- Fintech firms are increasingly muscling into crypto.

- Their interest in the sector will put them on a collision course with industry-native firms.

A version of this story appeared in our The Roundup newsletter on March 28. Sign up here.

Hi, Eric here!

Revolut is coming for crypto companies’ customers.

On Tuesday, the UK neobank rolled out a new mobile app for its crypto exchange Revolut X, with the stated aim of “challenging other exchanges.”

The app will initially only be available across Europe, but a spokesperson told me that Revolut aims to eventually launch it in the US.

“Crypto is a key area for Revolut,” the challenger bank said in an ad for a new crypto product marketing manager.

As thrown gauntlets go, it’s a big ‘un.

The neobank has offered crypto services since 2017, but it’s increasingly pushing into the space.

Last year, it increased its crypto team headcount by 60%, rolled out virtual cards that enabled customers to pay with crypto, and posted an annual profit of $545 million, partly driven by its crypto push.

And it’s not alone in challenging crypto-native firms like Coinbase, the biggest US-based crypto exchange.

Stock-trading apps like Robinhood and eToro, which filed to go public in the US this week, and digital payment provider PayPal are all muscling into crypto.

It has become more attractive for these firms to do so after US President Donald Trump promised to relax crypto laws as part of his bid to transform the country into the crypto capital of the world.

These firms have weight to throw around.

On Friday, Revolut’s top investor Schroders upgraded the valuation of its stake in the fintech by about 80%, which would put the challenger bank’s valuation at $48 billion. By comparison, Coinbase’s market capitalisation is about $48 billion, while Robinhood’s is $38 billion.

Fintechs also have the advantage of essentially being user-friendly, one-stop shops for customers’ every financial need. Crypto is just one service among many, some hot sauce for customers looking for another way to invest.

In a February note, Morgan Stanely analysts said Robinhood’s history of regulatory compliance and name-recognition will enable it to grab shares of the crypto market. A similar argument could easily be made for other fintechs.

Nicklas Nilsson, an analyst at research firm GlobalData, told me in December that 2025 will be a year when more new rivals jostle for position in the crypto market.

“We will see increasingly sophisticated crypto products from fintechs,” Nilsson said.

With Revolut’s launch of its new mobile app this week, it looks like Nilsson’s prediction is coming true.

Binance was used by terrorists and kidnappers in Nigeria, minister says

In a big scoop this week, Osato Avan-Nomayo reported that Nigeria’s minister of information is accusing the world’s biggest crypto exchange of letting terrorists use its infrastructure to facilitate payments.

Trump SEC pick Paul Atkins spared crypto grilling in Senate hearing

Aleks Gilbert sat in on Paul Atkins’ confirmation hearing as Trump’s pick to lead the Securities and Exchange Commission.

Too many young people invest in crypto, says FCA — ‘We are not anti-innovation’

Millennials are a key driver behind crypto companies’ growth. However, the UK’s top financial markets watchdog warned this week that too many young people have invested in digital assets without understanding the risks.

Post of the Week

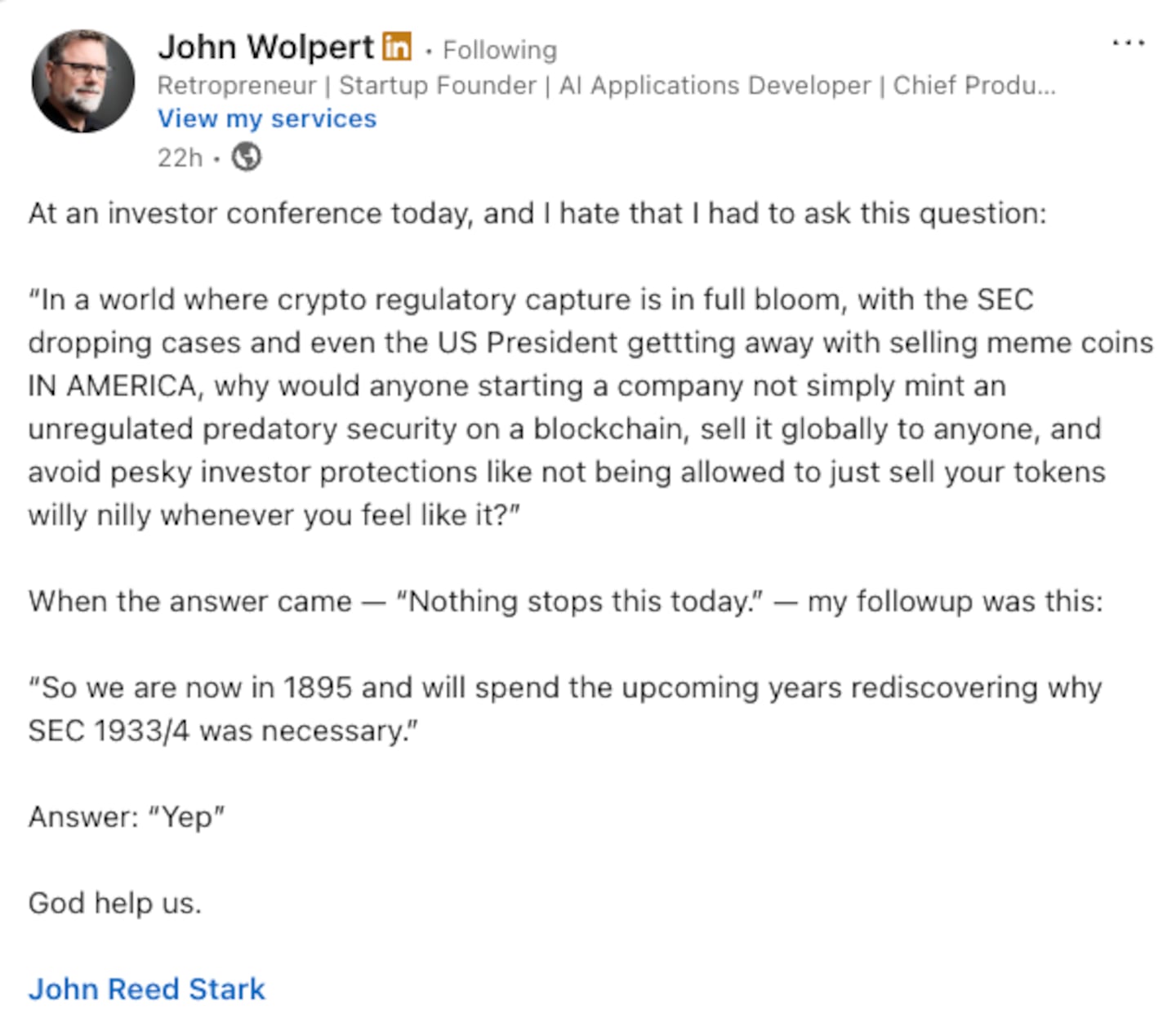

Crypto backer Atkins’ nomination as SEC chair is the latest sign that Trump aims to ease the regulatory pressure on crypto. However, not everyone thinks that halting the Biden era’s crypto crackdown is a good idea.