- US election results from seven states could move markets Tuesday night.

- Traders are also watching funding rates and other indicators for clues.

Crypto markets have been swinging in concert with polls ahead of the November 5 US presidential election over the past months.

For crypto, the vote between Donald Trump and Kamala Harris is the end of an unprecedented lobbying effort that has seen the industry plough $132 million to crypto-friendly candidates.

But they’ll have to be patient to see if those efforts paid off. With thousands of elections offices across 50 states and three time zones counting ballots, the outcome of the US election will take hours, if not days, to become clear.

Traders intent on making a profit on the election will have to pay attention to market signals, according to crypto data firm Kaiko.

The swing states

There are seven so-called swing states. Those are states where pollsters can’t confidently predict the outcome well in advance.

US presidential elections don’t rely on the popular vote, but rather on the number of state electors awarded in the Electoral College.

Those key states are Wisconsin, Michigan, Pennsylvania, North Carolina, Georgia, Arizona, and Nevada.

With results from other states considered a foregone conclusion, those seven states will decide the next president of the US.

If Vice President Harris wins all three so-called blue wall states in the north — Wisconsin, Michigan, and Pennsylvania — she wins the presidency, polling experts say. If Harris loses Pennsylvania, she’ll need to pick up at least two swing states in the South.

Georgia and North Carolina are expected to be the first swing states to tally their votes, according to the New York Times.

Results from Pennsylvania, Wisconsin, and Michigan are expected to come in a day later. Arizona and Nevada could take several days to count their votes.

Tick-trades

The first metric to watch are so called tick-trades. These show every executed buy or sell trade everywhere in the world where crypto is traded.

That’s relevant for crypto traders on election night as they can help time the market by showing when when buying or selling pressure is easing, Kaiko wrote.

“More importantly, it can offer clues about market participants’ expectations,” Kaiko explained.

“Most traders and large institutions will be monitoring results, likely using proprietary tools for an edge. Therefore, observing tick trades on major platforms provides insight into where ‘smart money’ is moving.”

Funding rates

“Funding rates will be crucial to watch on election day,” Kaiko said.

That’s because a high funding rate often indicates heightened demand for long positions in the market. A negative funding rate indicates heightened demand for short positions.

Long positions suggest traders want to hold an asset as they expect its value to increase, short positions suggest they like to sell it because they expect the value to decline.

“Traders, especially those with highly leveraged positions, will be sensitive to changes in the funding rate,” Kaiko said. “Sudden spikes in rates could lead to squeezes and cascading liquidations.”

Binance updates rates every eight hours beginning at midnight UTC. That means rates will be updated at 8 pm New York time, just as the first results are coming in, and again at 4 am New York time, when most — but not all of the votes — will have been counted.

