- Bitcoin's volatility has dropped 30% since 2020.

- Fewer spikes means a rally could last much longer, says expert.

It’s no longer enough that Bitcoin boosts investor portfolios. It needs to do so in dramatic fashion.

The largest cryptocurrency is up some 30% this year, but investors are missing one key component: unpredictability.

“This has been the most boring cycle of all time,” said TraderKoz, pseudonymous partner at venture studio Kelsier.

He’s not alone in that opinion.

“You’re bored out of your mind because you don’t have the same volatility as you had in the first cycle or last cycle,” Philipp Pieper, co-founder of tokenisation platform Swarm, told DL News.

They’re striking statements for an asset class known for outsized, rollercoaster price moves.

And recent macroeconomic factors, including Federal Reserve policy and the US election, have goosed the cryptocurrency. In the last 30 days, Bitcoin’s price has swung back and forth far more compared with the same period last year, according to Kaiko.

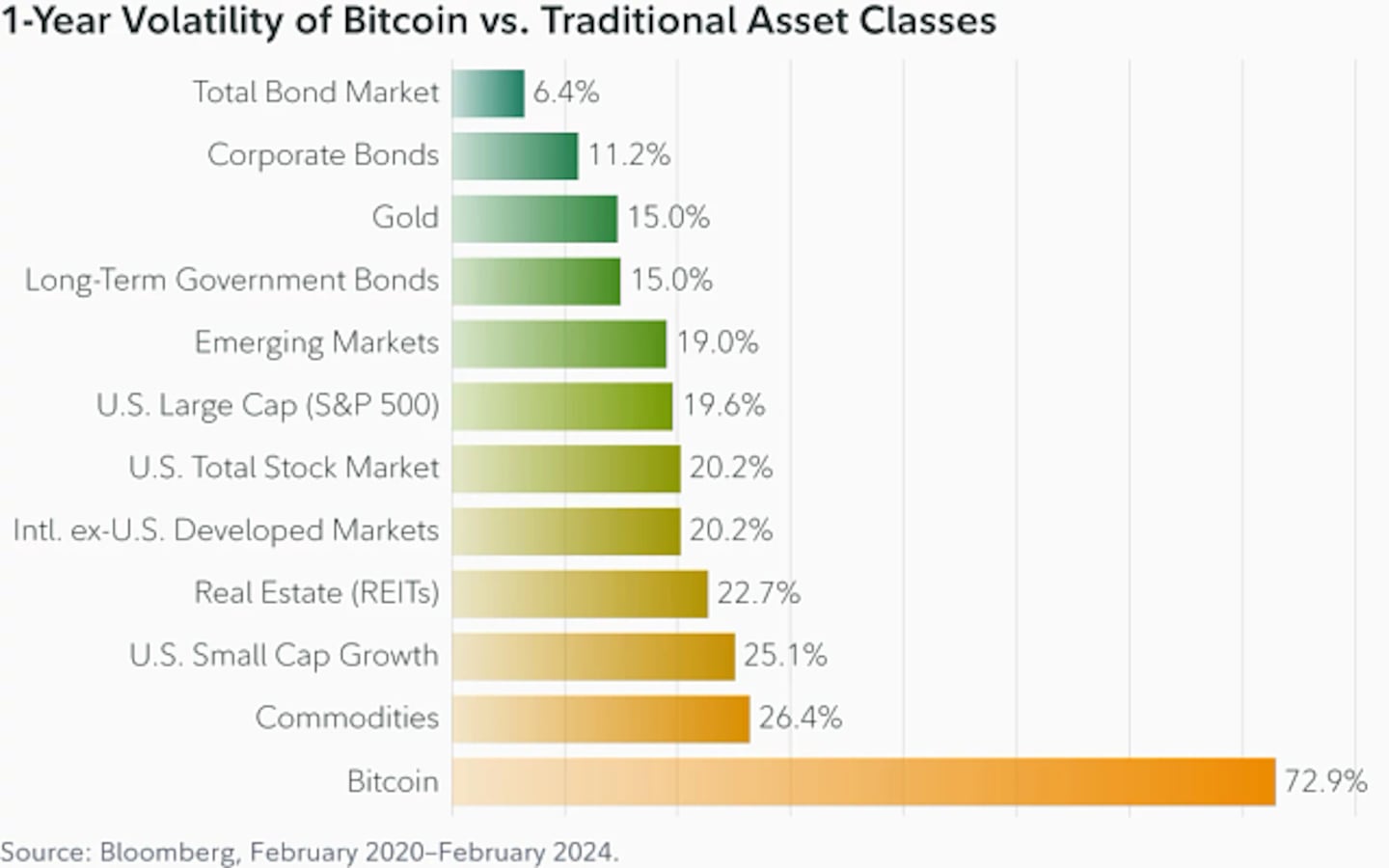

Fidelity found that Bitcoin has been nearly four times as volatile in the past four years compared with 11 other asset classes.

That’s a striking statistic even accounting for crypto’s relative tiny size — only about $2 trillion compared to, say the bond market’s hundreds of trillions.

But crypto traders eager to capitalise on high-risk, whale-sized market moves of years ago have been disappointed.

Bitcoin is taking investors for fewer dips and dives.

Data from Volmex, a crypto index provider, shows a drop in crypto volatility since 2020 — with Bitcoin seeing a 40% drop in wild swings and Ethereum posting a 30% tumble.

‘Impatient’

Cole Kennelly, CEO of Volmex, says the arrival of institutional investors is one explanation. The arrival of billions via giants like BlackRock has both helped crypto prices while smoothing out their volatile swings.

New launches of Bitcoin and Ethereum spot exchange-traded options will lure even more of them as professional investors seek products to hedge against volatility and bag returns, he told DL News.

Pieper also pointed to crypto ETFs as a reason for waning volatility.

The upshot is that this slow tick-up means investors should expect continued high prices well into next year.

Pieper sees Bitcoin going higher than $100,000, which won’t be easy, as that estimate “requires a lot of capital to flow in.”

“People have gotten impatient” for Bitcoin to rally again, he said.

Bitcoin’s three horsemen

Since Bitcoin hit a record $73,000 this year, the price has slipped and even crashed on a few occasions.

Markets have been upended by geopolitical turmoil and uncertainty around both Fed policy and the US presidential race.

“The baseline economic decisions that people are making about where to deploy their money have been a little ‘wait and see’ rather than, ‘OK, I’m ready to make some money. I’m ready to risk something,’” Pieper told DL News.

Escalation of conflicts in the Middle East and Ukraine would exacerbate these swings.

For now, all eyes are on the next few months.

Slowing US job growth has put pressure on the Fed to cut interest rates. Traders now place a 69% chance of a 50-basis point rate cut at this month’s meeting, according to the Chicago Mercantile Exchange’s FedWatch tool.

Meanwhile, the outcome of the election will bring certainty.

Many in the crypto industry are rallying around former President Donald Trump, who has vocally backed crypto. Though some crypto lobbying groups have rallied behind Vice President Kamala Harris, whose team has hinted at a pivot to the industry.

“It’s surprising to see them suddenly discover crypto,” said Pieper. “But that’s just trying to get voters. Whether that’s going to be followed through is a different story.”

In general, though, added the Swarm co-founder: “Maybe we just have to realise that the market is maturing a lot more.”

Liam Kelly is a DeFi Correspondent for DL News. Got a tip? Email him at liam@dlnews.com.