- Satoshi Nakamoto holds over $105 billion worth of Bitcoin.

- ETFs run by the likes of BlackRock are close to toppling that record.

- Experts say it will affect the price in big ways.

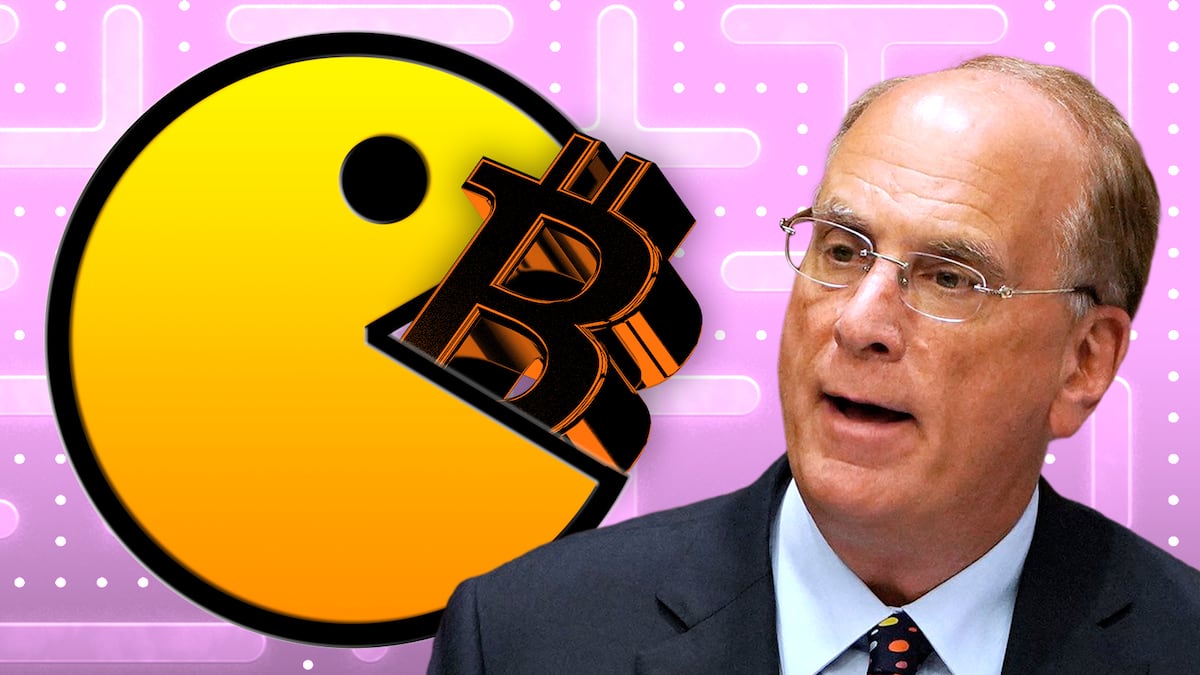

BlackRock, Bitwise and other exchange-traded fund providers are about to become the biggest holders of Bitcoin.

They’ve already gobbled up over $104 billion worth of the cryptocurrency this year, putting them within spitting range of toppling Satoshi Nakamoto as the biggest holder of the digital asset.

The cryptocurrency’s mysterious founder holds 1.1 million of the asset, worth over $105 billion in today’s value.

“By 2024 end, we expect Wall Street to replace Satoshi as the top Bitcoin wallet,” research firm Bernstein wrote in a recent report.

The prediction came on the back of financial institutions having increasingly tapped into cryptocurrencies this year.

“Institutional confidence in the asset class is at an all-time high,” Joshua de Vos, Research Lead at CCData, told DL News, adding that this trend shows no sign of abetting.

The shift is helped by optimism about the favourable regulatory environment promised by a second Donald Trump presidency.

Bitcoin ETFs

Spot Bitcoin ETFs have been the breakout crypto success story of 2024.

Since the US Securities and Exchange Commission approved 11 funds in January, they have together amassed over 5% of the world’s total Bitcoin supply.

Those cumulative ETF holdings differ from Satoshi’s stash in one key way — the secretive Bitcoin founder’s holdings are believed to belong to a mostly single entity.

The next biggest single holder of Bitcoin, MicroStrategy, holds just under 2% of the total amount of Bitcoin.

Still, the ETFs are rapidly closing the gap.

“Pac-Man mode activated,” Eric Balchunas, an ETF analyst at Bloomberg Intelligence, commenting on how the ETFs consumed roughly 10 times the amount of newly created Bitcoin last week.

Bitcoin to $740,000

Bitcoin retreated as it was on the cusp of breaking $100,000 last week. But analysts expect that it’s just a matter of time before it smashes the six-figure milestone.

Earlier this week, hedge fund Pantera Capital’s founder and managing partner Dan Morehead, said that institutions have only just started to scratch the surface.

He estimated that more big firms will dip their toes into the market as Trump delivers on his promises of more regulatory clarity.

That, in turn, will enable Bitcoin’s value to skyrocket. It has basically doubled its value every year for the past decade, Morehead wrote.

If the trend were to continue, Bitcoin would hit $740,000 in April 2028, he added.

Not just the price

Increased institutional adoption — both from private companies and governments looking to up their crypto holdings — is likely to make the asset less volatile, de Vos said.

“These developments could lead to an increased concentration of supply among the largest holders, further widening the gap between small and large market participants,” de Vos said.

Crypto market movers

- Bitcoin is down 0.2% over the past 24 hours to trade at $95,225.

- Ethereum is flat at $3,554.

What we’re reading

- Why Europeans are foaming at the mouth about crypto — DL News

- Are NFTs making a comeback? — Milk Road

- Coinbase-Incubated L2 Base Sees Record Transactions Thanks to AI Memecoin Deployer Clanker — Unchained

- How Microstrategy could collapse — Milk Road

- Why won’t Bitcoin reach $100,000 already? — DL News

Eric Johansson is DL News’ News Editor. Got a tip? Email at eric@dlnews.com.