- Standard Chartered’s bullish call of $120,000 goes against where traders are placing bets in options markets.

- The most popular bets in options markets suggest traders expect Bitcoin to reach $40,000 by December, and $60,000 by June.

- As positive factors lift sentiment, Bitcoin headwinds include Mt Gox repayments and the rise of altcoins.

Market watchers were stunned when Standard Chartered released a bold prediction earlier this month: Bitcoin is likely to reach $50,000 by the end of this year and hit a whopping $120,000 by the end of 2024.

Traders betting in the options market are less certain.

Cumberland trader Nick Trileski, analysing what’s called the cumulative distribution function in options markets, said the probability of Bitcoin exceeding its all-time high of $69,000 by June 2024 is about 1.4%.

Bitcoin has hovered around the $30,000 mark this month. Positive factors — including ETF launch plans from BlackRock and Fidelity — are competing with “dried-up volumes and anaemic price action” since the collapse of FTX, Trileski told DL News.

NOW READ: Why Bitcoin’s dominance in crypto is a sign of wider adoption

Traders are bullish on Bitcoin, just not as much as Standard Chartered analysts.

DL News analysis found that the most popular bets in options markets suggest traders expect Bitcoin to reach $40,000 by December. While the most popular June bullish options — or calls — imply bettors expect the price to reach $60,000 by then.

Bets called call spreads — which involve buying and selling a call option at the same expiry — for December are increasingly popular with traders, Trileski said, suggesting they’ll hit a payday with gains in Bitcoin.

But the payoff is limited.

If Bitcoin’s price does go above $50,000 by the end of 2023, traders will book a maximum profit of $10,000, he noted, citing low implied volatility and the price being over 50% below this as primary reasons.

Now read: Investors pull $4bn from Binance as regulators and rivals close in

Uncertainty is rife.

Spot trading volumes have reached multi-year lows across crypto exchanges; so-called altcoins are eating into Bitcoin’s market share; and a massive supply-side event from long-defunct exchange Mt. Gox looms on the horizon.

Mt. Gox repayments

Creditors of Mt. Gox, the now-defunct Japanese crypto exchange, are expected to finally start seeing repayments after nearly a decade since the firm’s bankruptcy. The exchange was hacked in 2014 and thousands of Bitcoin were stolen.

The impending Mt. Gox repayments and growing altcoin dominance could also be headwinds for Bitcoin.

In his outlook for the second half of the year, Coinbase’s head of institutional research David Duong noted that Mt. Gox repayments of Bitcoin may introduce some selling pressure.

Duong wrote that the 141,686 Bitcoin that’s due to be distributed to creditors as part of the Mt. Gox rehabilitation plan is among “sources of pressure in the months ahead.”

All repayments are due to be paid out by October 31, although deadlines have consistently been pushed back. Some Bitcoin could be sold before then, to raise the required funds to repay creditors, Duong noted.

NOW READ: Why Bitcoin’s dominance in crypto is a sign of wider adoption

Mt. Gox’s two largest creditors, who represent about 20% of all claims, have elected to be paid in mostly Bitcoin.

Coinbase estimates that the potential “upper limit of forced Bitcoin selling” could be somewhere around 35,000 Bitcoin, worth around $1 billion.

The Mt. Gox trustee has said repayments may take some time.

Altcoin dominance

Another headwind is the rise of altcoins.

Surging institutional interest in crypto markets and a positive ruling in Ripple’s case with the Securities and Exchange Commission has lifted sentiment for coins of all stripes, helping so-called altcoins rally.

But altcoin dominance in crypto markets can be interpreted as a bearish signal for Bitcoin as they offer alternatives for investors, eroding Bitcoin’s dominance.

Bitcoin remains in a “wait-and-see” phase as potential positive catalysts including the ETF approvals and the Ripple judgement have yet to bear fruit, Matt Kunke, a research analyst at market maker GSR, told DL News.

