- Experts see several signals that traders are expecting a higher Bitcoin price by the end of the year.

- Optimism over an early Bitcoin spot ETF approval is likely fuelling bullish bets, they say.

- But their predictions could be premature.

Bitcoin options traders are positioning themselves for a big price increase toward the end of the year, fuelled by optimism for the approval of the first spot Bitcoin ETF in the US.

Options data compiled by basedmoney.io shows investors have purchased $350 million worth of calls — bets that Bitcoin’s price will increase — at the final 2023 options expiry on December 29.

That’s more than double the November expiry, and many multiples higher than those set to expire in the first half of 2024.

“December volatility is higher than the November volatility which usually does not happen,” Bosslmp, a pseudonymous options trader and advisor to options DeFi protocol Dopex, told DL News.

According to Bosslmp, the increased volatility means the most popular bets are those that will pay off if Bitcoin exceeds the $34,000 to $35,000 range — call options on Bitcoin that expire in December.

“People are betting on the ETF coming by the end of the year. They’re betting it will be in December,” Bosslmp said.

Options are financial derivatives that let traders speculate on price moves or hedge against market volatility.

Call options give holders the right, but not the obligation, to purchase the underlying asset at a predetermined price.

Traders pay more for calls

It’s not just increased call volumes signalling that traders expect a spot ETF is just around the corner.

Positioning on crypto options exchange Deribit also highlights traders’ optimism about a Bitcoin ETF approval.

“Current implied volatility is notably higher than the historical volatility, indicating strong price movement expectations,” Luuk Strijers, chief commercial officer at Deribit, told DL News.

Traders are willing to pay more for calls than puts, he said, meaning that they expect those calls to generate more profit to justify the increased price.

“This trend is especially visible among retail traders,” Strijers said.

Strijers also pointed out that the difference between Bitcoin futures prices and spot prices is increasing again, further indicating positive expectations.

When futures markets outpace spot, it’s called contango. It signals that investors are willing to pay more for the underlying asset in the future.

Another signal that traders are bullish on Bitcoin is the relative interest between it and Ether, the second-largest crypto asset.

“Bitcoin volatility is still higher than Ether volatility, and that for me is generally a bullish sign,” Bosslmp said.

January deadline

Although options traders are betting that a Bitcoin ETF is coming, the expectation of a December approval could be premature.

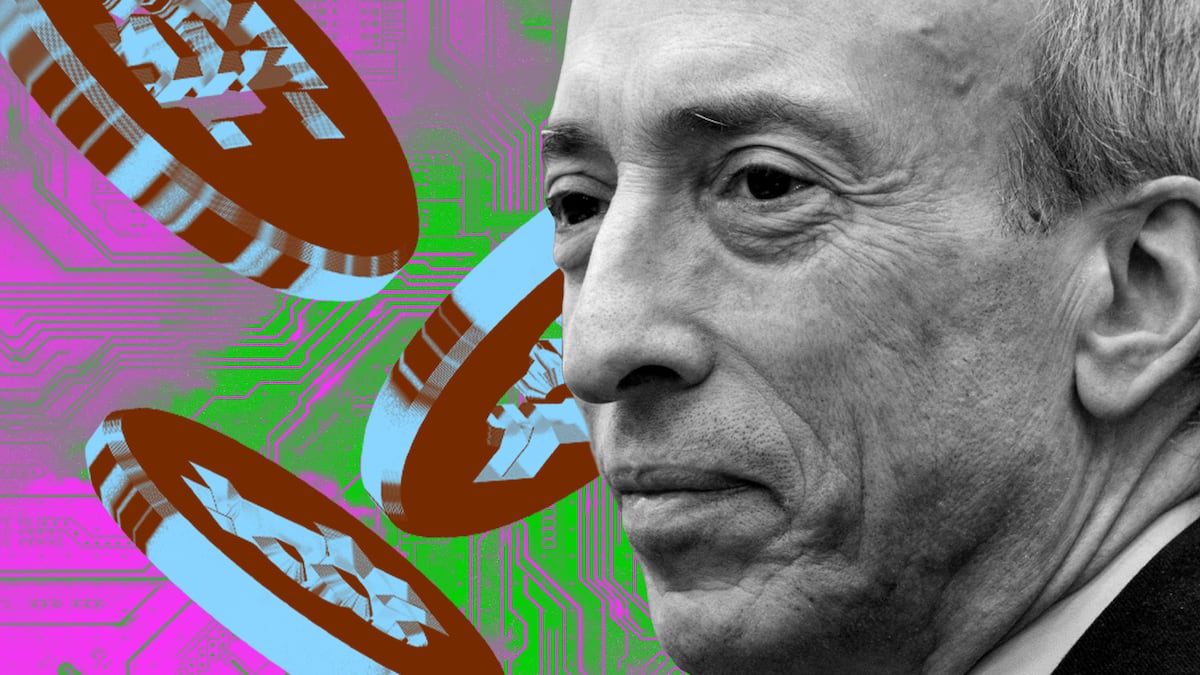

That’s because the US Securities and Exchange Commission, the agency in charge of approving a spot Bitcoin ETF, faces a final deadline to respond to several ETF applications on January 10.

Since the SEC has waited until previous deadlines to rule on Bitcoin ETF applications, the expectation is they will do the same again — even if they decide to approve them this time.

Despite the uncertainty, it may be hard for many traders to discount so many converging metrics signalling the expectation of higher Bitcoin prices.

“Individually, these indicators might not be very convincing,” Strijers said.

“However, when multiple signals align, this generates a stronger conclusion.”

Tim Craig is DL News’ Edinburgh-based DeFi correspondent. Reach out to him with tips at tim@dlnews.com.