- A PwC survey of 100 hedge funds found almost half are betting on digital assets.

- The report also broke down their strategies, and where they are most cautious.

Some 47% of traditional hedge funds have exposure to digital assets, soaring from about 29% last year and 37% in 2022, a survey found.

The survey of about 100 global hedge funds, conducted by PwC, and the Alternative Investment Management Association, found that the firms piled in due to increased regulatory clarity, and the launch of spot crypto exchange-traded funds in both the US and Asia.

Among those already invested, more than two-thirds, or 67%, plan to keep the same amount of money in crypto, while the rest say they’ll amp up their holdings by the end of the year.

“Further regulatory clarity is on the horizon,” Steve Kurz, global head of asset management at Galaxy, said in the report. “A sustained period of institutional adoption will follow.”

The 100 funds surveyed — 42% were traditional and 58% were digital-asset focused — had assets under management of about $125 billion.

Their responses were collected in the second quarter, when crypto prices were at or near records.

Strategies

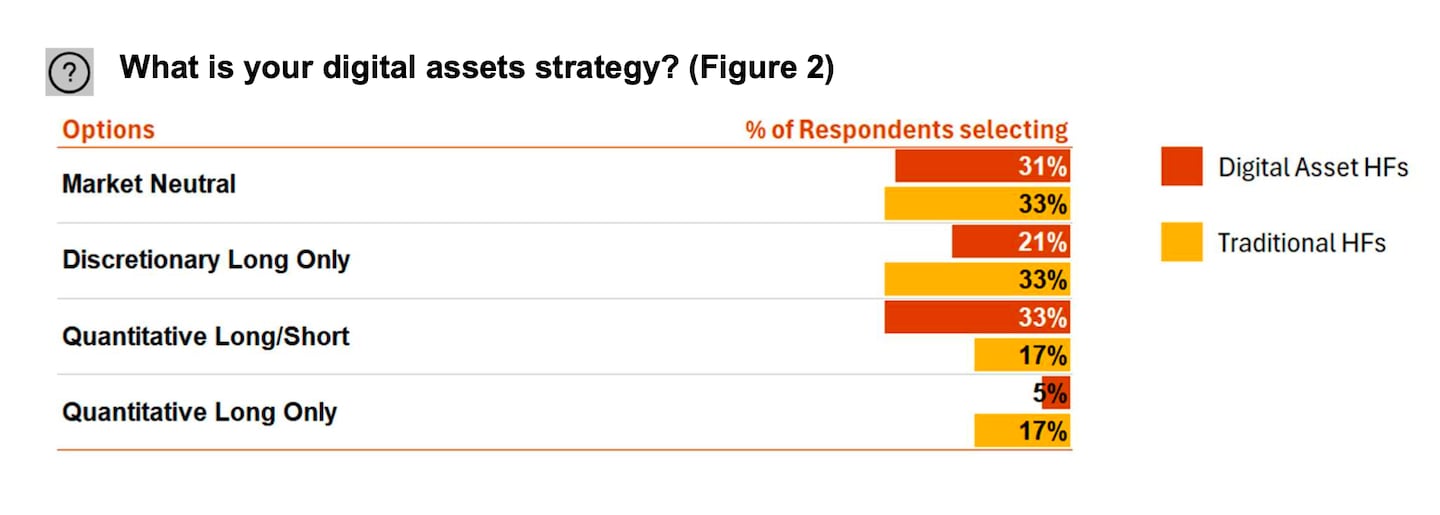

The most popular digital asset strategies among traditional hedge funds include market-neutral and discretionary long-only — each adopted by a third, or 33%, of respondents.

Investors favour market-neutral strategies “for their ability to manage risk while seeking returns in the fluctuating digital assets market,” the report said.

While discretionary long-only strategies “lack the volatility dampening characteristics of market-neutral portfolios, they can capitalise on the upside potential of innovative blockchain projects or tokens.”

Some 17% of respondents preferred quantitative long/short and quantitative long-only strategies.

The quantitative long/short strategy “tends to leverage algorithmic models and data analysis to capitalise on perceived market inefficiencies and trends,” the report said.

Fast exit

Don’t get too excited about hedge fund involvement in crypto, says macro analyst Noelle Acheson.

They’re not long-term holders, nor are they long-only investors.

“Remember that they are just as likely to go short as to buy and hold, and they can exit fast,” Noelle Acheson wrote in her “Crypto is Macro Now” newsletter.

Still, she added: “There is less and less reason for hedge funds to treat crypto as a pure risk play. The development of sophisticated derivatives markets, especially once options on the spot BTC ETFs start trading, means that they can more efficiently trade relative risk within the crypto basket.”

And, she said: “Greater liquidity as well as market size will bring in bigger players which will further help liquidity and market size,” as well as encourage further development in infrastructure.

Risks

Among traditional hedge funds that don’t invest in digital assets, more than three quarters, or 76%, say they’re unlikely to enter the space within the next three years. That’s up from 54% in 2023.

The top barrier to entry is the exclusion of digital assets from investment mandates, the report found.

Regulatory uncertainty as a key concern is waning as global frameworks including Europe’s MiCA rules emerge.

Trista Kelley is DL News’ Editor In-Chief. Got a tip? Email at trista@dlnews.com.