Implied volatility

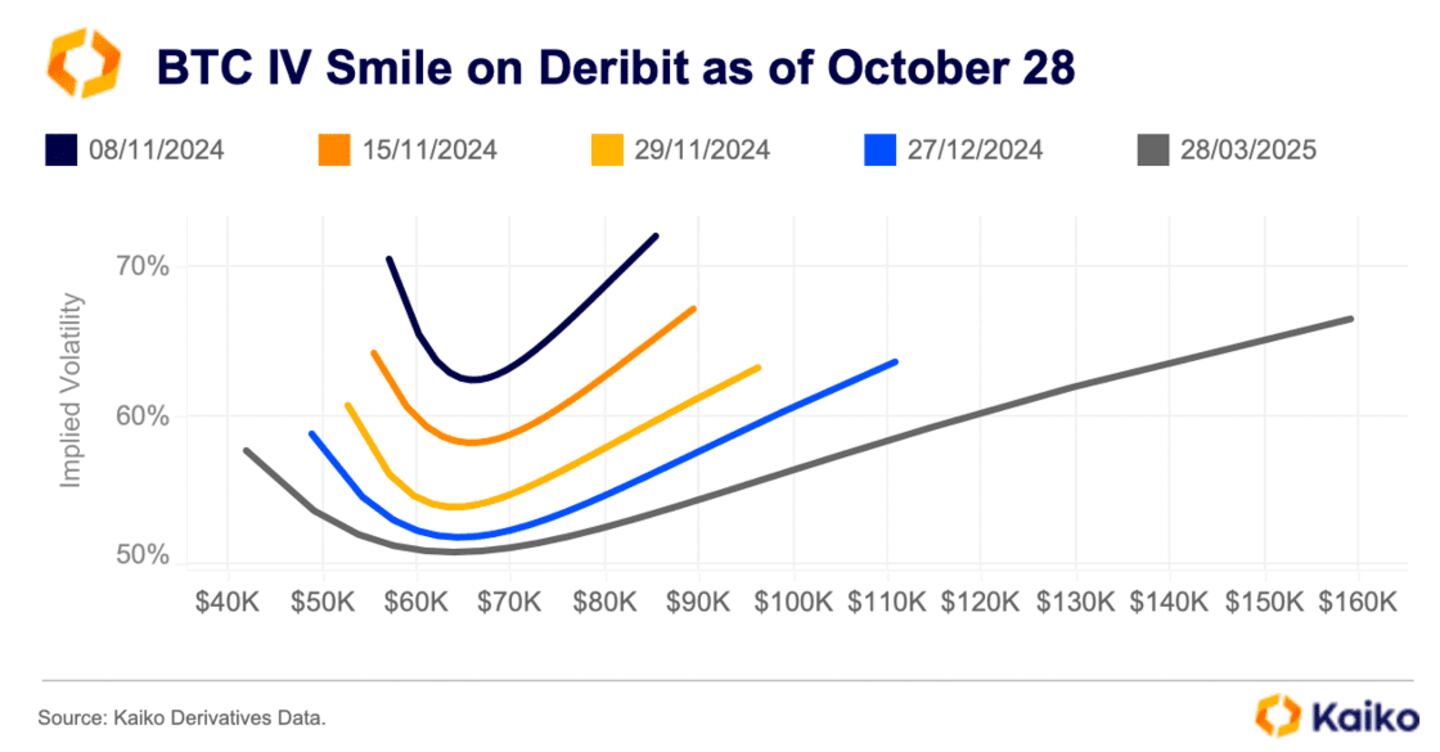

Traders will also want to watch implied volatility, said Kaiko.

Implied volatility measures the expectation that a particular asset will swing in price over a certain time period.

“This allows traders to quickly identify whether options are relatively cheap or expensive,” wrote Kaiko.

If implied volatility is higher in the near term than in the long term, that indicates other traders see a high likelihood of a “near-term risk event” like the US election, according to Kaiko.

Implied volatility through March 2025 is highest immediately after the US election, per Kaiko data. This is indicative of how challenging it is to predict the election’s outcome.

If the U-shaped curve, or “smile,” leans leftward, it suggests traders are bearish. If it leans rightward, it suggests they’re bullish.

Implied volatility data over the past few weeks suggests traders have grown bearish on Bitcoin as a result of its run to a near-record $73,000 on October 29, which forced many to hedge against a potential drop.

Crypto market movers

- Bitcoin is down 0.1% over the past 24 hours to trade at $68,650.

- Ethereum is down 0.2% to trade at $2,430.

What we’re reading

- Three reasons why retail is sitting out the Bitcoin rally — DL News

- Time to sell your $MKR? — Milk Road

- $44 Million Memecoin PNUT From Pump.Fun Emerges From Euthanized Viral Squirrel — Unchained

- The US Elections Vs. Your Crypto Bags — Milk Road

- Telegram’s Pavel Durov was — and wasn’t — at the TON conference in Dubai — DL News

Aleksandar Gilbert is a DeFi Correspondent at DL News. Got a tip? Email at aleks@dlnews.com.