- BlackRock’s iShares Bitcoin ETF set a new record for daily trading volume today.

- The spike in volume comes as Bitcoin’s price hit a new all-time high at over $69,000 before dropping sharply.

- The BlackRock ETF has accrued almost $11 billion in assets in less than two months — the fastest ever for an ETF.

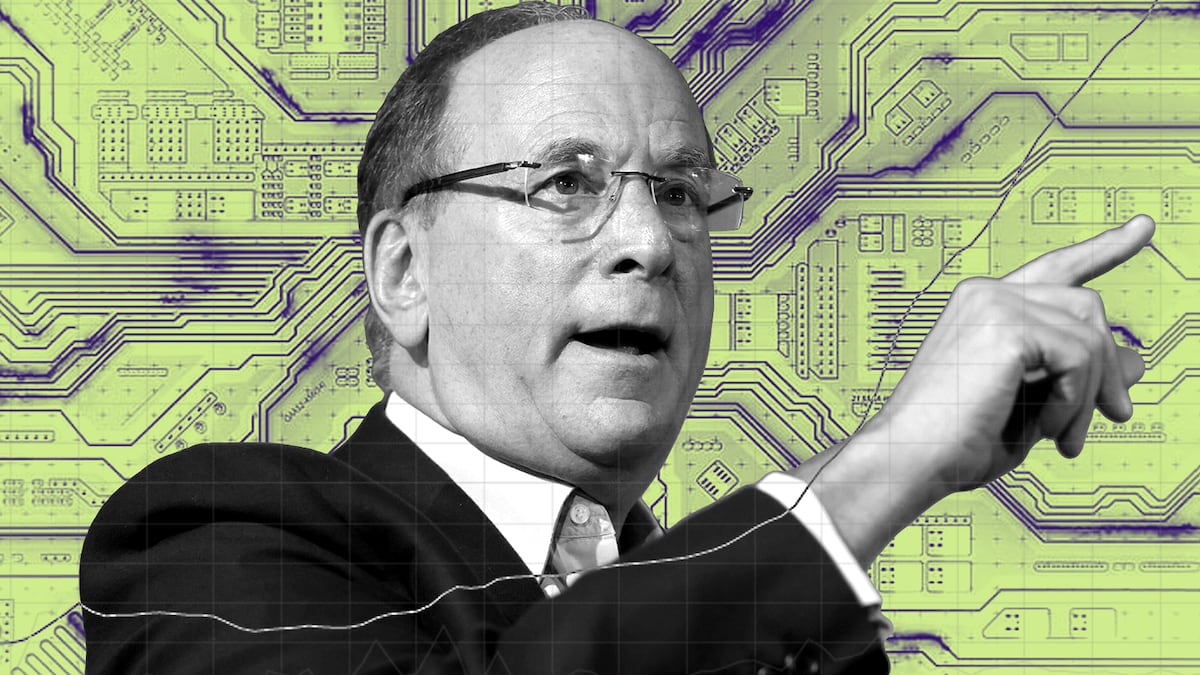

BlackRock’s spot Bitcoin exchange-traded fund set a new daily trading volume record today as Bitcoin hit an all-time high.

The leading cryptocurrency by market capitalisation hit a fresh record above $69,100 on Tuesday, topping its November 2021 record before falling sharply to around $61,000.

Amid the volatility, BlackRock’s iShares Bitcoin Trust ETF saw $3.7 billion in volume, according to TradingView. That’s $400 million more than its previous record of $3.3 billion set last Wednesday.

“These are bananas numbers,” Bloomberg Intelligence analyst Eric Balchunas wrote on X, as he noted record numbers for several spot Bitcoin ETFs.

The iShares fund has outperformed its competition since the US Securities and Exchange Commission approved 10 spot Bitcoin ETFs on January 10. Among its competitors are Fidelity Investments’ Wise Origin Bitcoin Fund — which also set a daily volume record today — and the Grayscale Bitcoin Trust. The ETFs have led the rally in Bitcoin as more mainstream investors place wagers on the digital asset.

In a different post on X today, Balchunas attributed “all or close to all” of Bitcoin’s rally to ETF hype before the SEC’s approval and subsequent flows afterward.

Bitcoin’s price has surged since January 2023, but it was BlackRock’s June 15 filing for a spot Bitcoin ETF in the US that kicked off the ETF hype.

Spot Bitcoin ETFs now have $50 billion in assets under management — $8 billion of which came from inflows, Balchunas wrote.

The iShares fund has $10.7 billion in assets under management less than two months after its launch, making it the fastest-growing ETF ever.

Spot Bitcoin ETFs allow investors to gain exposure to the asset without directly holding it. ETFs are “so damn good at taking something and making it liquid,” Balchunas wrote.

“Cheap, convenient and standardised,” he said.

Tyler Pearson is a junior markets correspondent at DL News. He is based out of Alberta, Canada. Got a tip? Reach out to him at ty@dlnews.com.