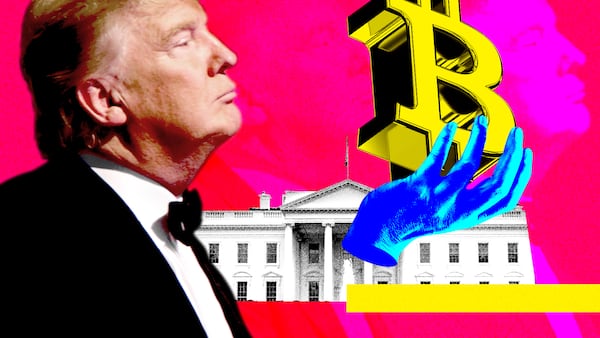

- Bitcoin smashes record for second time in two days.

- Bitcoin’s rally has been fueled by Trump’s election victory and interest rate cuts.

Bitcoin hit a new all-time high on Thursday on the second day of market euphoria following the election of Donald Trump in the US.

The price of one Bitcoin almost hit $76,900 on Thursday, topping the record it had set just 24 hours earlier.

Bitcoin’s latest rally comes as the US Federal Reserve lowered interest rates by a quarter of a percentage point, another sign the country’s central bank considers its three-year fight against inflation largely won.

Interest rate cuts typically benefit equities and cryptocurrencies by lowering the cost of borrowing and, in turn, encouraging investment.

Ethereum and Solana also rallied Thursday, hitting multi-month highs.

Ethereum jumped 2.5% to $2,900, its highest price since August, while Solana gained 3.7% to $197, just $5 off its calendar-year high of $202, according to CoinGecko.

Trump’s win in the US presidential election has been a boon for the crypto industry. Since November 4 — the day before the election — the worldwide value of all cryptocurrencies has increased 13% to $2.6 trillion.

Despite his initial scepticism, Trump has aggressively courted the industry this year, vowing to create a national Bitcoin stockpile, fire Securities and Exchange Commission Chair Gary Gensler, and pardon Ross Ulbricht, the founder of dark web marketplace Silk Road.

Ulbricht is currently serving a life sentence for creating and running Silk Road, a website where users could buy illegal goods and services using Bitcoin.

Mike Novogratz, founder and CEO of crypto investment firm Galaxy Digital, predicted on Thursday a “tsunami of institutional participation” in the crypto economy on the heels of Trump’s triumph.

And UK bank Standard Chartered predicted the election results would send Bitcoin to $125,000 by year’s end.

“We’ve gone from [President Joe] Biden who was proactively negative about the industry, to Trump, who is proactively positive,” Geoff Kendrick, global head of Digital Assets Research at Standard Chartered, said during a Wednesday briefing.

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can contact him at aleks@dlnews.com.