- Chase UK will bar customers from buying crypto via debit card or bank transfer starting October 16.

- The bank cited a rise in crypto-based scams, pointing to government data showing a 40% rise in the amount lost to such scams.

- Several UK banks have already placed restrictions on how much crypto customers can buy.

Coinbase’s Brian Armstrong lambasted JPMorgan’s Chase UK over its decision to ban its users from accessing crypto.

The bank said on Tuesday that it will bar its customers from buying crypto from October 16, citing an increase in crypto-based scams.Chase UK told customers in an email that, “if we think you’re making a payment related to crypto assets, we’ll decline it.”

“Totally inappropriate behaviour from Chase UK,” Armstrong said on social media platform X. He added that the decision does not respect the policy goals of Prime Minister Rishi Sunak and his economic secretary Andrew Griffith.

“UK crypto holders should close their Chase accounts if this is how they’re going to be treated,” Armstrong told his 1.2 million followers.

Chase UK told customers to look elsewhere if they want to invest in crypto.

“You can try using a different bank or provider instead — but please be cautious, as you may not be able to get the money back if the payment ends up being related to fraud or a scam,” the bank said.

It’s not the first time Armstrong has criticised a major US bank.

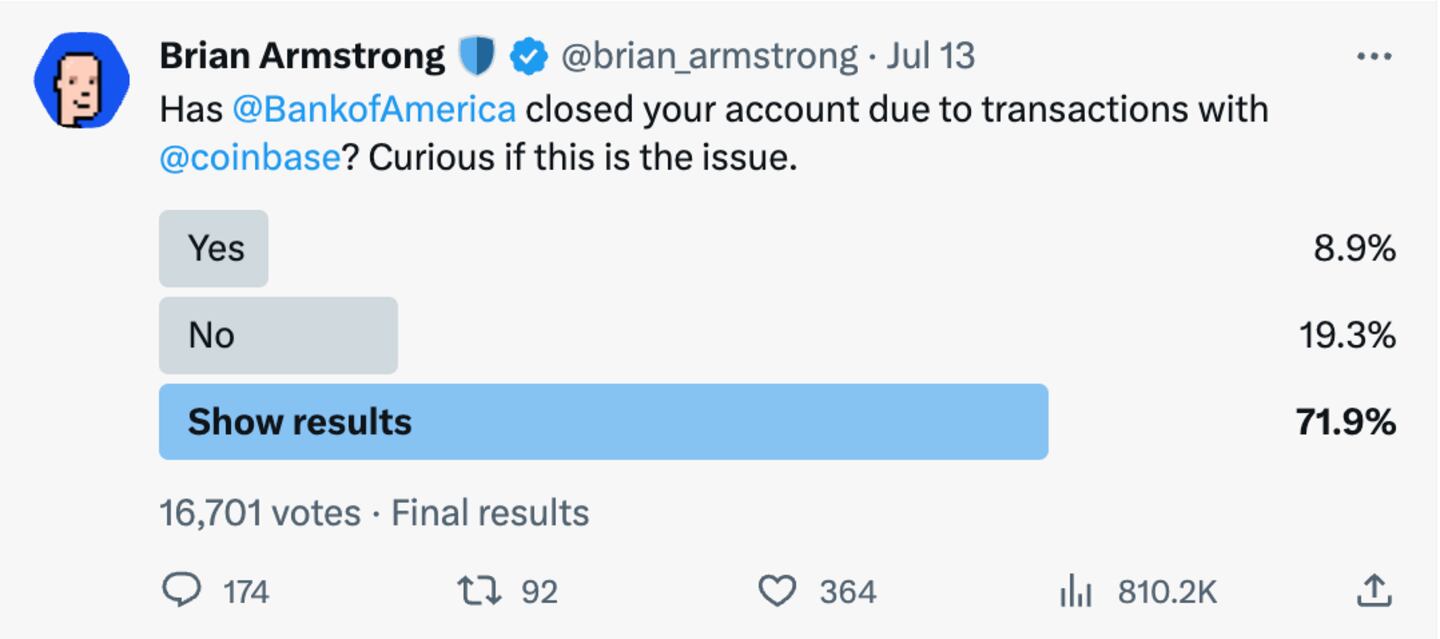

The Coinbase CEO shared a post in July that claimed Bank of America was waging a “war on Bitcoin and crypto.”

He followed up with a poll asking his followers if Bank of America had closed accounts due to transactions with Coinbase.

Over 16,000 users responded, most didn’t answer and instead opted to see the results. Fewer than 9% of people answered yes.

Crypto limits

Chase UK, which debuted in Great Britain two years ago and has less than two million customers, isn’t the first UK bank to limit crypto purchases.

Nationwide, HSBC, Banco Santander, Lloyds Banking Group and NatWest Group have placed limits on how customers can purchase crypto, Bloomberg reported in March.

Customers at Santander, for example, are only able to send up to £3,000 to a crypto exchange in any 30-day period.

Chase UK said its decision is intended to keep customers safe.

“We’ve seen an increase in the number of crypto scams targeting UK consumers,” a Chase spokesperson said in a statement shared with DL News.

UK government data shows the amount lost to crypto scams jumped more than 40% in the past year.

In the US, where it has more than 50 million customers, Chase has prevented customers from buying crypto with credit cards since 2018, as have Bank of America and Citigroup. But they are still able to do so via debit card or bank transfer.

“We continuously review and update our fraud prevention strategies based on the threat environment,” the spokesman said when asked whether Chase plans to implement similar restrictions on its customers in the US.

Update: This story was updated on September 27 to add Coinbase CEO Brian Armstrong’s reaction to the JPMorgan Chase decision in the UK.

Got a tip on JPMorgan or Coinbase? Contact aleks@dlnews.com and adam@dlnews.com.