- Ethereum ETFs have performed woefully.

- Flows have dwindled since launch.

- Analysts wonder if the SEC might have approved the ETFs too early.

Spot Ethereum exchange-traded funds have underwhelmed after trading in the US for three months.

Market observers such as Bloomberg Intelligence analyst James Seyffart predicted huge flows for Ethereum ETFs ― up to a quarter of the $32 billion projected for their Bitcoin counterparts.

Instead, the nine approved Ethereum ETFs have seen dwindling flows since stumbling out of the gate in July. Ether has fallen 25% since the ETF approval.

“I was so far wrong, I was way too bullish,” Seyffart said during a panel at the Permissionless crypto conference.

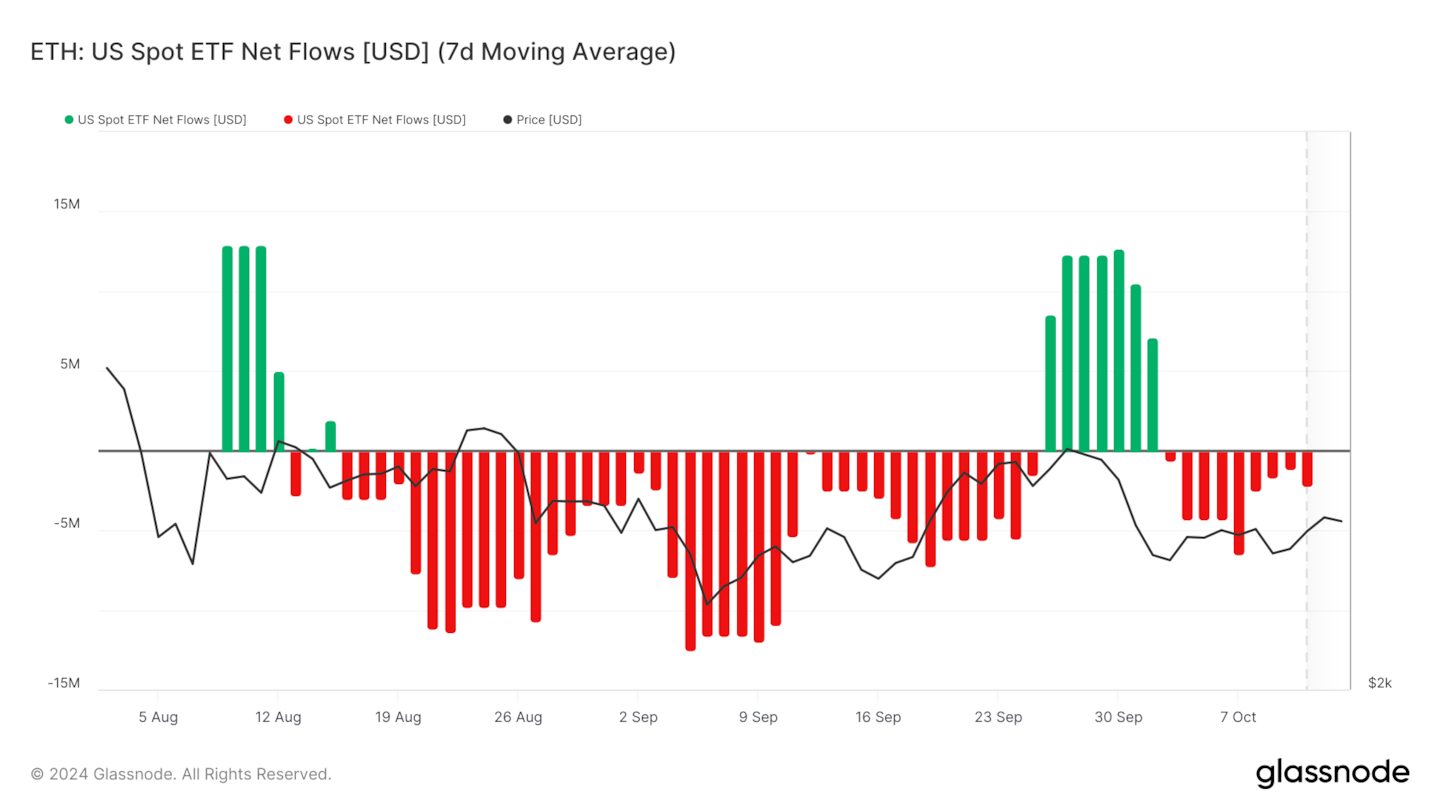

Ethereum ETFs have accrued negative daily flows 61% of the time since their approval, according to data from crypto analytics provider Glassnode.

On October 8, inflows were zero — a grim representation of the ETFs’ underwhelming performance.

Flows measure the net investments from institutional players in Ethereum ETFs.

Data from US crypto fund Farside Investors shows total Ethereum ETF outflows have reached $546 million.

Bitcoin ETFs scooped $12 billion in inflows in its first quarter alone.

Ethereum ETF approval represented a regulatory milestone for Ethereum in the US, especially as it represented a softening stance towards the crypto’s second biggest asset.

| Ethereum ETF Issuer | Ticker | Daily Flows |

|---|---|---|

| BlackRock | ETHA | $1.2b |

| Fidelity | FETH | $454.4m |

| Bitwise | ETHW | $318m |

| VanEck | ETHV | $68.9m |

| Franklin Templeton | EZET | $37.1m |

| Invesco | QETH | $22.6m |

| 21 Shares | CETH | $14.9m |

| Grayscale | ETHE | -$2.67b |

| TOTAL | -$546.1m |

Yet, its dismal performance might dampen hopes for the approval of Ethereum ETF options.

The US Securities and Exchange Commission extended its review of Cboe’s proposal to list options on Ethereum ETFs for more evaluation.

The SEC initially set a decision deadline on October 19 but pushed the date forward to December 3.

Cboe wants to list options from some of the major US-traded Ethereum ETFs including those from Invesco, Fidelity, and Grayscale.

Meanwhile, the SEC hasn’t shown that same reluctance for Bitcoin ETF options.

The SEC has already approved options trading on IBIT, BlackRock’s Bitcoin ETF, on Nasdaq.

Seyffart said Ethereum ETFs themselves might have benefitted from similar delays.

“The Ethereum ETFs would have been better off launching later,” Seyffart said.

“If the SEC had denied it, it might have arguably been a better time to launch [than in the summer].”

Bitcoin’s ETF approval came amid a massive price rise for the underlying Bitcoin crypto asset.

By the time the SEC approved 11 Bitcoin ETFs at the start of the year, Bitcoin had surged 57% in the last six months.

Despite a minor slump in the first ETF’s first week, the news propelled Bitcoin to a new peak of $73,000 in March.

Ethereum’s ETFs have proven the opposite — so far.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.