- Gemini says lending programme creditors will get back a 232% return on their investments.

- The money comes partly from sales of GBTC shares.

Bankrupt crypto lender Gemini announced on Wednesday that its Earn customers will recover more than $940 million in crypto — more than triple what they lost when the firm shuttered the lending programme in early 2023.

Some 232,000 Earn users will recuperate 100% of their digital assets in-kind, Gemini said in a statement.

What does that mean? Well, if a customer lent one Bitcoin to Earn, they will get one Bitcoin back.

That’s great news for customers. With Bitcoin now at $67,000 — compared with $20,000, when Genesis closed withdrawals — Gemini clients will be making a 232% recovery in dollar terms, according to Gemini.

Gemini and Genesis

Earn, which allowed investors to lend money to Gemini for 8% “low-risk” returns, was jointly managed by the exchange and brokerage Genesis Global.

Genesis had funds tied up in FTX, and so when that exchange collapsed in November 2022, Genesis suspended withdrawals for Gemini Earn customers.

Amid roiling markets, and the beginning of a bitter crypto winter, Genesis declared bankruptcy in January 2023 — at the lows of the bear market.

Since then, however, crypto prices have taken off. And an in-kind payment to Earn creditors means they will get back the value of their crypto pegged to their notional dollar value as of May 28, 10 am Eastern.

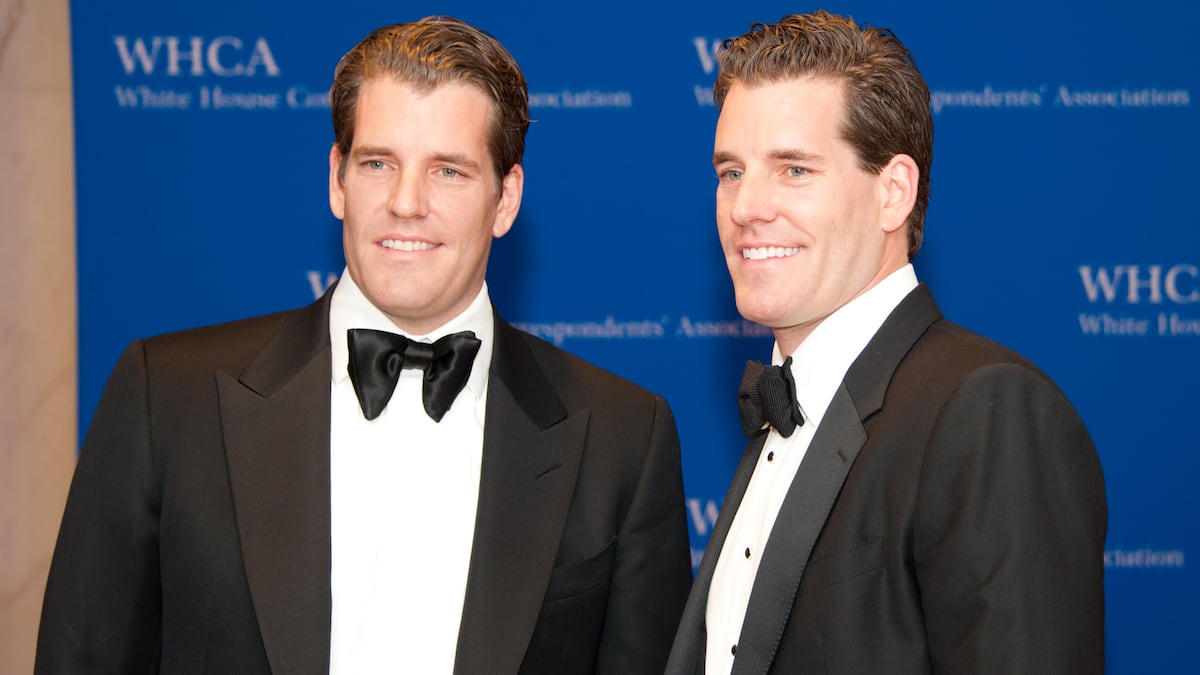

“We are thrilled that we have been able to achieve this recovery for our customers,” said Cameron Winklevoss, who founded Gemini along with his twin brother Tyler.

“We recognise the hardship caused by this lengthy process and appreciate our customers’ continued support and patience throughout,” Cameron Winklevoss said.

The money comes partly from $50 million that Gemini contributed, as well as from a court settlement that allowed Genesis to sell $1.6 billion in Grayscale Bitcoin Trust shares.

Gemini said customers will get back 97% of their crypto immediately and receive the rest of their balance within a year.

The returns are in stark contrast to the way FTX is being wound up.

In that case, money is being clawed back from the liquidation of the exchange’s assets — meaning it can go only so far toward paying back creditors.

FTX’s lawyers celebrated the bankruptcy plan they proposed recently, saying customers would get paid in full, with interest.

However, some customers say that’s not good enough, partly because their assets are valued as of November 2022, and don’t reflect crypto’s rally.

Joanna Wright writes about markets for DL News. Email her at joanna@dlnews.com.