these big behemoths in the tech space need this AI compute. There’s really no way around it.”

When asked whether they would be open to potentially being acquired, Hut 8 and Hive both said no.

Tom Carreras is a market correspondent at DL News. Got a tip about Bitcoin mining and AI? Reach out at tcarreras@dlnews.com