- Strategy’s Bitcoin holdings fell $5.9 billion in the first quarter of 2025.

- Its software business has been struggling, too.

- The company warned it could be forced to sell its Bitcoin if the cryptocurrency falls much further.

Strategy, the enterprise software-cum-Bitcoin holding company formerly known as MicroStrategy, likely lost money through the first three months of the year due to the cryptocurrency’s steep drop.

Strategy held $41.7 billion in Bitcoin to start the year. It spent another $7.6 billion on Bitcoin through the end of March.

But because Bitcoin fell in that span, the company ended the quarter with only $43.5 billion in Bitcoin on its books, a $5.9 billion loss. Strategy said it expects a net loss for the quarter.

Bitcoin fell about 12% through the first three months of the year, to $82,500.

Strategy develops software for large companies like hotel chain Hilton and furniture retailer Crate & Barrel.

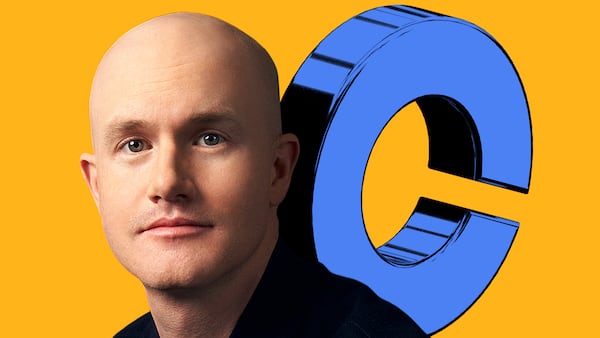

But its founder and CEO, Michael Saylor, became enamored with Bitcoin during the pandemic. In 2021, the company bought its first Bitcoin as a hedge against inflation, and it has morphed into a Bitcoin holding company in the years since, repeatedly issuing new stock and taking on new debt in order to finance the purchase of additional Bitcoin.

That strategy made the company one of the best-performing stocks late last year, and inspired several copycats.

Earlier this year, the company re-branded from MicroStrategy to Strategy, and unveiled a new, orange logo featuring the Bitcoin symbol.

Strategy said Monday its future rests on the performance of Bitcoin.

As of March 31, the company had more than $8.2 billion in debt on which it owes about $35 million per year in interest. The company must also pay more than $146 million per year in dividends on its stock.

“Our enterprise analytics software business has not generated positive cash flow from operations in recent periods, and may not generate sufficient cash flow from operations to satisfy these financial obligations in future periods,” the company said.

If Strategy’s core business doesn’t pick up, it would pay its obligations by issuing new stock or taking on new debt — maneuvers it will struggle to pull off if Bitcoin falls much further, the company said.

“These risks could materialize at times when bitcoin is trading below its carrying value on our most recent balance sheet or our cost basis,” Strategy said.

“As bitcoin constitutes the vast bulk of assets on our balance sheet, if we are unable to secure equity or debt financing in a timely manner, on favorable terms, or at all, we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable.”

As of March 31, Strategy owned 528,185 Bitcoins acquired at an aggregate purchase price of $35.6 billion, or $67,458 per Bitcoin.

Bitcoin fell as low as $74,800 on Monday amid a broader market selloff inspired by sweeping US tariffs that took effect over the weekend. By 9pm New York time, however, Bitcoin had recovered to $79,600.

Aleks Gilbert is DL News’ New York-based DeFi reporter. You can reach him at aleks@dlnews.com.