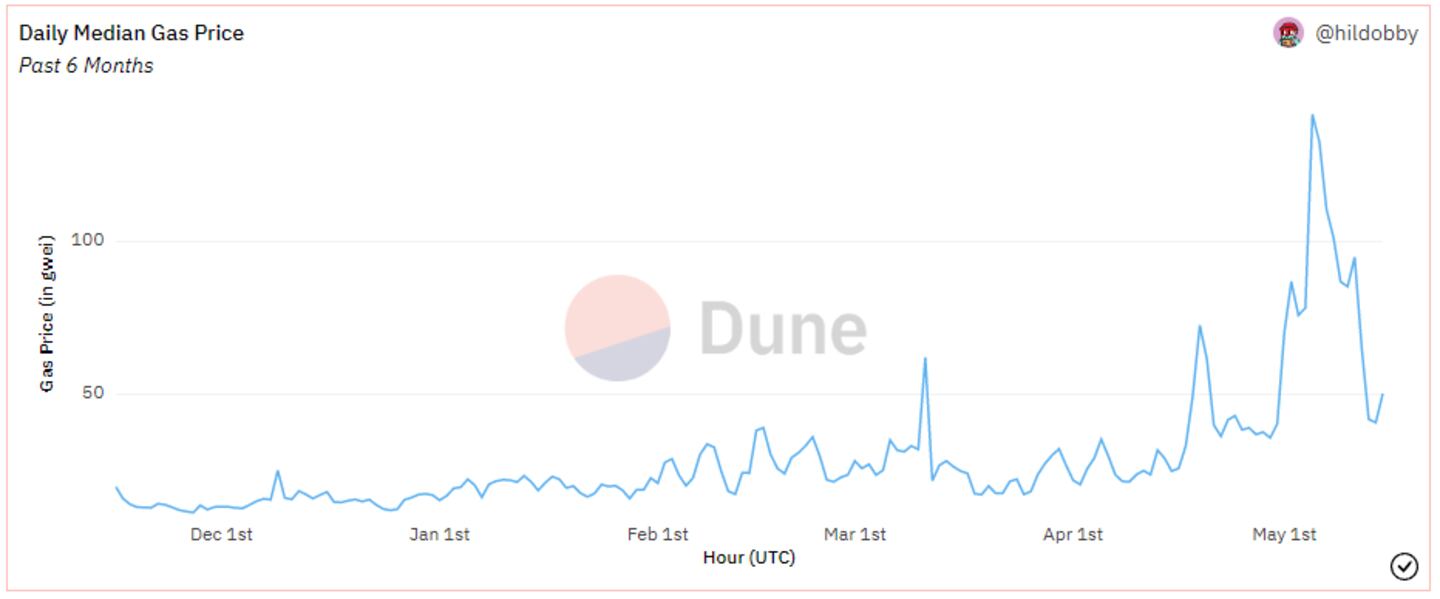

- Ethereum’s “gas fees” were propelled by an influx of users trading memecoins including Pepe

- A 64% plunge in DeFi transaction costs on Ethereum offers a reprieve for traders

- ‘The question is: Is the meme narrative finished now? or is this a small pullback?’

A 64% plunge in DeFi transaction costs on Ethereum offers a reprieve for traders after a memecoin frenzy drove such fees to a more than one-year high.

Since late April, Ethereum’s “gas fees,” a measure of the cost of executing transactions on the network, were propelled by an influx of users trading memecoins including Pepe, a token derived from the internet meme Pepe the Frog.

During the height of this activity, a basic Ethereum transaction — such as transferring tokens between wallets — escalated to over $20, a stark contrast from the sub-$5 fees typical for much of the past year. More complex transactions involving higher gas fees, such as token trades on decentralised exchanges, incurred even steeper costs.

Pepe at $1 billion

But after a period of unprecedented gains which saw Pepe surpass a $1 billion market capitalisation, the memecoin madness that defined Ethereum in recent weeks “seems to slowly be dying down,” Hildobby, a pseudonymous data analyst at crypto venture fund Dragonfly, told DL News.

Dune data compiled by Hildobby, shows that median gas fees on Ethereum have dropped 64% from an early May peak. On May 15, the median gas fee for transactions returned to 50 gwei, down from 142 gwei on May 5.

Ethereum’s gas fees are typically expressed in gwei, a unit equivalent to one-billionth of an Ether.

Hildobby explained that the median gas fee is a proxy for Ethereum blockspace demand and represents what users should expect to pay to get their transactions processed.

Like most blockchains, Ethereum employs a dynamic fee system designed to thwart malicious actors from inundating the network with transactions, obstructing other users.

When Ethereum’s activity level rises, the network correspondingly increases the base fee — the minimum amount of gwei users must pay to initiate transactions.

If the volume of transactions remains high, gas fees continue to escalate. However, a decrease in demand for transaction submission triggers a corresponding reduction in the base gas fee.

NOW READ: MiCA is here. There are nine other EU crypto laws you should know about

In the context of trading memecoins like Pepe, traders must take into account the cost of submitting transactions to Ethereum. If traders can’t offset the high gas fees with profits, they’ll trade less.

‘Insanely high’

“Gas gets so high that most people get priced out or it no longer becomes worth it for a lot of people to do smaller transactions,” Ryan Myher, co-founder of crypto analytics platform LORE, told DL News.

“The return on investment would have to be insanely high just to cover the gas.”

While the current drop in activity on Ethereum is providing a respite from high transaction fees, not everyone is convinced the memecoin hype is over.

Alex Strong, a trader at crypto trading firm Scimitar Capital, told DL News that the main reason gas costs were down was because fewer people are speculating on-chain in the past week.

This drop in activity “might be temporary,” he said, leaving open the possibility for another memecoin resurgence.

Typically, during periods when investors are willing to take on risk, they tend to pile into more volatile assets like stocks or crypto. And memecoins are risky even by crypto standards.

At least one market move suggests a memecoin surge is a sign of the top:

NOW READ: Aragon’s $200m activist battle ignites DAO debate: ‘Lining up soldiers doesn’t mean an attack’

In May 2021, Dogecoin, often described as the original memecoin, hit an all-time high of $0.73, while Bitcoin traded above $55,000. But a month later, the total crypto market capitalisation had dropped 36% from its highs, with Dogecoin down more than 56%.

“Gas prices are dropping significantly and coming back to pre-meme craze levels, almost,” Crypto Koryo, a pseudonymous crypto trader and writer, told DL News.

“The question is: Is the meme narrative finished now? or is this a small pullback?”

“Let’s see how it goes this time,” he said.