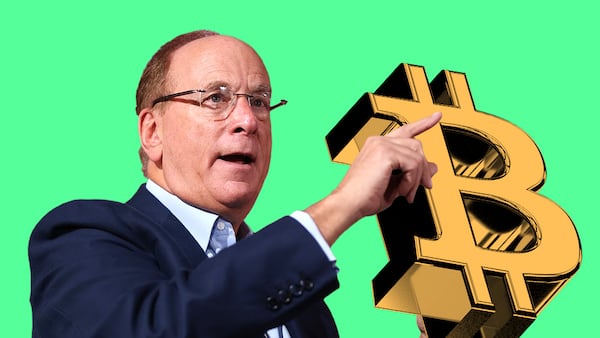

- BlackRock’s spot Bitcoin ETF has just hit $10 billion in assets.

- IBIT is the fastest fund in ETF history to reach that mark.

- The next $10 billion could come from higher price rises in Bitcoin.

BlackRock’s spot Bitcoin exchange-traded fund now commands $10 billion in total assets under management, but it may cross the $20 billion mark soon thanks to Bitcoin’s soaring price.

That’s according to Eric Balchunas, senior ETF analyst for Bloomberg Intelligence, who wrote on X that the second “$10 billion [will be] easier because market appreciation [becomes a] bigger variable.”

Market appreciation refers to the increase in the value of the underlying asset, Bitcoin.

The cryptocurrency has also soared over 27% in the past seven days to trade above $65,000 for the first time since mid-November 2021.

As Bitcoin’s price ripped, the dollar value of BlackRock’s holdings also soared.

Bitcoin’s price appreciation will also Benefit BlackRock’s bottom line, as fees on ETFs are typically calculated based on AUM.

Ignoring fee promotions, this means BlackRock will earn around 0.25% of that $10 billion, or $25 million.

On its first day of trading BlackRock had inflows of just over 2,400 Bitcoin.

The digital asset traded around $46,000 at the time, meaning the AUM was just over $110 million.

Those 2,400 Bitcoin are worth nearly $20,000 more today, or $48 million more.

Bernstein analysts and other market watchers have predicted that Bitcoin could soar to over $150,000 over the next year.

BlackRock’s ETF, IBIT, is the fastest ever ETF to get $10 billion AUM and that only 152 out of 3,400 ETFs have joined it in the $10 billion club, Balchunas said.

The 10 new US spot Bitcoin ETFs have continuously smashed new records following their approval for launch by the Securities and Exchange Commission on January 10.

The regulator and its reluctant chair Gary Gensler’s approval have contributed to the recent Bitcoin rally — ironic given his multi-year crypto crackdown.

“Gensler should be really proud,” Balchunas told DL News last week.

The regulatory approvals are signs that “not just Bitcoin, but the industry is being taken more and more seriously,” Rebecca Rettig, chief legal and policy officer at Polygon Labs, told DL News.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.