- Crypto funding plunged by 75% in the first six months of 2023 compared to 2022.

- The results come as the industry is at its most bullish mood since the fall of FTX.

First the bad news.

In the first half of 2023, funding for crypto startups tumbled to $3.7 billion, which is less than a quarter of the investment made in the same period in 2022, according to DefiLlama data.

No surprise there — with Gary Gensler and other US regulators bearing down on crypto giants such as Coinbase and Binance it’s hard to blame venture capitalists and other investors from staying away.

NOW READ: Investors pull $4bn from Binance as regulators and rivals close in

The good news is that fundraising data is, by definition, a lagging indicator.

Even though there is a lot of angst in crypto, there’s also a lot of bullishness.

Bitcoin, in case you haven’t noticed, has soared 85% this year, and Ethereum is up 57%, according to CoinGecko data.

And even though headlines still reverberate with news of crypto Ponzi schemes and hacks of DeFi protocols, Wall Street is moving into crypto.

BlackRock and Fidelity have applied for spot Bitcoin exchange-traded funds, and Citadel Securities, Apollo Global Management and even Charles Schwab are keen on grabbing market share in the new asset class.

NOW READ: Deutsche Bank, Citadel Securities signal the crypto land grab is accelerating

So what does this all mean?

Hard to say, but one thing is certain — investors love company.

And with TradFi leaning in, you can bet VCs, angel investors, and other players are emboldened to look for promising crypto startups.

Whether this translates into a jump in fundraising flows in the second half of the year remains to be seen, of course.

But one datapoint that is telling is that the US crypto industry attracted more investment than any other sector worldwide even amid the regulatory crackdown.

