- Crypto stocks are feeling the burn from Trump’s tariffs.

- Coinbase and Strategy are among Monday’s losers.

- Market analysts predict things will get worse from here.

Coinbase, Strategy and Block are among the stocks feeling the burn of US President Donald Trump’s tariffs.

Their drop comes amid a plunge that shaved almost 6%, or $246 billion, off the cryptocurrency market’s total value over the past 24 hours — and market watchers expect it to get worse before it gets better.

“Cryptocurrency markets have entered extreme fear mode,” Petr Kozyakov, co-founder and CEO at Mercuryo, told DL News.

Trump triggered the tumble among crypto stocks, digital assets, and wider markets last week when he unleashed a wave of tariffs upon both trading allies and rivals.

Crypto stocks fall

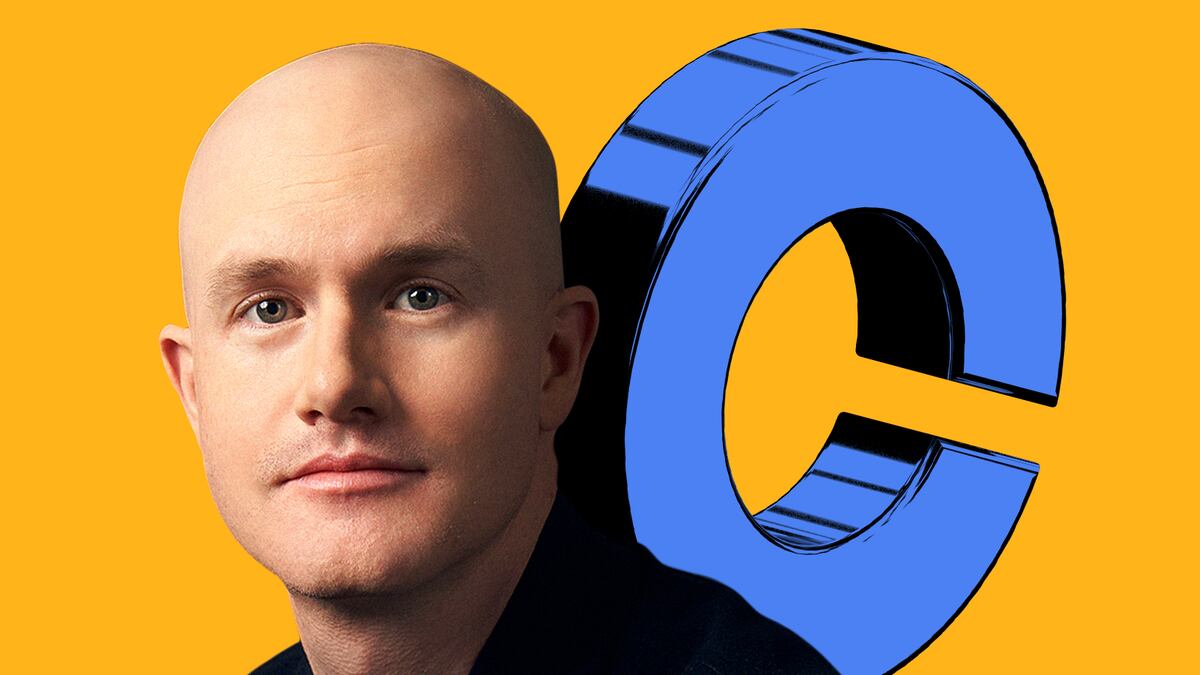

Coinbase’ stocks fell almost 6% to $152 at the Monday open. The drop came after Cathie Wood’s investment firm Ark Invest bought $13.4 million worth of Coinbase stock on Friday, according to The Block.

Michael Saylor’s aspiring “Bitcoin bank” Strategy dropped almost 8% to $270.69.

Block, X co-founder Jack Dorsey’s payments company that also offers Bitcoin services, fell just under 7% to $50.26.

Bitcoin mining firms Marathon, Riot and Hut 8 also fell by 1.5%, 2.5% and 1%, respectively.

Last week, Hut 8 announced a deal with the president’s sons, Eric and Donald Trump Jr., that would bring a portion of Hut 8’s mining capabilities under the aegis of a new company, American Bitcoin Corp.

Gamestop, which recently announced a private raise of $1 billion in order to add Bitcoin to its treasury, was up 3% to $24.24 at time of writing.

Several fintech firms are increasingly muscling into the crypto market to compete with native firms. Two of them, Robinhood and PayPal, were both up by roughly 2%.

S&P 500

Crypto market watchers don’t expect digital assets to recover any time soon.

“It’s likely that we’ll still go lower from here,” Carlos Guzman, analyst at crypto-trading firm GSR, told DL News.

“There are no apparent near-term positive catalysts for crypto that would justify a decoupling from the grim macro situation.”

Broader markets were not left unscathed. The S&P 500 and the tech-heavy Nasdaq 100 were down by 1.66% and 1.72%, respectively, when they opened on Monday.

Even Trump’s allies in the investment community are urging the president to reverse his policies.

“We are heading for a self-induced, economic nuclear winter, and we should start hunkering down,” Bill Ackman, the CEO of hedge fund Pershing Square and an outspoken supporter of Trump, said.

Andrew Flanagan is a markets correspondent for DL News. Have a tip? Reach out to aflanagan@dlnews.com.