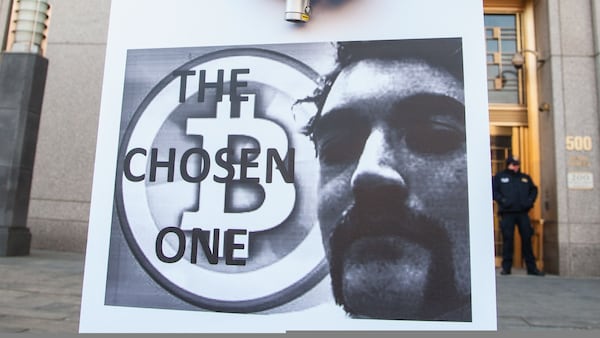

- A day after Trump's inauguration an asset manager submitted an application to turn his memecoin into an exchange-trdaded product.

- The flurry of applications is a big bet that Washington's crypto crackdown is over.

Here come the memecoin ETFs.

No sooner did Donald Trump take office as president than a flurry of applications for new crypto exchange-traded funds hit regulators’ inboxes.

Rex Shares and Osprey Funds jointly filed fund applications for Dogecoin, the president’s new memecoin TRUMP, and another for the BONK token.

Other issuers have filed dozens of applications for ETFs for the likes of Hedera, XRP, Litecoin, and Solana.

Radical bet

The new president may have promised to end Washington’s crackdown on crypto but memecoin ETFs seem like quite the radical bet.

What are the odds they get approved?

“Would have been close to zero a few weeks ago,” Adam Morgan McCarthy, an analyst at Kaiko, told DL News. “Odds are slightly higher now, he said, but not by much.”

In reality, the slew of new filings are a marketing play more than anything else, he said.

“Competition is rough for Bitcoin ETFs,” McCarthy said. “They don’t make tons of money for the issuers. They’ll take any edge they can get going forward that differentiates them.”

BlackRock’s Bitcoin ETF commands most of the market with more than $60 billion in net assets. Fidelity’s offering, the second largest, manages $23 billion.

Still, crypto has been on a tear since Trump won the election on November 5. Bitcoin is up 51% in that period.

We are so back. Here's a massive list of all the current digital asset ETF filings that I'm aware of: pic.twitter.com/npHuTmox5K

— James Seyffart (@JSeyff) January 21, 2025

While it took Bitcoin more than ten years to get approved, fund issuers are now betting on a crypto-friendly administration approving new ETFs much faster, said McCarthy.

“The rules of the game have changed,” he said.

Liam Kelly is a Berlin-based reporter for DL News. Got a tip? Email him at liam@dlnews.com.