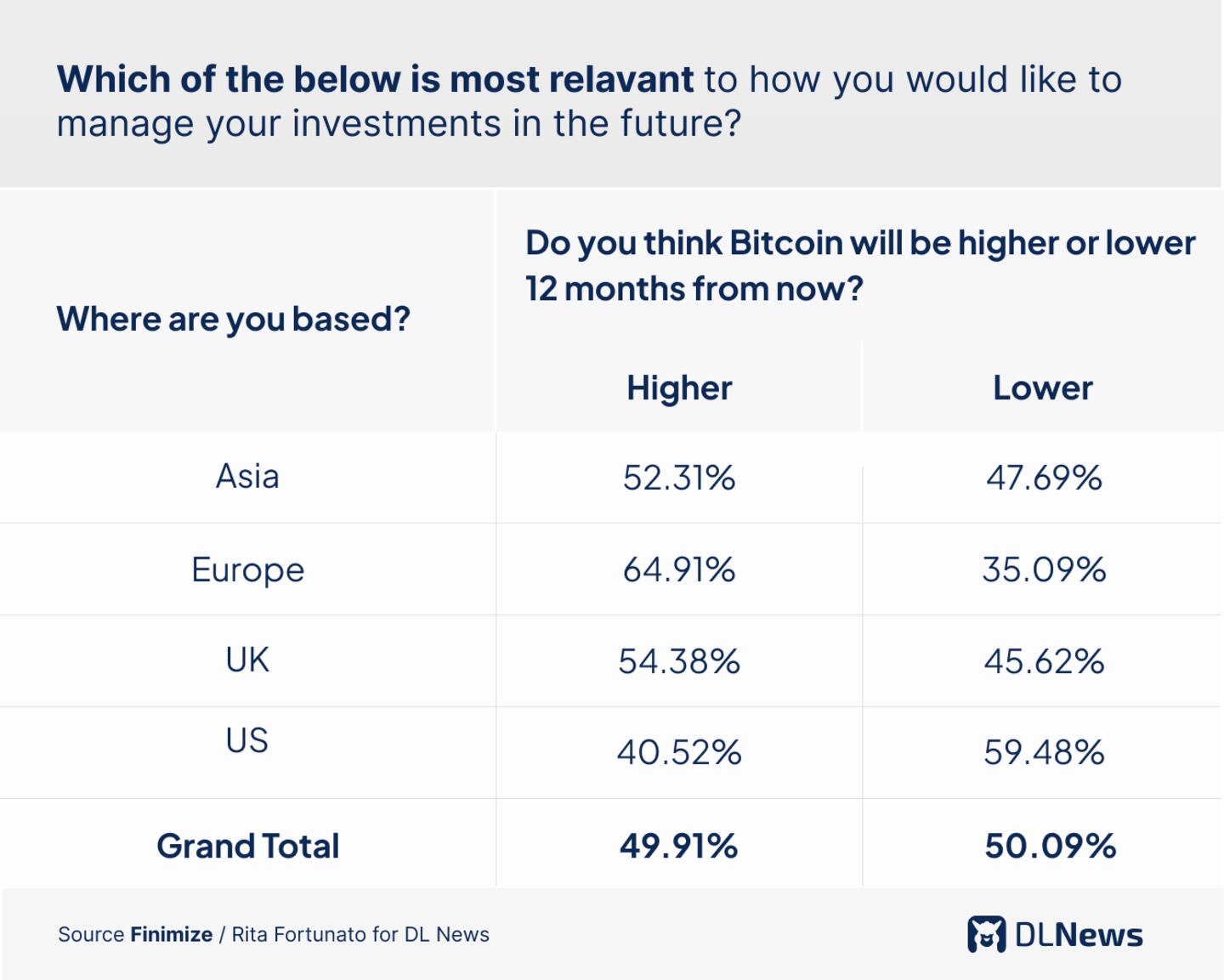

- Only 41% of Finimize's American customers believe Bitcoin prices will be higher a year from now, while among Europeans, the percentage was 65%.

- This means 49% of the Finimize community thinks the price of Bitcoin will be higher in 12 months time. That's down from 73% last year.

