- Ethereum options traders are bullish for June.

- The May 31 options expiry signals some short-term volatility.

Traders are betting that Ethereum will continue to rally following the US approval for a spot Ethereum exchange-traded fund.

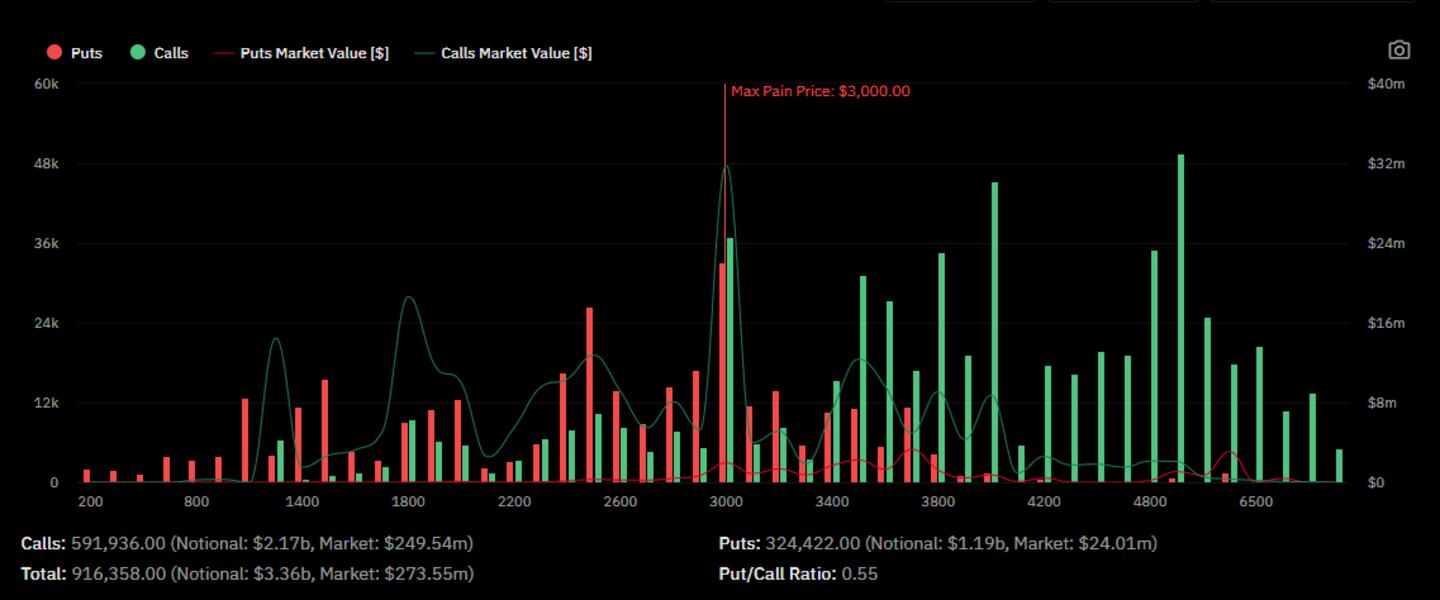

Some $3.4 billion in options that expire on June 28 signals a surge in traders buying calls — or bullish bets — that Ethereum will exceed $4,000.

The positioning in the derivatives indicates many traders are even targeting prices above $5,000, TzTok-Chad, the pseudonymous founder of decentralised options exchange Stryke, told DL News.

Options let traders speculate on price moves or hedge against market volatility. They give holders the right, but not the obligation, to buy the underlying asset at a predetermined price.

The June 28 options expiry is significant because it is the final expiry of the month — usually the most traded.

Ethereum steals the spotlight

On Monday, Ethereum soared as Bloomberg analysts upped their odds that the Securities and Exchange Commission would approve a spot Ethereum ETF.

On Thursday, the SEC validated essential documents for the launch of Ethereum ETFs — a step that all but guarantees their eventual approval.

The shock about-face from the SEC steals thunder from Bitcoin among options traders.

“The spotlight is firmly on Ethereum, with Bitcoin experiencing relatively subdued interest,” Luuk Strijers, CEO of options exchange Deribit, told DL News.

Strijers said that the nod from the SEC, investors are focused on acquiring short-term options, comparing the market volatility to that seen during earnings announcements in traditional financial markets.

A bumpy road ahead

Still, if Ethereum does rally to $5,000, it might not be a clear path.

“Expect some volatility leading into May 31, considering there will be considerable profit-taking from large traders,” TzTok-Chad said.

Positioning for the May 31 options expiry shows traders are less bullish.

The put-to-call ratio for the May 31 expiry shows signs of pessimism — it is 0.82, compared with 0.55 for June 28.

The ratio is a measurement used to gauge the overall mood of a market. A higher put-call ratio — going as high as 1 — signals a more bearish outlook.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.