- What will an Ethereum ETF mean for the markets?

- Galaxy’s Mike Novogratz and Ethereum co-founder Joe Lubin are among experts weighing in.

Ethereum shot up this week amid a swing to optimism about US approval for exchange-traded funds that track the cryptocurrency.

The reasoning behind the sudden U-turn is up for debate, but market watchers are generally aligned on what a regulator nod would do for Ethereum and other cryptocurrencies.

Asset manager VanEck is the first Ethereum ETF application on the Securities and Exchange Commission’s pile, due May 23.

Here’s what experts are saying.

Galaxy’s Mike Novogratz

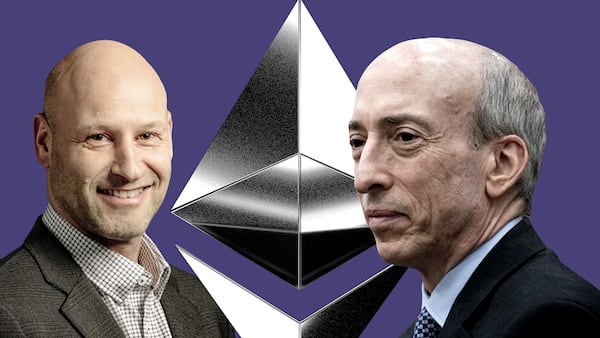

A “widespread” pivot in Washington in the last 24 hours just upended the Ethereum ETF game, said Galaxy Digital CEO Mike Novogratz.

If the SEC’s change of heart was politically motivated, “that’s a seismic shift,” Novogratz said.

“If that’s what actually happened, prices are going to be much higher than here.”

Consensys’ Joe Lubin

Expect a “floodgate” of demand for Ether, which will likely lead to a supply crunch and drive prices higher, says Joe Lubin, co-founder of Ethereum and founder of crypto infrastructure firm Consensys.

Institutions that have already gained exposure to Bitcoin ETFs “will most likely want to diversify into that second approved ETF,” Lubin told DL News.

“There’s going to be a pretty large amount of natural, pent-up pressure to purchase Ether” via ETFs, he said. He added the caveat that there will be less supply to accommodate that demand than when the spot Bitcoin ETFs were approved in January.

Bitwise’s Matt Hougan

”Crypto is in the process of going mainstream, and that this progress will push crypto to all-time highs,” Bitwise Chief Investment Officer Matt Hougan wrote in a blog post this week.

But Hougan suggested that the catalyst was not the sudden optimism on ETFs.

”Something remarkable happened in Washington: A bipartisan group of senators and representatives passed the first pro-crypto piece of legislation in Washington’s history.”

He referred to the bill to repeal the SEC’s SAB 121 policy that imposed strict rules on crypto custody.

“This newfound support for crypto in DC — whether we get the spot Ethereum approval or not — is the latest proof point,” Hougan said.

Swarm’s Timo Lehes

Timo Lehes, co-founder of blockchain platform Swarm, sees “significant inflows of capital” into Ethereum once an ETF is approved.

“Once you have allocated to Bitcoin, you also look to something else as part of portfolio diversification,” he told DL News. “Naturally, investors choose eth, as the next largest crypto asset.”

While inflows will probably pale in comparison to those for Bitcoin’s ETF when it launched in January, “it will still be enough to move the dial on its price action.”

Kaiko

Options traders who have “crowded around” bullish options are now looking at gains, said Adam McCarthy, an analyst at Kaiko.

But investors should be cautious, Kaiko said: “Hong Kong ETFs didn’t see much demand and have had mixed days with several net outflow days already. No staking is a big factor too, and likely impacts demand further.”

He suggested watching Grayscale’s $9 billion ETHE product, “if it suffers large outflows, that would be significant for prices.”

Bernstein

The approval of a spot Ethereum ETF will drive a 75% surge to $6,600, according to estimates made by Gautam Chhugani and Mahika Sapra, analysts at research firm Bernstein.

They noted that the SEC’s approval of similar Bitcoin products in January spurred a 75% rally in the following weeks.

“We would expect similar price action for ETH,” Chhugani and Sapra said in a report this week.