- The uncertain macro environment pushed retail investors to look toward traditional institutions for confidence, rather than pure play crypto firms.

- Most modern investors will still hold some crypto as part of a diversified portfolio, but not as much as during the crypto mania times.

As we head into the final months of 2023, pessimism about the future of Bitcoin prices persists, with just 49% of respondents on financial information platform Finimize saying they think Bitcoin will be higher a year from now, down from 73% who said the same thing last year.

Notably, there was a significant disparity in optimism between American respondents and those from other parts of the world, with just 41% of Americans agreeing with the statement, compared with 65% of Europeans, 54% of those in the UK, and 52% of those in Asia.

We sat down with Max Rofagha, Finimize’s CEO and founder, this week to discuss the crypto market and retail sentiment. Finimize boasts over one million users that read its analysts’ bite-sized views on the markets each week. Rofagha shared some exclusive insights on the crypto sector from the firm’s community with DL News.

How do retail investors view the crypto industry? What are you seeing among the Finimize community?

The hype has worn off a little, but we’re not seeing total skepticism; 49% of our community still thinks Bitcoin will be higher 12 months from now, versus 73% of them last year. Around that time last year, crypto brought in the most engagement of all of our content topics. Now, it performs in line with most other asset classes.

I’m sure we’ll see a similar trend with AI, once the hype dies down, those that understand the technology and are happy to take a long-term view will remain.

Are there any shifts or changes you’re seeing among retail when it comes to crypto? How are retail investors reacting to the drop in crypto prices?

Remember, most retail investors lost money from investing in crypto. And with the negative crypto headlines consistently cropping up, alongside news of the collapse of prominent companies in the space, the mainstream audience isn’t blindly investing in crypto.

Instead, they’re looking out for projects with genuine real-world utility that could lead to mass adoption. Such as central bank digital currencies, payments, and settlements. As for individual crypto projects, the more well-established currencies like Bitcoin and Ethereum are viewed as a safer bet than early-stage projects.

How has the US regulatory crackdown impacted investor sentiment and/or behavior?

Today’s uncertain macro environment has pushed retail investors to look toward major institutions for confidence, rather than pure play crypto firms, venture capitalists, and influencers. The more companies like PayPal, BlackRock, Fidelity, and central banks are in the headlines supporting crypto, the more the mainstream investors’ confidence builds.

Regulation’s helped, too. Investors want to see signs of legitimacy, and more regulation could improve crypto’s mainstream image. True crypto believers, though, would see this as a major drag on the speed of innovation.

What retail investing trends in general should readers know about?

I think the three trends in retail investing that will shape the future are rising sophistication, increasing self-direction and a growing appetite for alternatives.

High quality information is increasingly being made accessible to retail investors, leveling the playing field between institutions and individuals. Putting data and research into the hands of the masses in a way that is easy to digest helps retail investors make more informed decisions for themselves.

The combination of both improving information and accessible tools has led to the majority of modern investors wanting to be self-directed with their investments. In our recent survey, 63% would rather manage their own investments than delegate to either an adviser or digital service. This could have major implications for the wealth management industry as the great wealth transfer continues over the next 10-20 years.

Finally, we’ve seen a growing interest in alternative assets, with 53% planning to invest in alternative assets this year, up from 38% the previous year. Retail investors are increasingly comfortable locking their investments up for long time periods in order to access returns beyond those available from public markets. Given rising interest rates and future public markets returns potentially being lower than in the recent past, alternative assets have become more appealing. Technology is also making it easier for retail investors to get access to previously unavailable assets like private equity, real estate and more.

What are you seeing in terms of geographical differences? London vs Dubai, Hong Kong etc.?

Our latest survey showed that crypto sentiment in the US was far lower than around the rest of the world, with only 41% believing that Bitcoin prices would be higher a year from now. The UK was 54%, Europe 65%, and Asia 52%.

Any other insights worth sharing?

Most modern investors will still be holding some crypto as part of a diversified portfolio, but not as much as during the crypto-mania times.

But with a massive transfer of wealth expected when family money changes generations, money-managing institutions should be seriously assessing their approach to crypto.