- Memecoins tied to AI cults are going viral.

- AI-generated memecoins are now a distinct crypto niche due to their popularity.

- Retail traders are piling in.

Crypto’s memecoin market has a new power player: AI cults.

These AI-generated tokens are based on so-called neo-religious themes that have become crypto’s latest cultural phenomenon, especially on Solana. They’re often playful, hinting at the rise of all-powerful artificial intelligence, and there’s typically no AI associated with these tokens, per se.

AI memecoins in total have surged to a $1.7 billion market value.

AI memecoins’ popularity has coincided with a returning buzz in memecoins after a major slump in August and amid sustained interest from retail traders, according to a new report by crypto analytics provider Kaiko.

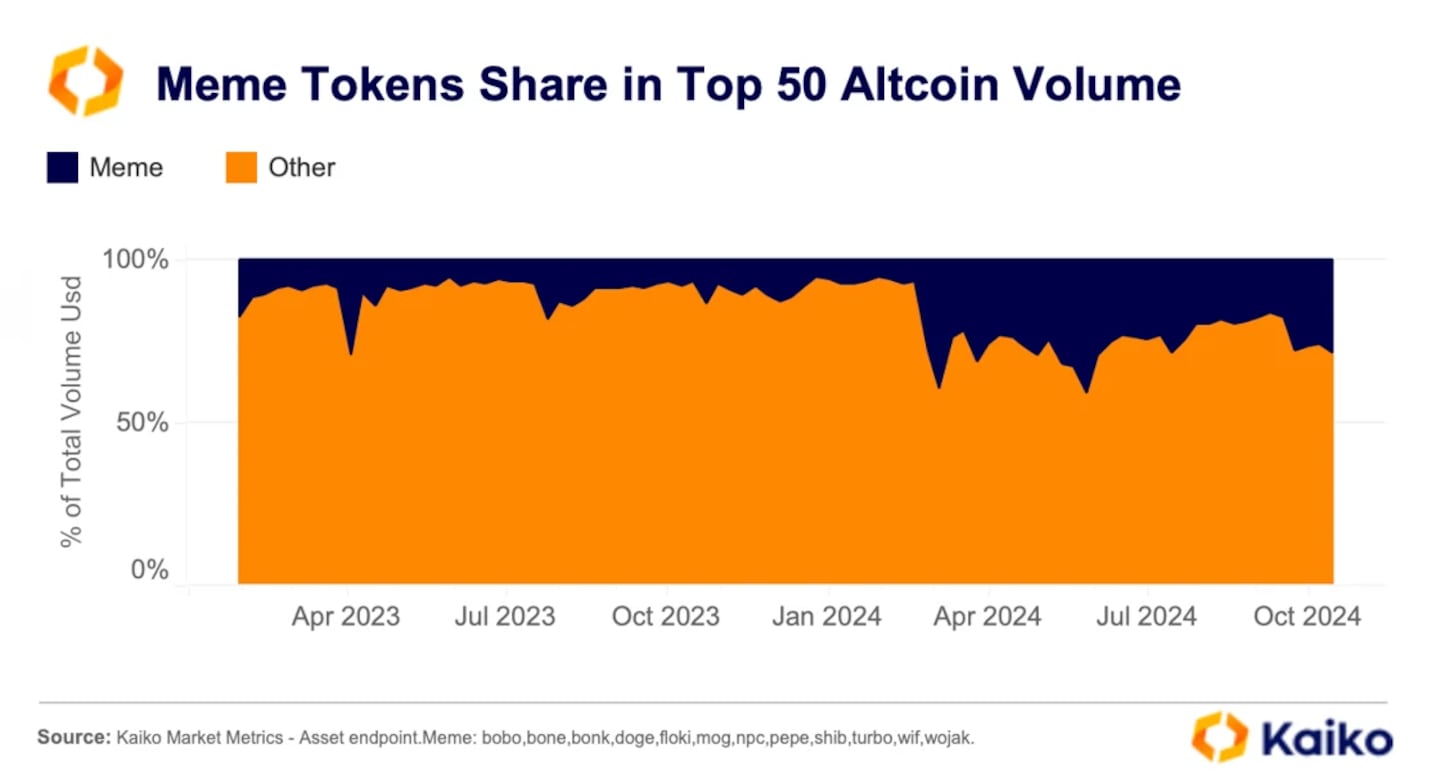

“Average memecoin trading volume has gone up more than five-fold in 2024 compared to last year,” said the report.

One of the most popular AI memecoins is Goatseus Maximus, or GOAT for short, which stirred controversy and confusion last week after it rocketed to a $300 million market size.

As speculation grew that venture capitalist Marc Andreessen was somehow connected to GOAT, he quickly distanced himself from the memecoin.

“I have nothing to do with the GOAT memecoin,” Andreessen posted on X. “I was not involved in creating it, play no role in it, have no economics in it, and do not own any of it.”

Although that may have slowed the hype, it didn’t kill it. GOAT is trading at 43 US cents, up 16% over the last 24 hours.

GOAT has gained a following from some big names, though, including BitMEX founder Arthur Hayes. “When I heard about an AI launching its own memecoin and religion, I immediately aped in,” Hayes said.

The GOAT memecoin became popular after a rumour spread online that it was created by an AI agent. But the AI in question, Terminals of Truth, did not create the token. Instead, the anonymous creator tagged Terminals of Truth which endorsed the token and muddied the story about its origins.

AI cult memecoins

Memecoins draw from viral internet trends and pop cultural references, and the AI cult variety is no different.

AI cult memecoins have contributed to a 39% uptick in crypto trading volume on decentralised exchanges on Solana, according to this Dune dashboard.

According to CoinGecko, Turbo is the biggest AI memecoin, with a $678 million market size.

Toad-themed Turbo bills itself as the “first AI-generated memecoin,” or one created by so-called AI agents.

Memecoin dominance

Memecoins have been crypto’s most active market. The largest memecoins are now worth almost $63 billion in market value, CoinGecko data shows.

That valuation only captures the notable tokens but crypto’s freewheeling memecoin universe expands daily with new coins added to the mix.

According to Kaiko, memecoins averaged $16 billion in trading volume in 2024 ― up from $3 billion last year.

Apart from volume, memecoins also command a greater share of the total crypto market value.

“Their share in the top 50 altcoins by market capitalisation has also grown, increasing from 7% in early 2023 to between 25%–30% in 2024,” Kaiko wrote in a research note on Monday.

Kaiko also noted that memecoins even dominate other cryptos on smaller exchanges where the sector can even approach 50% of the trading volume on such platforms.

Retail appeal

While memecoin activity is still driven by speculative trading, their outperformance of other cryptocurrencies this year is still notable.

Kaiko cited the tendency for hype-driven mania among memecoin communities as part of the reason for the sector’s success.

Also, retail traders tend to view memecoin launches as being fairer than other crypto tokens backed by venture capital investors, Kaiko wrote

That’s because the latter hit the market at inflated valuations but limited token supply as most of the coins are locked up in vesting schedules. Those vested tokens periodically enter the market and dilute the supply leading to massive price decline.

Conversely, memecoins are launched with all of their supply unlocked, which enables more organic price discovery, according to Kaiko.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.