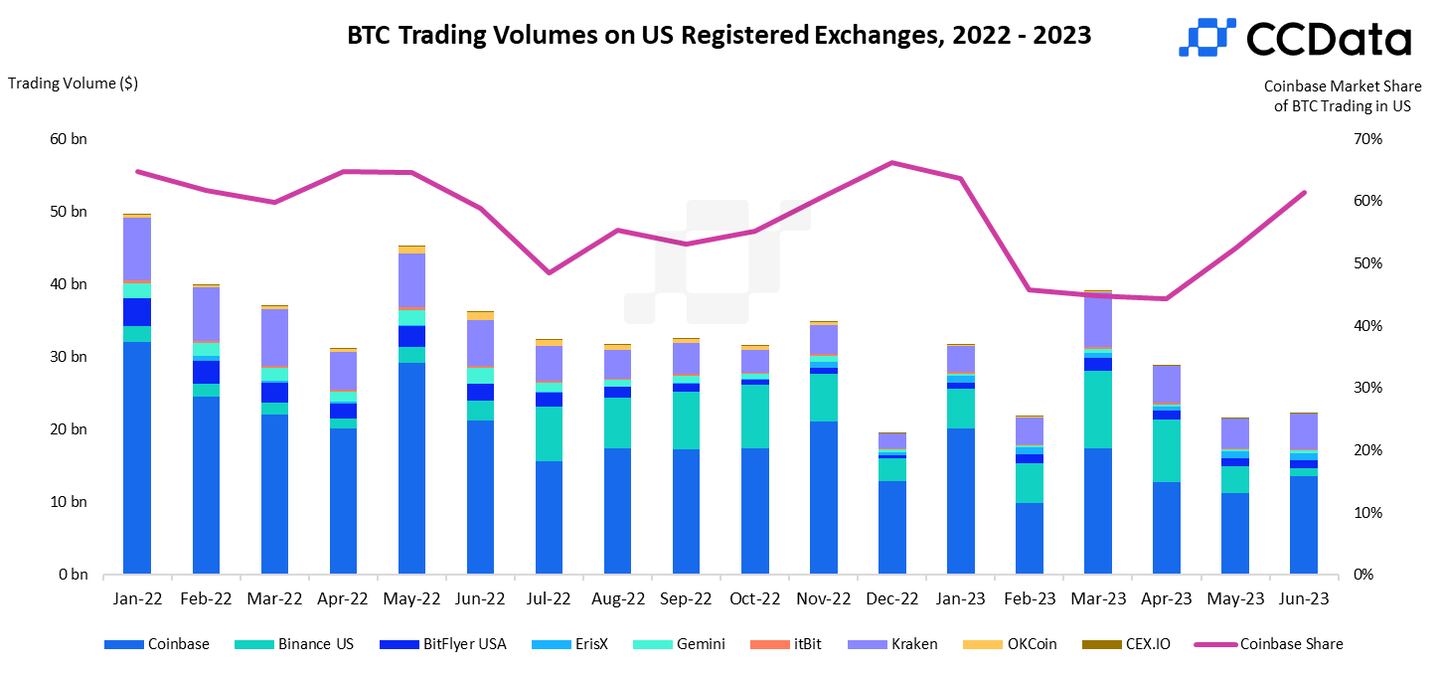

- BlackRock, Fidelity and others chose Coinbase for price surveillance in their spot Bitcoin ETF applications.

- The exchange accounts for just 5.8% of global Bitcoin volume.

- That might be a snag for the Securities and Exchange Commission, which wants surveillance agreements to tackle fraud and manipulation.

Coinbase is relatively tiny on the global stage, which might be a red flag for the Securities and Exchange Commission when it comes to approving spot Bitcoin exchange-traded funds.

That’s according to Jacob Joseph, a research analyst at CCData, who warned that Coinbase’s sliver of market share in so-called spot markets — or instantly priced markets that exclude derivatives — means it has limited visibility of the broader market.

Coinbase, the US’s biggest exchange, makes up just 5.8% of all worldwide Bitcoin trading on centralised platforms.

NOW READ: Larry Fink says Bitcoin is ‘digitalising gold’ in another sign BlackRock is all-in on crypto

Bitcoin ETF applications from Ark Invest, BlackRock, and Fidelity hinge on such surveillance-sharing agreements with Coinbase, which Joseph said was a perplexing choice.

“It is possible that naming Coinbase as the surveillance partner will not be sufficient for the approval,” he told DL News.

“Regardless of whether the volumes are too small to be material in preventing fraud, the largest players in the space seem to be turning to Coinbase for surveillance-sharing agreements.”

The surveillance partnerships, or SSAs, seek to address SEC concerns about manipulation and fraud. The SEC’s contention is that most trading happens outside of the US on exchanges that can be suspectible to manipulation.

The SEC has said a surveillance-sharing agreement with a market of “significant size” might address these.

