- The derivatives exchange will now offer Ether/Bitcoin ratio futures.

- Volumes and open interest in crypto derivatives on the CME reached all-time highs this year.

The recent bullishness of the crypto market has whet investors’ appetites to bet on it, and the CME Group is giving them another opportunity by adding Ether/Bitcoin ratio futures to its suite of crypto products.

The Chicago-based exchange is one of the world’s leading derivatives exchanges by contracts traded. It recently reported revenue of $1.4 billion and an operating income of $839 million for the second quarter.

From Sunday, local time, the new product will allow traders exposure to both Bitcoin and Ethereum in a single and less volatile trade, according to Giovanni Vicioso, head of cryptocurrency products at the CME.

The new contract is cash-settled to the value of the Ethereum futures price at the settlement date, divided by the corresponding Bitcoin futures price at settlement.

Historically, the ratio has had lower volatility than trading just Bitcoin or Ethereum, Vicioso told DL News. Both assets can now be traded without the need for directional views.

Traders could create a similar trade themselves, but at an added risk. The spread could be done with several legs, the individual components or transactions that make up a trading strategy, but this creates more risk.

Each individual leg has its own risk, and price slippage would become an issue. Pre-packaging the product for traders makes it more effective, Vicioso said.

Derivatives pop on regulatory woes

Traders have increasingly turned to derivatives amid growing regulatory uncertainty and to limit the risk of exposure to unregulated counterparties, especially after the collapse of FTX in November.

Bitcoin and Ethereum have reclaimed lost ground since the beginning of the year after a rough ride in 2022 — though both are still way off record highs. Bitcoin is up more than 70%, while Ethereum has risen 51%.

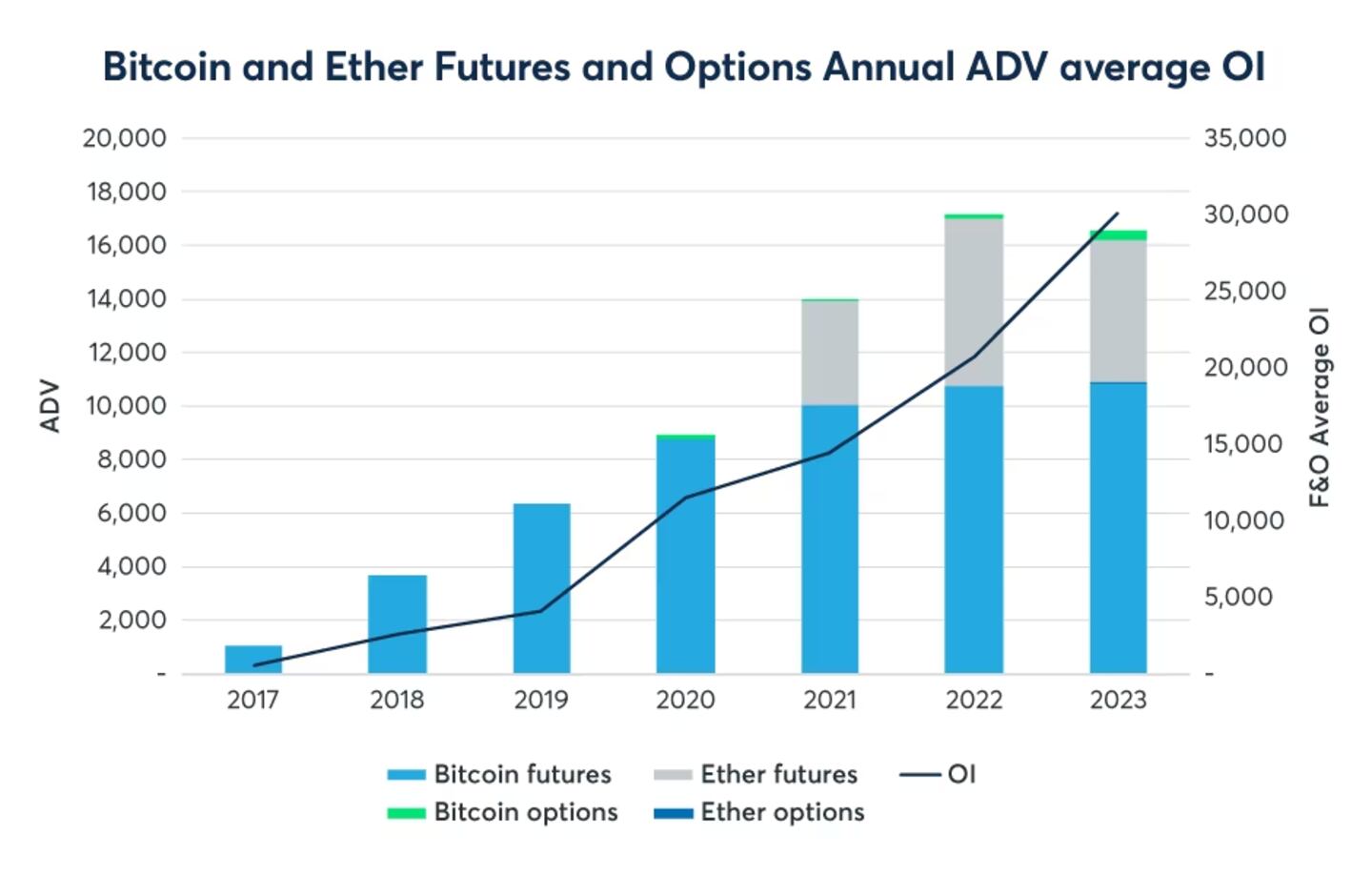

“The resiliency of the leading two cryptocurrencies by market capitalisation has attracted additional institutional interest for our suite of trusted cryptocurrency products leading to record volume and open interest across our futures and options,” the CME’s second-quarter insights report noted.

Open interest refers to the total number of outstanding derivative contracts for an asset that haven’t settled.

Bitcoin futures volume on the CME just clocked its busiest month of the year. Volumes are approaching $55 billion for July, according to Coinglass data. The average daily volume of cryptocurrency futures and options has risen to record highs this year.

Vicioso told DL News the uptick in activity is a function of the “maturity” of the space.

The number of large open interest holders has also increased, Vicioso said. LOIHs averaged a record 107 in the second quarter. These are entities that hold at least 25 contracts.

“Traders of all kinds are using our cryptocurrency products to manage risk/exposure around-the-clock and protect and benefit from price movements in Bitcoin and Ether,” the CME’s second quarter crypto insights report noted.

Futures open interest for Bitcoin has been stable in July, David Duong, head of institutional research at Coinbase, wrote on Friday. Almost 472,000 Bitcoin ($13.8 billion) in volume has been done this month, after picking up at the end of June, with “institutional players increasing their participation on CME,” he noted.

CBOE, another derivatives exchange based in the Midwest, received regulatory approval to launch leveraged crypto derivatives products in June.

With more regulated derivatives venues, institutional investors have typically favoured exposure through options and futures. This also eliminates any need for custody of crypto assets.