- Retail investors were burned over the weekend following a memecoin launch on Solana.

- Analysts see Solana gaining ground in a big way this year.

- Drivers include ETF approval.

A memecoin scandal involving Argentina’s president has dragged on Solana’s price.

Javier Milei’s tweet about the LIBRA memecoin left many holding the bag and resulted in charges being brought against him there.

LIBRA crashed from a $4.5 billion market cap to around $200 million.

Solana’s price has slumped 20% from a high last week before the Milei chaos.

Bettors on Polymarket now give Solana a 22% chance of breaking through its previous $293 all-time high by June 30. That’s down from an 85% chance on January 21 when the bet launched.

Polymarket bettors put an 86% chance that Solana will fall to $160 this month.

LIBRA and similar tokens increasingly launch on Solana, with memecoin launch platform pump.fun seeing nearly $3 billion in volume over the past two weeks on Solana — tying the crypto’s fortunes to those products.

While memecoins “may be a dampener short-term, the technology behind blockchain and Solana is here to stay,” Chris Chung, founder of Solana swap platform Titan, told DL News.

“The memecoin frenzy has helped Solana build up the infrastructure to truly support mass adoption.”

Chung isn’t the only one who has been optimistic about Solana’s chances.

Here’s where VanEck, Bitwise, and Pantera Capital see drive the price of XRP.

VanEck

VanEck analysts Matthew Sigel, Patrick Bush, and Nathan Frankovitz see Solana reaching $520 by the end of 2025.

In January, Solana’s revenue in 2024 was higher than the next four chains combined, VanEck wrote, becoming the layer-1 leader in terms of decentralised exchange volume, revenues and daily active wallets.

VanEck also points to the lively ecosystem for app revenue on the network. Useful apps can become a flywheel that in turn attracts more talented developers to make more engaging apps, driving more user adoption.

The chain has, they wrote on February 5, become “the focal point for on-chain crypto trading, driven by a strong developer community and a design optimised for high user activity.”

Most importantly, wrote VanEck, is Solana’s share of the total market cap for smart contract networks like Ethereum and Solana.

Solana holds some 15% of the value of the smart contract platform market, “but we forecast its share to rise to 22%” by year-end.

Pantera Capital

Pantera Capital’s Cosmo Jiang and Eric Wallach wrote last month that 2024 was a year of tailwinds, with trading activity breaking records throughout the fourth quarter.

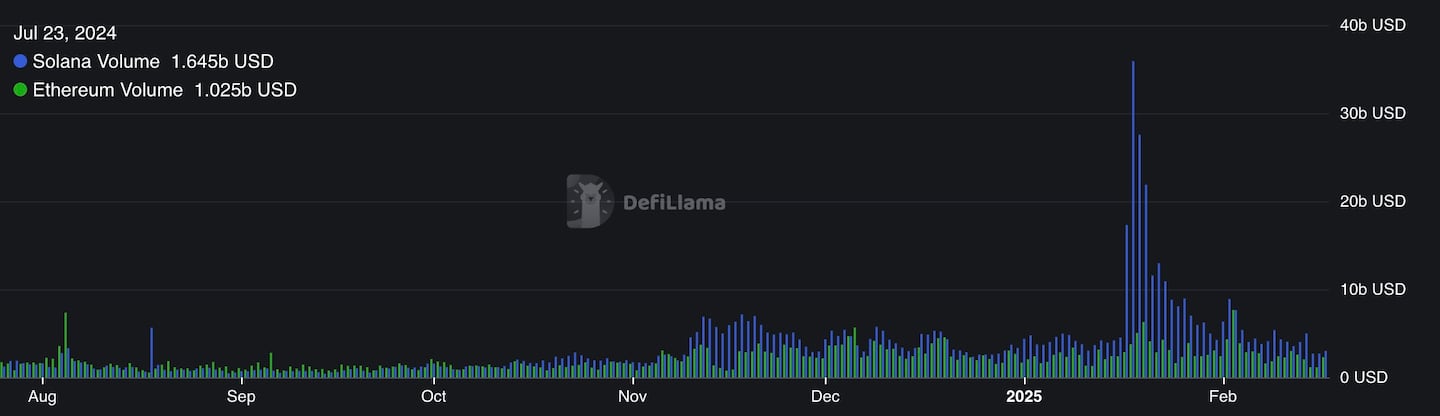

Those records included decentralised exchange volumes consistently surpassing Ethereum’s, including native DEX Raydium capturing the most volume across all of crypto’s decentralized exchanges.

Thank memecoins – the network’s single biggest driver of growth.

“Solana’s robust token creation ecosystem continues to flourish,” wrote Jiang and Wallach.

“Solana now consistently accounts for over 90% of all new tokens appearing on DEXs.”

Volume has remained higher on Solana than Ethereum recently, according to DefiLlama.

Pantera, like VanEck, also points to Solana’s thriving developer contingent as a driver.

While the overall crypto industry saw an average 9% decline in developer activity, Solana achieved an 83% annual growth in monthly active developers, they wrote.

The biggest impact, wrote Jiang and Wallach:

The token is among the most likely next digital assets to have an ETF, which can supercharge flows.

“The market continues to underestimate the probability and impact of a Solana ETF.”

BitWise

BitWise’s Chief Investment Officer Matt Hougan sees good news in bad sentiment.

“It is arguably the best time in history to invest in crypto,” Hougan wrote on February 12, before the Milei scandal. “And yet. Today, retail investors are wallowing in despair.”

That’s because of the decline in altcoins, which have clobbered retail participants, Hougan wrote.

“The average crypto asset is getting crushed.”

It’s good news for the big players like Ethereum, Bitcoin and Solana – because institutional buyers will be laser-focused on those assets.

Polymarket

Bettors on the platform see little chance for Solana’s short-term price action, putting the odds of it reaching above $200 by the end of this week at just 10%.

Longer-term, the outlook seems rosier.

The timeline for approval of Solana ETF applications – which have been made by Grayscale, VanEck, BitWise, 21Shares and Canary Capital – puts the earliest possible timeline for approval around the mid-year.

Polymarket participants put an ETF approval this year at 83% likely, though only 31% think it will be approved by July 31.

JPMorgan has estimated they could bring up to $6 billion in inflows.

Additional reporting by Liam J. Kelly.

Andrew Flanagan is a Markets Correspondent for DL News. Got a tip? Reach out to aflanagan@dlnews.com.