NOW READ: Fidelity may beat hiring goal for a 500-strong crypto unit in finance land grab

Cboe and Nasdaq refiled applications last week which named Coinbase as the crypto exchange for pricing surveillance.

Valkyrie this week refiled its application for a Bitcoin ETF, also naming Coinbase as its surveillance partner.

The regulator has long maintained the stance that it won’t approve a spot Bitcoin ETF as long as non-US exchanges dominate the Bitcoin markets with their alleged manipulated trading activity, Joseph added.

Coinbase represents over 60% of Bitcoin trading volume in the US. But the country’s market only accounts for 9.5% of the total spot volume globally.

The exchange’s market share is also falling, according to CCData, down just under 0.5% in June.

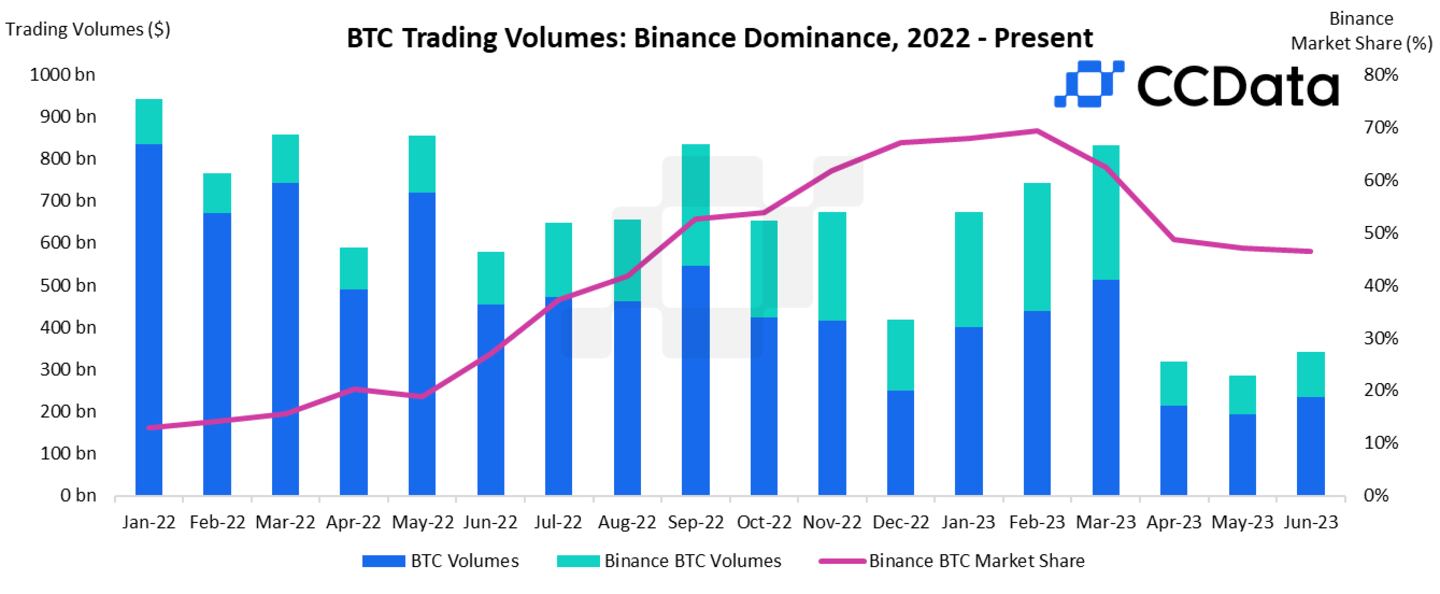

Rival Binance, which is facing regulatory scrutiny across Europe and the US, still has a stranglehold on the market.

The exchange accounts for roughly 50% of Bitcoin trading volumes worldwide, according to CCData.

Undeterred

BlackRock announced its spot Bitcoin ETF application in mid-June — weeks after the SEC sued Coinbase for allegedly operating an unlawful exchange and permitting investors to trade in assets that it failed to register as securities.

NOW READ: Crypto exchange guardrails are coming whether Gary Gensler wins his crusade or not

The agency asked a federal court in Manhattan to order Coinbase to cease operating as an exchange, a broker, and a clearing firm until it complies with securities laws.

The court’s decision could scupper all of the potential surveillance-sharing agreements if Coinbase is forced to cease operations.

NOW READ: BlackRock CEO Larry Fink softens crypto stance further with ‘tokenisation’ push

Coinbase sued the SEC before the filing. The exchange said it was an attempt to force the regulator’s hand.

CEO Brian Armstrong’s firm says cryptocurrencies are instruments that cannot be regulated like stocks and bonds and demand new frameworks for oversight.

Coinbase didn’t reply to our requests for comment.

To share tips or information about Coinbase or another story, please contact the author at adam@dlnews.com.