- Tokenisation will enable financial giants to tap into the $27 trillion Treasury market, S&P Global Ratings says.

- While efforts from BlackRock and Franklin Templeton could drive confidence, legal hurdles remain.

BlackRock’s BUIDL fund has paved the way for investors to tap into the $27 trillion market for US government bonds.

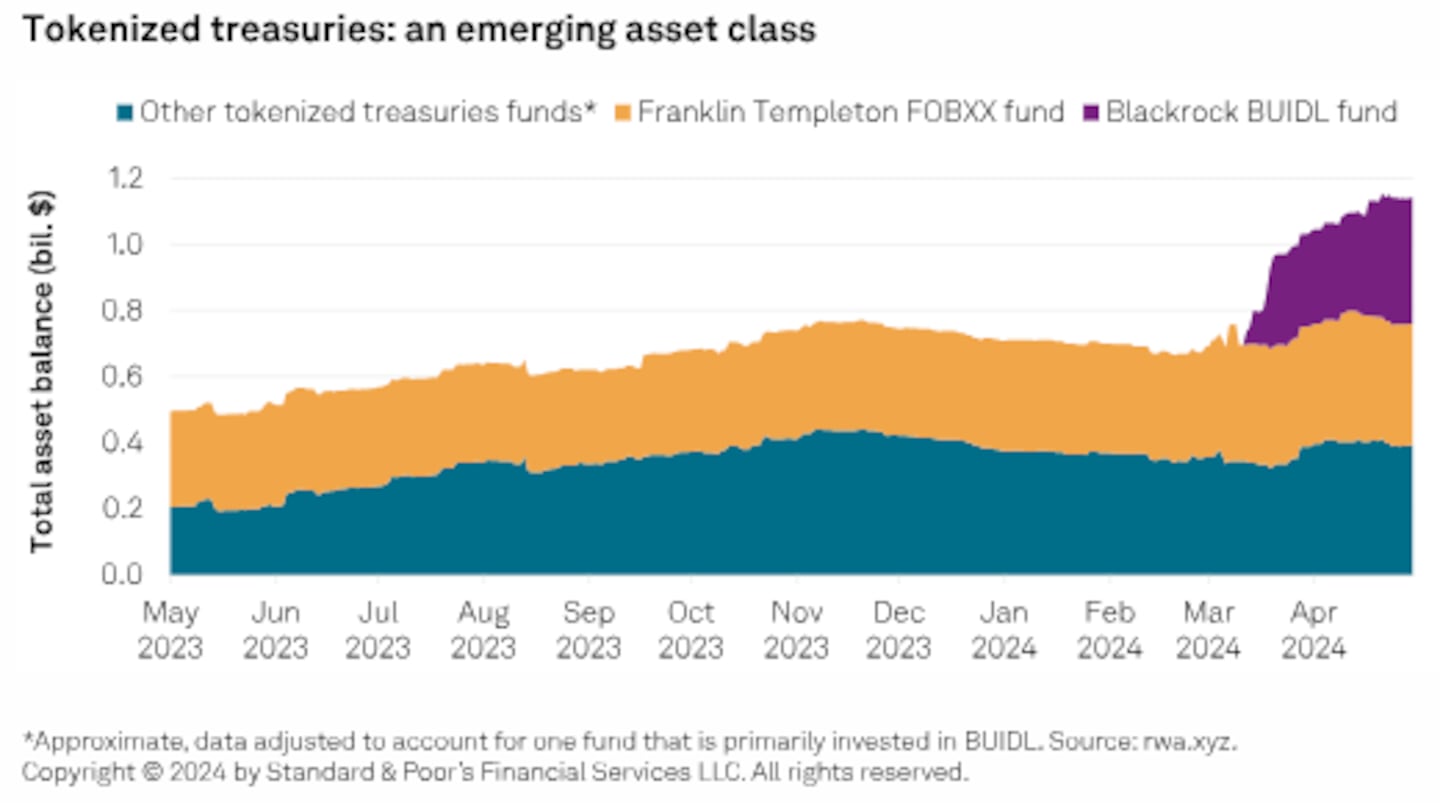

The tokenised Treasury market has already amassed over $1 billion on public blockchains, primarily Ethereum, but this could be just the beginning, according to Andrew O’Neill, digital assets managing director at S&P Global Ratings.

“The tokenised Treasuries market is picking up,” O’Neill wrote in a report on Tuesday. The launch of BlackRock’s Ethereum-based tokenised fund BUIDL in March accelerated this trend, he said.

Benefits for issuers and investors include allowing on-chain businesses to access real-world yields, O’Neill wrote.

The report is the latest indication of the financial sector’s growing interest in tokenisation, which refers to the process of linking real-world assets with digital tokens on a blockchain. BlackRock’s CEO Larry Fink has said that his ultimate goal is “the tokenisation of every financial asset.”

Franklin Templeton, JPMorgan, and Visa are also among the industry giants seizing the opportunity.

Why does tokenisation matter?

Among the benefits, O’Neill said tokenisation could shore up liquidity and reduce the risk of a run on money-market funds from investors seeking to use their tokens as collateral.

Products like BUIDL enhance liquidity management for money market funds by allowing round-the-clock, on-chain access to a market constrained by conventional open and closing times.

Tokenisation can also provide on-chain businesses access to real-world yields, reducing the inefficiencies associated with transitioning assets between on and off-chain environments, S&P Global Ratings wrote.

This can streamline operations and provide new investment avenues for companies operating within the blockchain ecosystem, O’Neill said.

They also provide a use case for public blockchains in traditional financial markets, O’Neill said.

Challenges

O’Neill noted two main challenges for the tokenisation push: Regulatory hurdles, and creating interoperability between legacy systems and modern blockchain platforms.

For example, the legal landscape has restrained US banks from tapping into tokenisation, O’Neill said.

However, he also said that emerging regulatory frameworks in key jurisdictions that tackle things like stablecoins will boost adoption.

Stablecoins are cryptocurrencies pegged to the value of an underlying currency, such as the US dollar, or commodities, like gold.

These advancements could lead to a broader application of blockchain technology in traditional finance, O’Neill said.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.