- Standard Chartered sees a surge in stablecoin usage.

- Donald Trump has signaled more friendly legislation that will stoke adoption.

- The stablecoin market topped $198 billion today.

The market for stablecoins is set to explode.

Today, the stablecoin market taps into a meager 1% of the US money supply – about $21 trillion – and 1% of total foreign exchange transactions, about $2.1 trillion. That’s according to analysts at Standard Chartered, who said they see plenty of room for growth.

“As the sector becomes legitimised, a move to 10% on each measure is feasible,” Geoff Kendrick and Nick Philpott wrote in the bank’s nine-page analysis. That level of growth would represent a market ranging from at least $2.1 trillion to $2.3 trillion.

Donald Trump and a majority Republican government could be key to unlocking US gains as potential use cases widen globally, they said.

Stablecoins are nearing $200 billion in market capitalisation. The leading asset, Tether’s USDT, surged after Trump’s victory, strengthening its place at the top of the sector with $134 billion in market value.

The stablecoin market is becoming increasingly crowded. Industry stalwarts like Tether and Circle face growing competition from fintech giants PayPal and Robinhood as well as new players including Ethena. XRP-issuer Ripple and UK neobank Revolut are also working on stablecoins.

In DeFi, users have transacted a staggering $700 billion in stablecoins, rivaling payments behemoth Visa.

Use cases

The use cases are a potential game changer, the analysts said.

Stablecoins can’t overcome volatility in the currencies that they track. They instead represent an operating system upgrade of how money can be accessed and moved, Standard Chartered said.

Stablecoins were initially a handy means to access crypto exchanges, particularly those not connected to the local banking system. But their allure has another driver: demand for a store of value that isn’t as volatile as other cryptocurrencies.

The plumbing underpinning global financial markets is opaque, clunky, and full of middlemen. That opens up more use cases, Standard Chartered said, pertaining to settlement, credit, and operational risk.

Remittances are another use case, the bank noted, with a market opportunity of some $857 billion in annual flows.

Additionally, some 1.4 billion people are unbanked, making transactions worth about $20 trillion per year, Standard Chartered said, citing World Bank estimates.

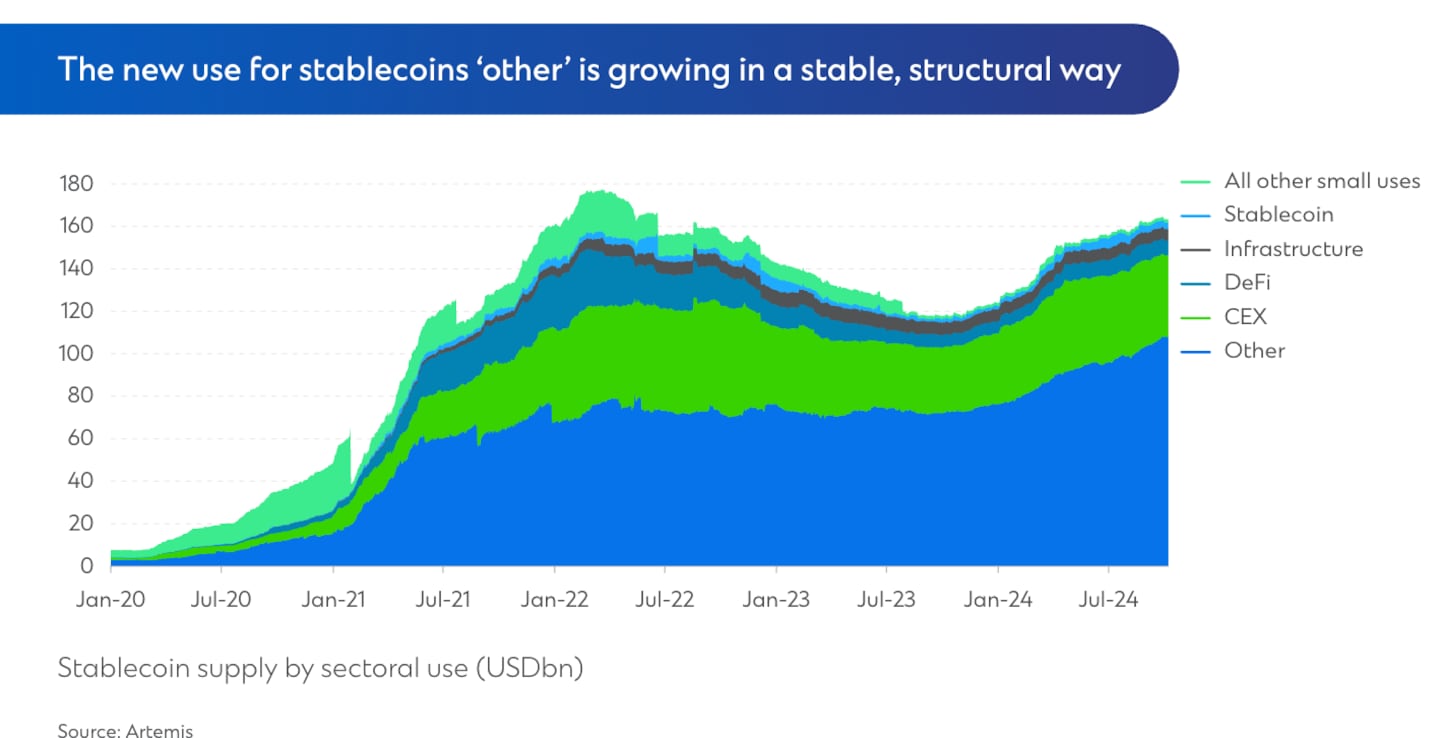

Transactions for other use cases — such as people in emerging markets saving in dollar-linked stablecoins — are around 50% of all transactions, the report said.

Swift, the global financial payment infrastructure, isn’t foreign to the need to innovate either.

It began experimenting in 2023 with a series of private-sector partners such as BNY and Lloyds Banking Group. A blog post from early September outlined a vision to explore how members can transact interchangeably with existing and emerging currency types.

Trump optimism

Standard Chartered also pointed to three bills introduced during President Joe Biden’s tenure – all of which fizzled out. “Each aimed to create the guardrails for banks to issue stablecoins,” the analysts said.

“More progress on this is likely under the Trump administration when it takes power in early 2025.”

There is some hope for meaningful legislation before Trump takes power. Washington insiders told DL News that Congress may attempt to pass stablecoin laws during its “lame duck” session, the period between an election and the start of a new Congress.

Crypto market movers

- Bitcoin is down 1.7% over the past 24 hours to trade at $94,190.

- Ethereum is down 1.6% over the past 24 hours to trade at $3,563.

What we’re reading

- What’s going on with XRP? Five reasons why the Ripple-issued crypto is surging — DL News

- Aave on Par With Traditional Banks as Net Deposits Reach All-Time High of $31 Billion — Unchained

- 10 huge moments you missed in Nov — Milk Road

- XRP Becomes the Top Traded Token on Binance and Coinbase, Hits Almost 7-Year High — Unchained

- Crypto can’t get banked because of a ‘deep state’ conspiracy? Time for a reality check — DL News

Pedro Solimano is a Markets Correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.