- Saylor's firm MicroStrategy has purchased 190,000 Bitcoin to become the world's largest corporate holder.

- The firm faces stiff competition from a batch of new spot Bitcoin ETFs in the US from the likes of BlackRock and Fidelity Investments.

When it comes to Bitcoin, MicroStrategy co-founder and chairman Michael Saylor says he’ll be “buying the top forever.”

The entrepreneur and long-time Bitcoin bull, whose business intelligence firm MicroStrategy is the world’s largest private Bitcoin holder with 190,000 Bitcoin worth $9.9 billion, reiterated on Tuesday his intentions to keep accumulating.

In an interview with Bloomberg TV, when asked when it would make sense to sell some of the firm’s nearly $10 billion of Bitcoin holdings, Saylor remained unyielding.

“There’s no reason to sell the winner to buy the losers,” he said. “Bitcoin is the exit strategy — it’s the strongest asset.”

Saylor defined Bitcoin as an asset class similar to gold and real estate.

“Capital is going to keep flowing from those asset classes into Bitcoin, because Bitcoin is technically superior to those asset classes. There’s no reason to sell the winner to buy the losers.”

Saylor’s comments come amid a Bitcoin ETF frenzy following the approval of nine spot bitcoin ETF products in January.

BlackRock and Fidelity Investments’ Bitcoin ETFs have reached a respective $6.6 billion and $4.4 billion in inflows in five weeks, according to DL News’ in-house ETF tracker.

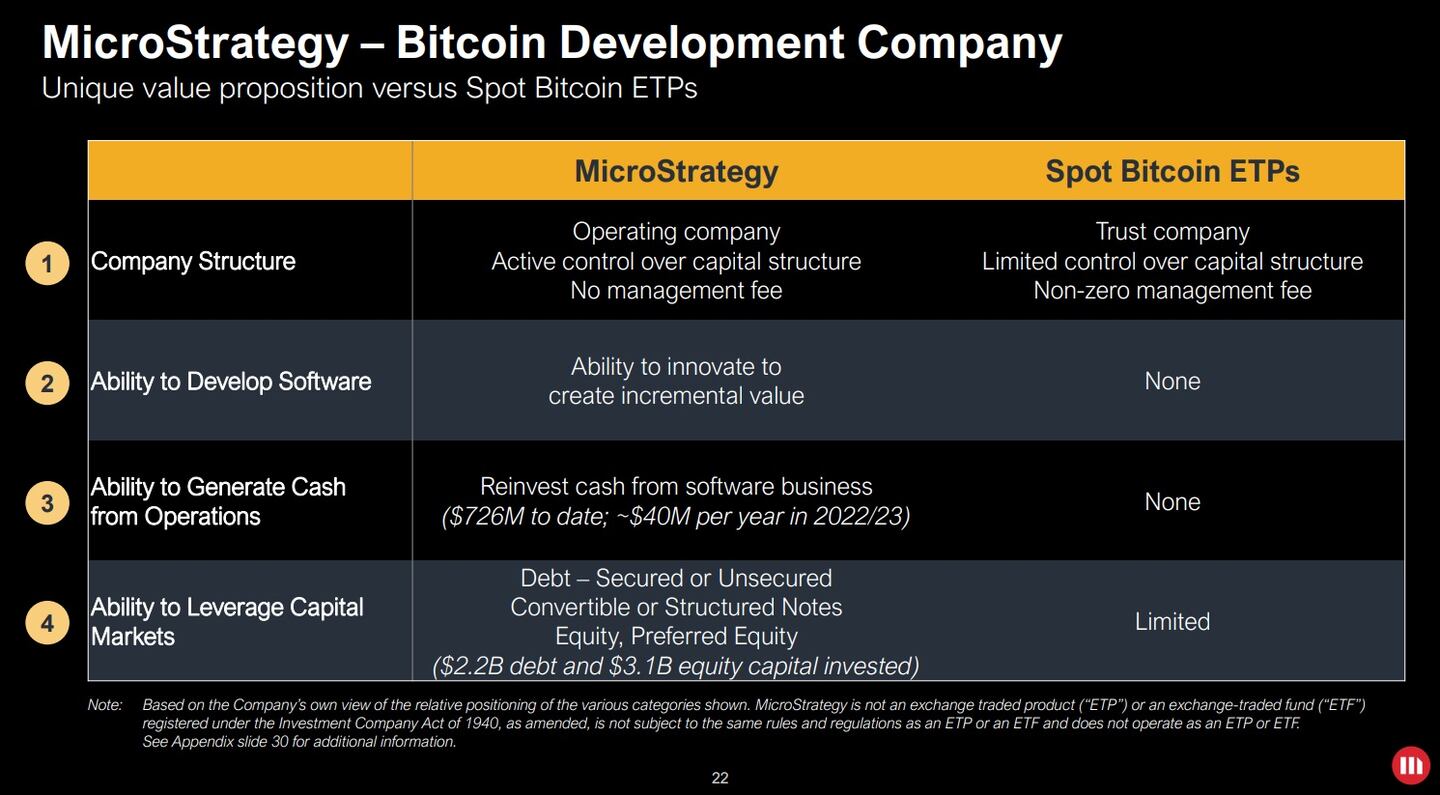

MicroStrategy vs Bitcoin ETFs

During an earnings presentation earlier this month, the firm said it had purchased an additional 56,650 Bitcoin at an average price of $33,580 throughout 2023.

MicroStrategy outlined its “unique value proposition” when compared to the new batch of spot Bitcoin ETFs. The firm pointed to its ability to leverage capital markets and generate cash with its software business as advantages over spot ETFs.

The combined market for spot Bitcoin ETFs sits at $45.2 billion, compared to MicroStrategy’s $9.9 billion of Bitcoin holdings.

Tyler Pearson is a markets correspondent at DL News. He is based out of Alberta, Canada. Got a tip? Reach out to him at ty@dlnews.com.