Ethereum traders are piling into bets on the cryptocurrency’s price, sending a key market metric to a record.

Crypto traders love to speculate via derivative contracts with no settlement date called perpetuals, dubbed perps.

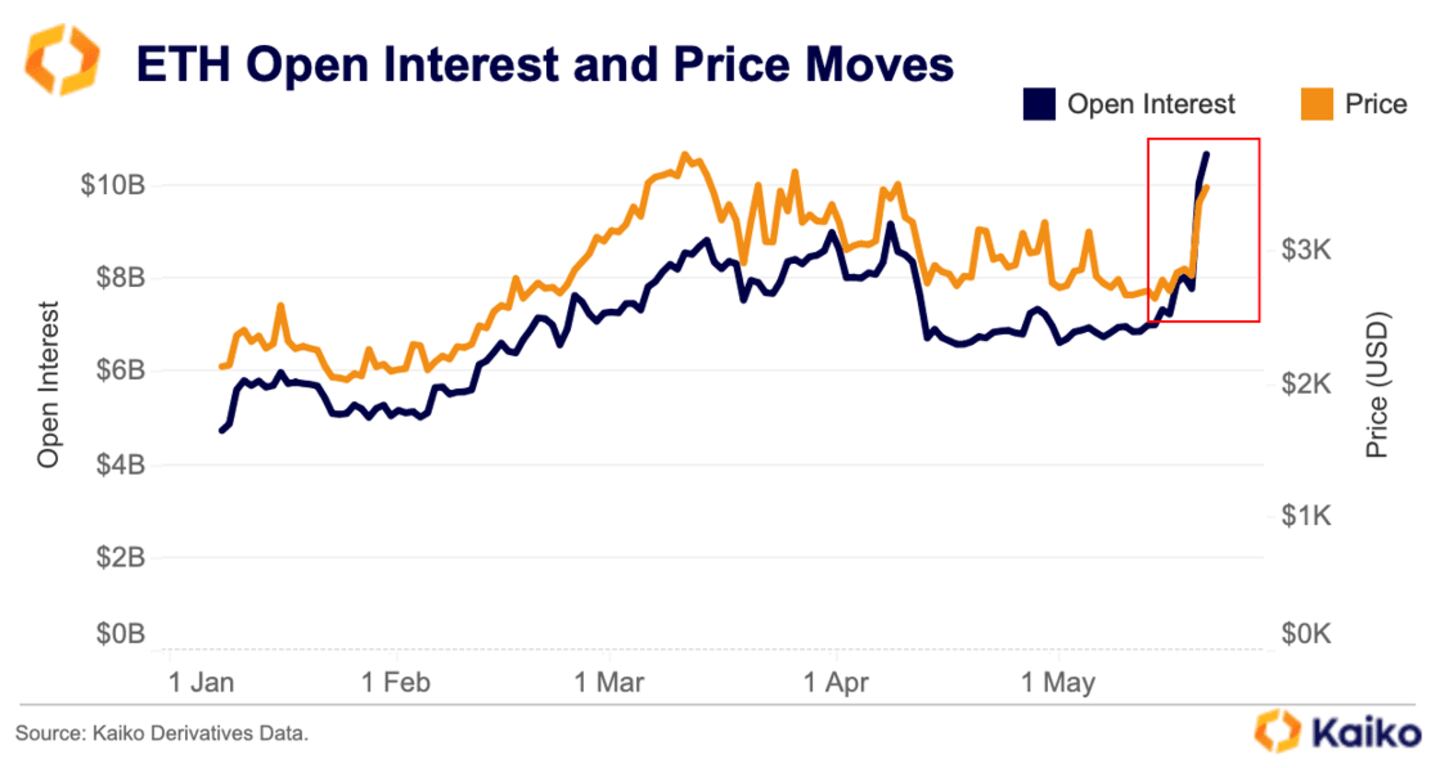

Ethereum perps’ so-called open interest — which reflects the demand for contracts — soared to all-time highs of over $10.7 billion this week.

That’s according to research firm Kaiko, which attributed the market frenzy to optimism about US approval of Ethereum exchange-traded funds, which has buoyed the cryptocurrency’s price.

Analysts see open interest as a valuable metric to assess sentiment.

Ethereum jumped more than 22% over the last week amid a sudden shift in hopes that the Securities and Exchange Commission would greenlight the ETFs.

The SEC seemed poised to deny the applications as late as last week. That changed when Bloomberg ETF analyst Eric Balchunas flagged that “the SEC could be doing a 180 on this” amid political pressure — investors then considered approval a done deal.

The SEC granted approval on Thursday.

Kaiko noted signs of bullishness elsewhere in the market. The funding rate for Ethereum perps jumped from -0.02% on Saturday to 0.03% by Tuesday.

A high funding rate often indicates heightened demand for long positions in the market — traders holding those positions are willing to pay a premium to maintain them.

That’s a sign of optimism about the longer-term price.