- Coinbase revenue beat estimates on Thursday, but competition from Robinhood is eating into the firm’s market share.

- The exchange’s retail and institutional trading volumes were hit in the second quarter.

- Staking services helped boost revenue, as did the rising price of Ethereum during the quarter.

Problems persist for Coinbase, despite beating analysts’ earnings estimates. The exchange saw trading volumes decimated as rivals ate into market share on its home soil in the US.

Investors sent the shares higher on better-than-expected results. The exchange posted a net loss of $97 million, paring a loss of almost $1.1 billion over the same three-month period a year ago. Revenue for the quarter was $707 million, above estimates of $636 million.

Still, investors shouldn’t be too excited, warned analysts from investment bank Mizuho.

Coinbase hiked retail prices from the first quarter, according to Mizuho analysts led by Dan Dolev: “2Q retail take rate was 221bps vs. 168bps in 1Q,” they wrote, suggesting fees rose to an average of about 2.2% from about 1.7%.

This could accelerate market share losses on the retail front, they said.

Coinbase’s share of combined volume with trading app Robinhood fell to 61% last quarter, down from 65% in the first quarter.

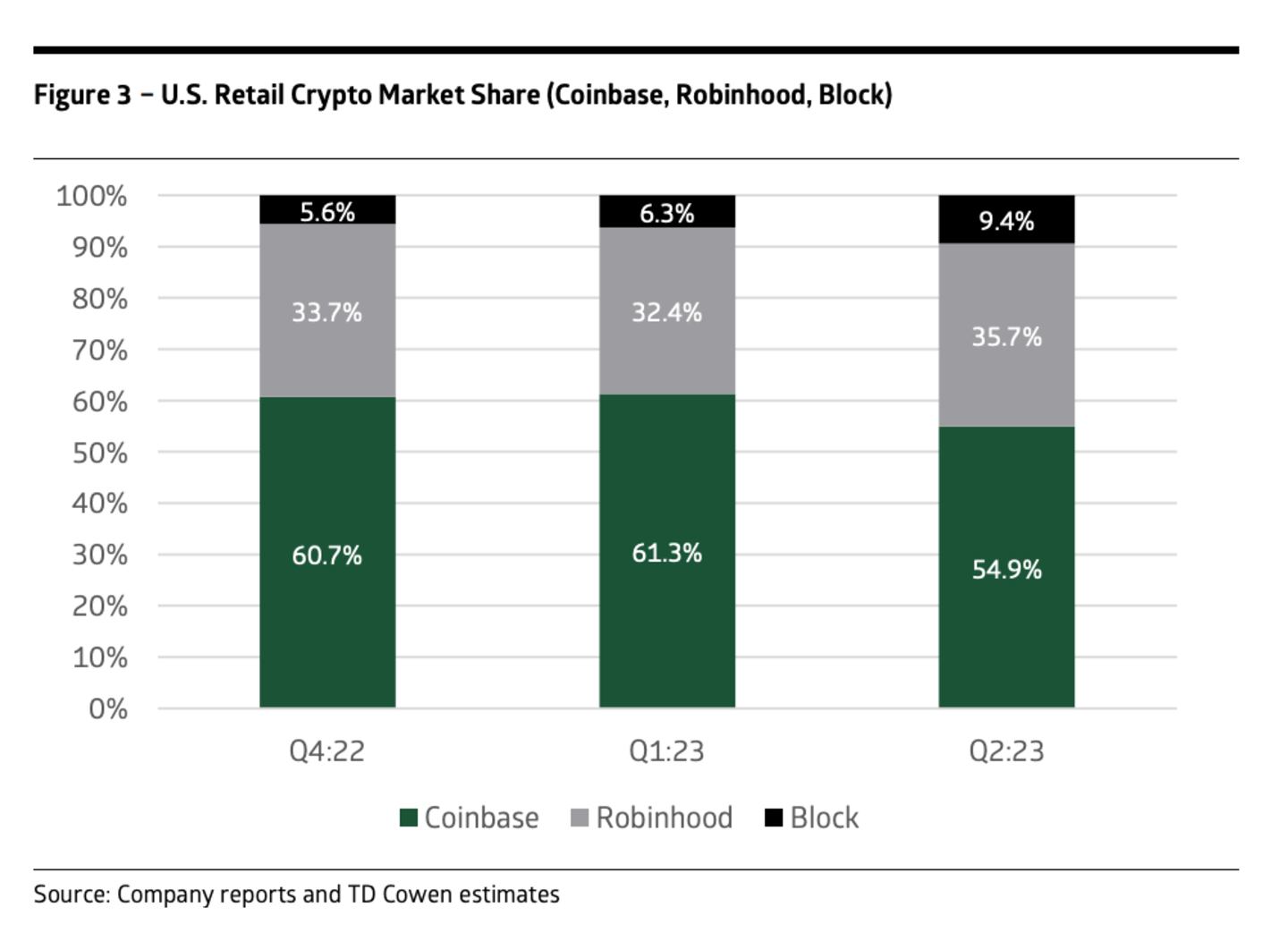

Analysts from investment bank TD Cowen echoed Mizuho’s concerns, noting how early signs suggest Coinbase is losing market share to Robinhood and Block, the fintech firm run by Twitter founder Jack Dorsey.

Coinbase’s share of the US retail crypto market fell 6.4% from the first quarter.

Robinhood and Block gained 3.3% and 3.1%, respectively, according to TD Cowen.

Coinbase institutional trading volume plunged 37% from the first to the second quarter.

Institutional traders have been skittish on crypto markets since the collapse of FTX last year, with many flocking to derivatives on regulated venues like the CME.

“Did somebody say institutions are the next frontier? Reiterate Underperform,” Mizuho concluded.

Both TD Cowen and Mizuho reiterated underperform ratings, with price targets unchanged at $36 and $27. Coinbase was trading at $88.60 by noon New York time on Friday, down 2.2% since the open.

