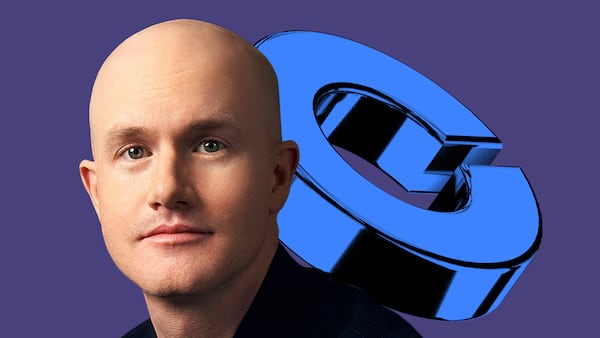

- Founder and CEO of Brava, Graham Cooke, had an interesting thought experiment.

- If his vision plays out, the paths to initial public offerings could become a lot more interesting.

Graham Cooke, founder and CEO of the stablecoin management firm Brava, had an interesting thought.

“The IPO is dead. And Coinbase just killed it.”

Cooke argues that tokenisation will put paid to the practice of initial public offerings of traditional shares.

He also says the boom in private markets offers an opportunity to sidestep the onerous task of raising capital via public stock markets.

“Instead of complex IPOs with dozens of middlemen, companies will tokenise their shares directly,” Cooke wrote. He did not immediately respond to a request for further comment.

Cooke explained that Coinbase’s aim to tokenise its stock is the canary in the coal mine for initial public offerings.

Tokenisation

Coinbase has said it wants to tokenise its shares. And at least one issuer has used almost $44 million worth of shares to back a tokenised product according to RWA.xyz.

The trend to get assets like stocks and bonds onchain has been led by fund giant BlackRock.

The $12 trillion asset manager’s BUIDL Fund, on Ethereum, leads real-world assets onchain with $1.8 billion in total value, according to DefiLlama.

Such an opportunity will lure others and is the “real disruption,” Cooke said.

Private markets

Another factor driving companies away from IPOs are private markets, which S&P Global says are expected to reach more than $18 trillion by 2027.

Those who opt to stay out of the running for public capital have advantages, which according to Cooke: “Raise billions privately; avoid quarterly Wall Street pressure; focus on long-term innovation.”

A wave of potential IPOs in the crypto space have been either rumoured or filed for, including the exchanges Kraken and Gemini, USDC issuer Circle, and Ripple, the company behind the XRP token.

But the future will look different, Cook said.

For the 1%

That’s because stock ownership has become a rich person’s game. The top 1% of Americans hold more than half of corporate and mutual fund shares, according to the Federal Reserve.

That opens an opportunity for the rest of the country.

“Think about it: The next Google, Amazon, or Apple won’t IPO,” Cooke continued. “They’ll tokenise their shares, giving everyday people access to opportunities previously locked away for the ultra-wealthy.”

“Every week, new breakthroughs completely disrupt company valuations,” wrote Cooke.

Andrew Flanagan is a markets correspondent for DL News. Have a tip? Reach out to aflanagan@dlnews.com.