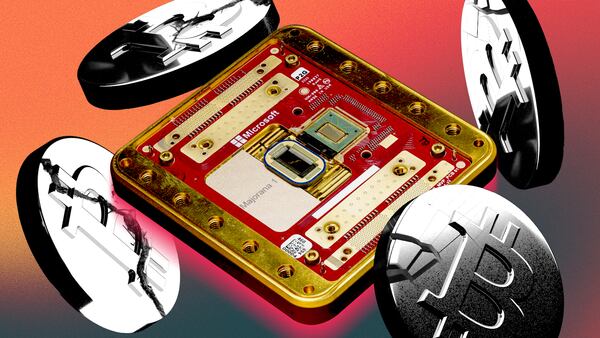

- The crypto market lost more than $276 billion during Tuesday’s market crash.

- Memecoins are the key victims of the collapse.

- Bitwise CIO points to four other crypto trends for longer-term investment.

The high-pitched whooshing sound crypto investors heard this week wasn’t just their portfolios in free fall.

It was also the last gasp of the industry’s notorious memecoin sector. At least, that’s according to Matt Hougan, the chief investment officer at asset manager Bitwise.

The catastrophic launch and crash of several high-profile memecoins in recent weeks has officially muted one of the sector’s loudest and buzziest segments over the past year.

It certainly didn’t help either that funds tied to the record $1.5 billion Bybit hack were then used to launch a memecoin on Solana project Pump.fun, according to Bybit. Pump.fun promptly blocked and removed the token.

The two in tandem, said Hougan, have officially led to “the death of the memecoin carnival.”

And good riddance.

“The overall thesis is the same: The short-term news is bad, the long-term news is good,” he said. “When that happens, I like my money on the long-term.”

What’s next for crypto?

Hougan, whose firm offers several crypto exchange-traded products, said there are four long-term trends he’s holding out for.

What crypto is digesting right now is the end of the memecoin boom. The combination of Melania, Libra, and the Lazarus Group using memecoins to launder stolen ETH will kill it dead. Maybe not today, but within 6 months.

— Matt Hougan (@Matt_Hougan) February 25, 2025

The good news is there are already things ready to replace…

He pointed to the continued growth of the stablecoin market, the rise and return of decentralised finance, crypto adoption among institutional investors, and changing tides on Capitol Hill.

Several key pieces of crypto legislation are working their way through the halls of Capitol Hill, such as one that will establish a clear framework for issuing stablecoins in the US, and another that seeks to define which regulatory agency will oversee the crypto market.

At the same time, the Securities and Exchange Commission has been busy pausing or dismissing investigations into various crypto companies, including Coinbase and Uniswap Labs, as well as Robinhood’s digital assets business.

Although Tuesday also marked the largest record outflows for spot Bitcoin ETFs, Hougan pointed to the billions already invested into these offerings as reason for continued optimism.

He expects these funds to soak up $50 billion by year-end.

The $101 billion DeFi niche is still more than $75 billion off from its record high, but the Bitwise CIO underlined “heightened activity” across lending protocols, derivatives, and prediction markets as signs of a rebirth.

Finally, the $230 billion stablecoin market, or cryptocurrencies pegged to the dollar, has grown by leaps and bounds over the last eight months.

Major fintech players — and even members of the Federal Reserve — are taking a closer look at these tokens, too.

If stablecoin legislation is passed, Hougan predicts the stablecoin market will more than quadruple in size.

With memecoins and nine-figure hacks on the other side of the equation, Hougan is as bullish as ever on the industry.

“This is what I call a no-brainer.”

Crypto market movers

- Bitcoin is holding steady, losing just 0.8% over the past 24 hours to reach $88,267.

- Ethereum is up 1.1% over the same period to trade at $2,455.

What we’re reading

- SEC drops Uniswap Labs investigation ― DL News

- Bitcoin’s Tuesday bloodbath was the bottom, analyst says ― CoinDesk

- Today’s market nuke explained ― Milk Road

- Are Memecoins Collapsing? These 8 Charts May Be Signaling Yes ― Unchained

- Bitcoin is plummeting. Here’s where Arthur Hayes and six experts say it’s headed next ― DL News

Liam Kelly is a Berlin-based reporter for DL News. Got a tip? Email him at liam@dlnews.com.