Trading takes a back seat

Revenue from trading was below that from other areas last quarter and the exchange is hopeful it can continue to expand in other areas.

Subscription and services revenue came in at $335 million, above the $327 million transaction revenue made on trades during the quarter.

Trading volume fell to $92 billion during the quarter, with $14 billion from retail and $78 billion from institutional users.

Now read: Why Circle can’t shake SVB hangover as market cap plunges to two-year low

The majority of this is linked to interest income, which reversed its course during the quarter as Circle’s USDC stablecoin saw its market cap decline.

Despite surging year on year, interest income fell 16% quarter on quarter to about $200 million. The deterioration of the USDC’s supply is expected to continue into the third quarter, TD Cowen analysts said on Friday, further impacting interest income.

Elsewhere, subscription and services revenue benefited from Ethereum’s Shapella upgrade, the exchange noted.

Blockchain rewards, which includes staking services revenue, grew nearly 20% from the first quarter to $88 million in the three months to June.

What drove such growth? The exchange said: “Higher staked balances — including a significant increase in institutional ETH balances subsequent to the Shapella upgrade in April.”

Ethereum’s improved price also benefited Coinbase, with the asset jumping 17% from the first to the second quarter.

Base

Coinbase’s Ethereum layer 2 platform Base had a soft start for builders in July and will fully launch its mainnet next week on August 9.

The long-term goal is for Base to be a major revenue driver, management noted on Thursday’s earnings call.

Now read: Coinbase’s Base had 24 hours of meme coin frenzy, rug pulls and $58m in deposits

Last weekend saw an uptick in activity on Base, helped by the launch of a flurry of memecoins. The Layer 2 clocked up over $870,000 in revenue over the last seven days, according to DeFiLlama data.

TD Cowen doesn’t expect the Ethereum layer 2 to have a material impact in the near term.

To share tips or information about Coinabse please contact me at adam@dlnews.com.