- Fink said the advent of analytics and data could help broaden the crypto market.

- BlackRock is committed to producing more cryptocurrency products, the CEO said in an earnings call.

- BlackRock's ETF has a net assets of $24 billion.

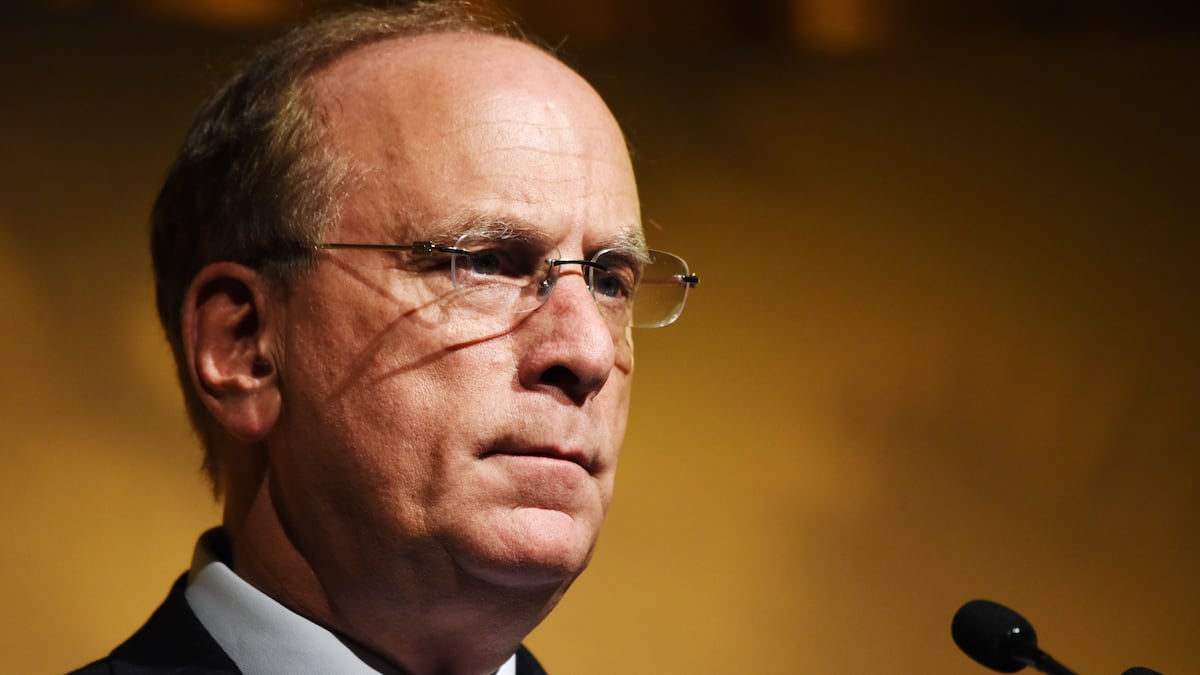

As a young banker at First Boston back in the early 1980s, Larry Fink helped pioneer the creation of mortgage-backed securities, the debt instruments that would explode into a multi-trillion dollar market and rewire the housing market.

On Friday, Fink, now the CEO of BlackRock, harked back to those halcyon days as he discussed the emergence of a new asset class — Bitcoin and cryptocurrencies.

“Years ago, when we started the mortgage market, when the high-yield market occurred, [it] started off very slow,” Fink said during the company’s third-quarter earnings call with analysts on Friday.

“It built as we built better analytics and data, and then better analytics and data, more acceptance, and a broadening of the market,” he continued.

“I truly believe we will see a broadening of the market of these digital assets,” Fink said.

$24 billion ETF

It’s not every day that one of the most influential voices in finance promotes cryptocurrencies as a world-beating new asset class.

Fink has every reason in the world to talk up crypto given the rollout of BlackRock’s Bitcoin exchange-traded fund, which now sports more than $24 billion in net assets.

Yet Fink’s comparison of Bitcoin’s evolution to that of his early days creating mortgage-backed securities — a link that a BlackRock spokesperson explained to DL News — is striking.

The mortgage-backed securities market was worth $11 trillion in 2022, according to a report from the Federal Reserve Bank of New York.

And the instruments, which enable investors to garner exposure to different types of real estate loans, have become one of the pillars of Wall Street.

The market’s expansion over the decades, Fink said, is due to improved analytics, better data, and the sector’s standardisation. The same, he suggested, is coming for crypto.

Ethereum ETF

While sceptics may take issue with his analogy, there’s no mistaking Fink’s bullishness on digital assets.

“This quarter, we launched our Ethereum ETF, which has garnered more than $1 billion of net inflows in the first two months of trading, and follows the successful launch of our Bitcoin product,” said Fink on the call with analysts.

“We will continue to pioneer new products by making investing easier and more affordable.”

UPDATE: Elaborates on BlackRock spokesperson comments.

Liam Kelly is a DeFi Correspondent at DL News. Got a tip? Email him at liam@dlnews.com.