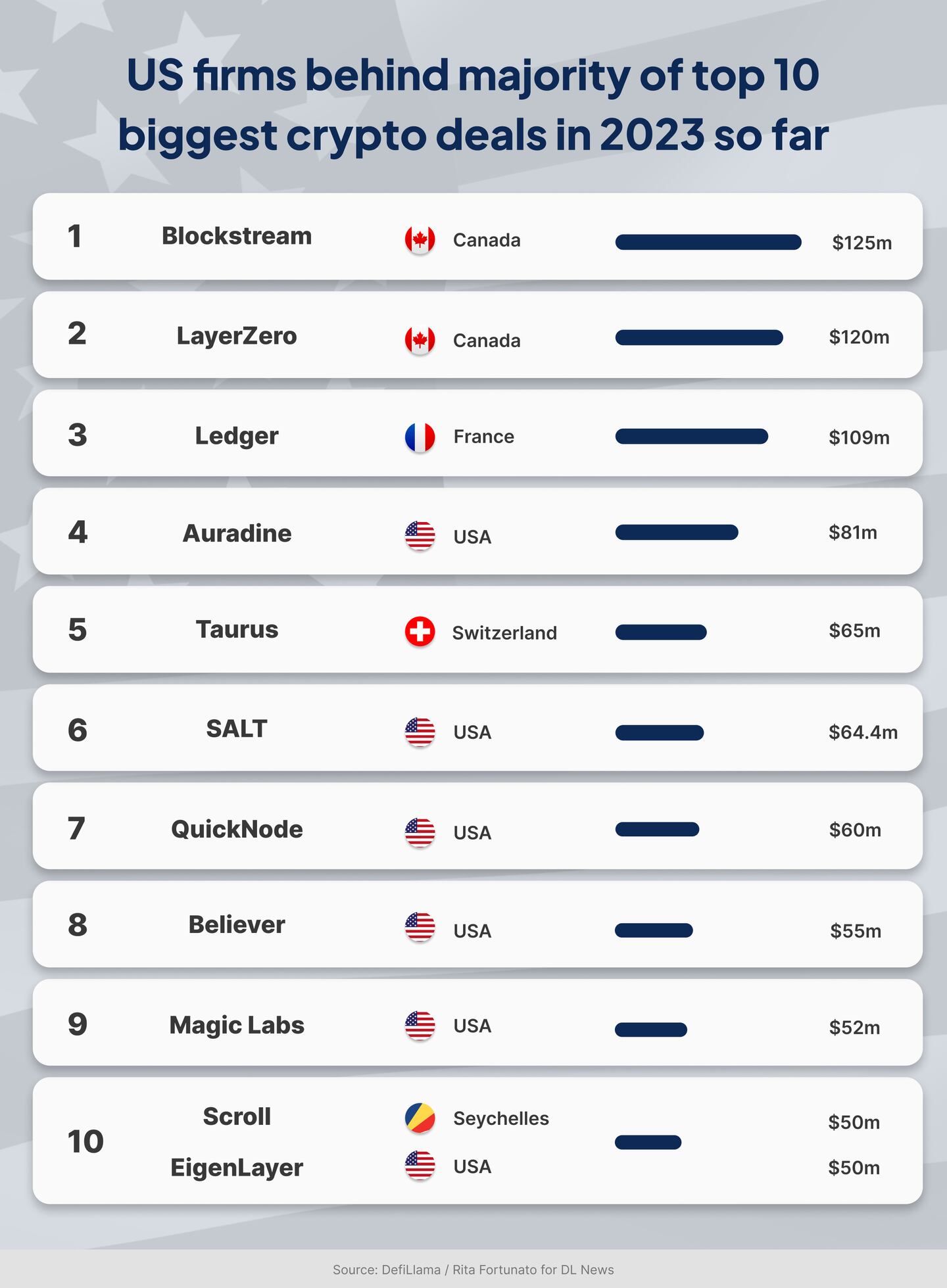

Six of the 10 biggest funding rounds, led by Blockstream’s $125 million round, were in the US.

But that picture could be fluid as the SEC demands crypto outfits register their offerings like stocks and bonds.

NOW READ: UK crypto projects secured $232m in Q1 as country offers ‘fit-for-purpose regime’

“While the US has dominated funding deals to this point, it’s feasible for other regions to rise in prominence as the industry continues to grow and transform,” Bryan Daugherty, global public policy director enterprise blockchain company BSV Association, told DL News.

Meantime, other sectors are catching the eye of VCs and their ilk.

Rattled investors have turned to less toxic sectors such as artificial intelligence for their investments — even if industry stalwarts like Paradigm have insisted that no such pivot is on the cards for them.

Over the past 18 months, VCs have splurged $15.5 billion dollars into AI startups, according to PitchBook data.

And there’s more than BTC’s rise to stimulate investors’ animal spirits.

As DL News reported earlier this week, there are 25% more developers building blockchain projects now than there were back at the industry’s November 2021 peak.

That is not a lagging indicator — it’s a forward looking one.

Here’s a list of the top fundraising deals in the first half of 2023:

Blockstream

Based in: Canada.

Business: Bitcoin infrastructure.

Funding round: $125 million.

Lead investors: Kingsway Capital.

LayerZero

Based in: Canada.

Business: Messaging protocol.

Funding round: $120 million.

Lead investors: a16z.

Valuation: $3 billion.

Ledger

Based in: France.

Business: Hardware wallets.

Funding round: $108 million.

Valuation: $1.4 billion.

Auradine

Based in: United States.

Business: Web infrastructure.

Funding round: $81 million.

Lead investors: Celesta Capital and Mayfield

Valuation: $500 million.

Taurus

Based in: Switzerland.

Business: Digital asset infrastructure.

Funding round: $65 million.

Lead investors: Credit Suisse.

SALT Lending

Based in: United States.

Business: Crypto lending.

Funding round: $64.4 million.

QuickNode

Based in: United States

Business: Web3 development.

Funding round: $60 million.

Lead investors: 10T Holdings.

Valuation: $800 million

Believer

Based in: United States.

Business: Gaming.

Funding round: $55 million.

Lead investors: Lightspeed Venture Partners.

Magic

Based in: Untied States.

Business: Wallet as a service.

Funding round: $52 million.

Lead investors: PayPal Ventures.

Valuation: $500 million.

Scroll

Based in: the Seychelles

Business: A zero-knowledge layer 2 network.

Funding round: $50 million.

Valuation: $1.8 billion.

EigenLayer

Based in: United States.

Business: Restaking protocol.

Funding round: $50 million.

Lead investors: Blockchain Capital.

Valuation: $250 million.

Do you have a tip about crypto funding or another story? Reach out to me at eric@dlnews.com.