- Galaxy Digital is going public in the US.

- Its top line is huge for a company its size.

- The firm derives almost 99% of its revenue from digital asset sales.

What do Netflix, Starbucks, and Visa have in common?

Each of these household names are significantly smaller than Galaxy Digital in terms of revenue.

At least, at first glance.

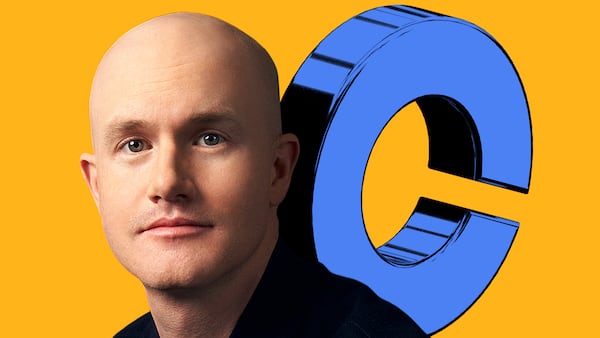

Led by CEO Michael Novogratz, the listed Canadian crypto company recorded a whopping $42.6 billion in total revenue in 2024, according to its registration for an initial public offering filed with the US Securities and Exchange Commission last month.

That puts Galaxy Digital in the top fifth of the Fortune 500.

Obvious question

The eye-watering figure raises an obvious question — how can a seven-year-old company with approximately 520 employees record more than double the annual revenue of BlackRock, the world’s biggest asset manager with 19,800 workers?

The short answer: it doesn’t.

Galaxy combines the revenue it derives from fees, Bitcoin mining, and other businesses with “digital asset sales.” Indeed, digital asset sales account for almost 99% of Galaxy’s top line, its income statement shows.

So what gives? Why conflate business revenues with the sale of Bitcoin, Ether, USDT, and other cryptocurrencies?

When DL News sought guidance from Galaxy Digital’s media relations team we were told the company cannot comment because it is in a quiet period before the IPO.

Trading volume

What appears to be happening is that when Galaxy executes a trade of a digital asset for a customer it factors the transaction into its top line. Its customers include centralised crypto exchanges, according to its financial filings.

“Firms in the trading space have different ways of presenting their volumes and the commissions that they earn on those volumes,” said Mark Palmer, a fintech and digital assets analyst for Benchmark Co, who covers Galaxy.

“In Galaxy’s case, it presents its trading volume as total revenue,” Palmer told DL News.

‘It’s something you would see from a market maker.’

— Matthew Foreman, Falcon Rappaport & Berkman

To be sure, Galaxy then subtracts digital asset sales from its top line as transaction expenses, and along with other costs, this left the company with reported net income of $347 million last year.

Matthew Foreman, partner and co-chair of the tax group at Falcon Rappaport & Berkman in New York, agreed that the billions of dollars in revenue seem extraordinary.

By offsetting its revenue with transaction expenses it appears the company is recording its financials like a market maker, a company that provides liquidity to the marketplace.

“I can’t confirm what they’re doing, but it’s something you would see from a market maker, whether in digital assets, corn futures, or any other asset class or subclass,” Foreman told DL News.

To drill down a little further, this treatment suggests that Galaxy is acting as a “principal” that controls the asset rather than as an agent or a broker, which tend to execute a trade of the asset on behalf of clients.

“The accounting treatment becomes very noticeable in digital asset trading and market making businesses because of the sheer transaction volume,” Foreman said.

Three divisions

Galaxy does more than sell digital assets.

The company is organised into three operating businesses. Its Global Markets division provides financial services and products to investors and runs trading and investment banking units.

Galaxy’s Asset Management division offers retail and institutional clients with active and passively managed investment products.

And its Digital Infrastructure Solutions business houses a Bitcoin mining operation, among other businesses.

The Global Markets business generates revenue from fee-paying clients. It also includes “realised and unrealised gains” on digital assets and equity investments, according to its fourth quarter earnings statement.

The Asset Management business, which manages investments for the company and its subsidiaries as well as clients, also books realised and unrealised gains and losses on principal investments.

While Galaxy’s huge revenue line may turn heads, it appears to be just another quirk of the crypto industry.

Andrew Flanagan is a markets correspondent for DL News. Have a tip? Reach out to aflanagan@dlnews.com. Edward Robinson is the story editor for DL News. Contact the author at ed@dlnews.com.