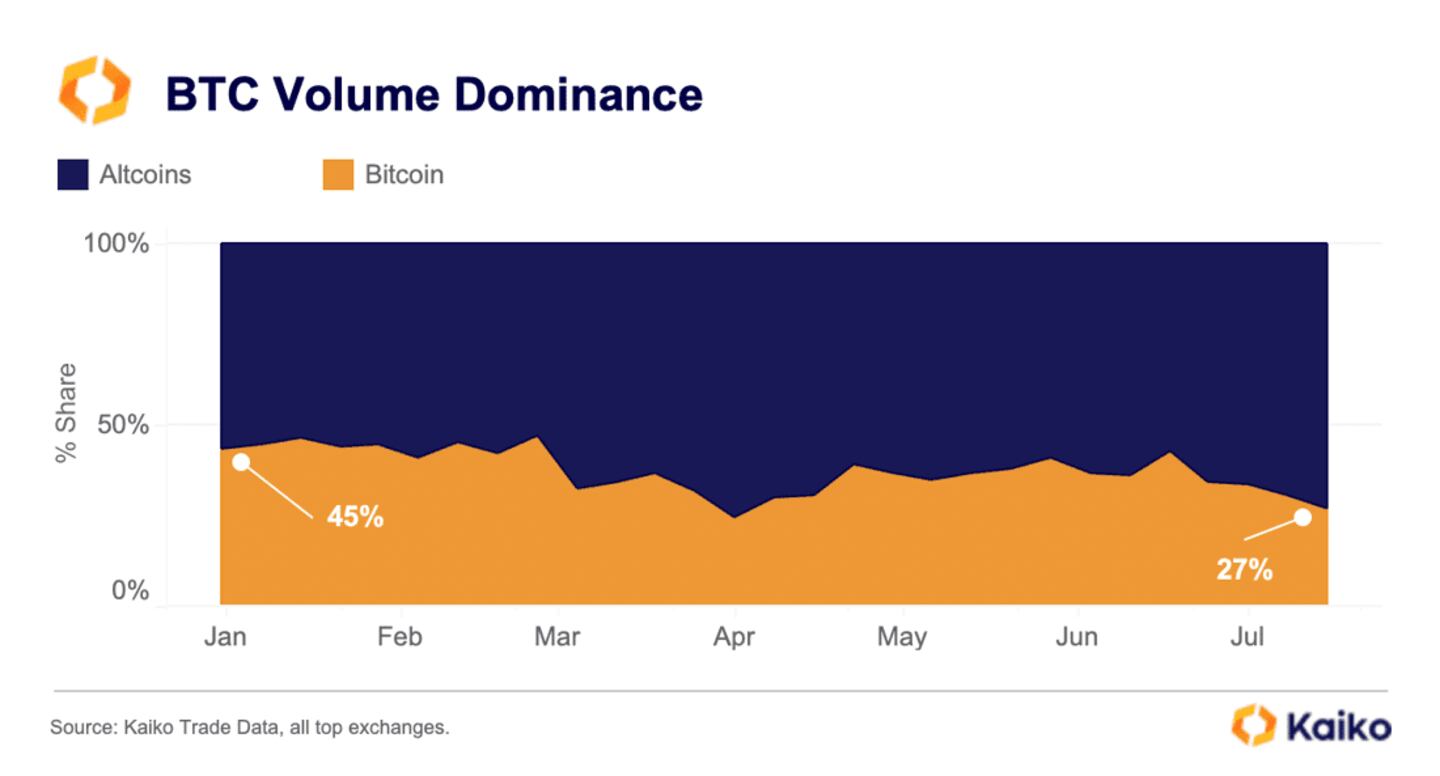

Bitcoin’s dominance has slipped 8% this month, and about 20% this year, according to Kaiko data.

Bitcoin’s dominance across the top 25 centralised exchanges is currently 27%, its lowest point since April.

The drop was more extreme outside of the US, particularly in South Korea where altcoin trading volume spiked.

“On US exchanges, altcoins have also gained traction over the past month, which suggests the regulatory crackdown has not yet dampened demand,” Kaiko researchers said in a note to clients.

Coinbase’s Duong wrote that the dip in dominance and price suggests a potential change, saying Bitcoin’s price peaked in early July amid bullish sentiment from the Ripple case.

Whether this carries over to the remainder of July may rest on what the Federal Reserve says at its FOMC meeting this week, Duong added.

A 25 basis point interest hike increase is widely expected, based on futures pricing and one Fed-watching tool.