The launch of Sui has thrust the secretive role of market makers into the spotlight, and has led some to question whether ordinary investors in the multibillion-dollar blockchain’s eponymous token are getting a fair deal.

Backed by big names including Andreesen Horowitz, Jump Crypto, Binance Labs, and Coinbase Ventures, the SUI token ranked among the 10 most-traded since its Wednesday debut.

As with any major token launch, market makers have received some of the initial token supply in order to facilitate trading.

The SUI token has a fixed supply of 10 billion tokens. Just over 528 million were available at launch, with the remainder to be released over the coming months and years. A little more than half of the launch tokens, worth about $370 million, have been allocated to market makers, according to Binance Research — an unusually large sum, several observers told DL News.

“No one really knows what the terms of the deal are,” Matt Batsinelas, the founder of Glass Markets, a crypto market data provider, told DL News.

Without that knowledge, it’s hard to say whether the allocation of hundreds of millions in tokens was warranted. But “a few hundred million dollars worth [of SUI] is a lot of inventory to lend out to market makers across any market cap token,” Batsinelas said.

His comments were echoed by critics of the SUI token allocation, who took to Twitter to protest an arrangement they say benefits market makers at the expense of retail investors.

$SUI vesting schedule looks like as if was made by Alameda

— Unlocks Calendar (@UnlocksCalendar) May 5, 2023

You dont want to be invested on 3-Nov-23 cliff unlock, when circulating supply will 3x

Also, MMs now hold 54% of circulating supply, very concentrated and at high risk of dump - they also seem in the money currently pic.twitter.com/aNcw1b2m9T

But one market maker is pushing back. In an interview with DL News, they said there was no evidence they or their peers were “dumping” on retail investors, and said the token allocation was within industry standards.

‘Sui has been very transparent and proactive in communicating about its tokenomics’

— A Sui Foundation spokesperson

Market makers serve a key function in the world of finance by providing liquidity to assets whose value might otherwise swing wildly during large trades.

“There has not been any deal before with this kind of predatory token allocation,” pseudonymous crypto influencer Degen Trading told DL News.

The identities of the market makers who have received SUI tokens and the terms of their deals have not been made public. If market makers agreed to call option-style deals, they would be loaned tokens on the condition they eventually return those tokens or pay for them at a predetermined price. If the tokens are trading above that predetermined price, the market makers have an incentive to sell.

That’s a lot of “ifs,” according to a market maker for SUI.

Objections from Degen Trading and others are based on several assumptions, they told DL News. In addition, more tokens will be released as market makers’ repayments come due.

“That is very normal for really any big launch like this,” the market maker said.

Just under 2% of the initial supply was set aside for a “community access program” that rewards early participants in the Sui ecosystem. That market makers received an extra nine-tenths of a percent “isn’t abnormal,” the market maker added.

NOW READ: Secretive trading firms that pile into crypto are ‘first sign’ of mainstream adoption

While it’s hard to prove that market makers are able to sell their token for a profit, “they’re hedging” as if they are, Degen Trading said.

He noted the token’s funding rate — or periodic payments to holders of perpetual options — and said it is “emblematic” of big bearish bets via derivatives positions.

A spokesperson for the Sui Foundation said the reception to Sui’s launch and token drop overall was positive.

Criticism comes from a “very, very small group of people,” the spokesperson said. “Sui has been very transparent and proactive in communicating about its tokenomics.”

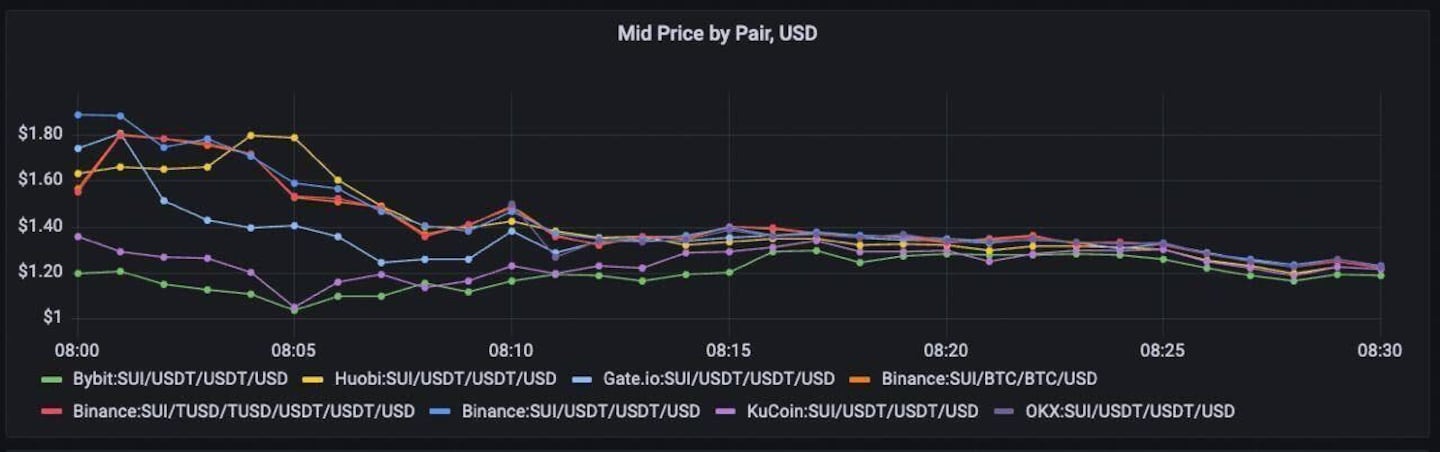

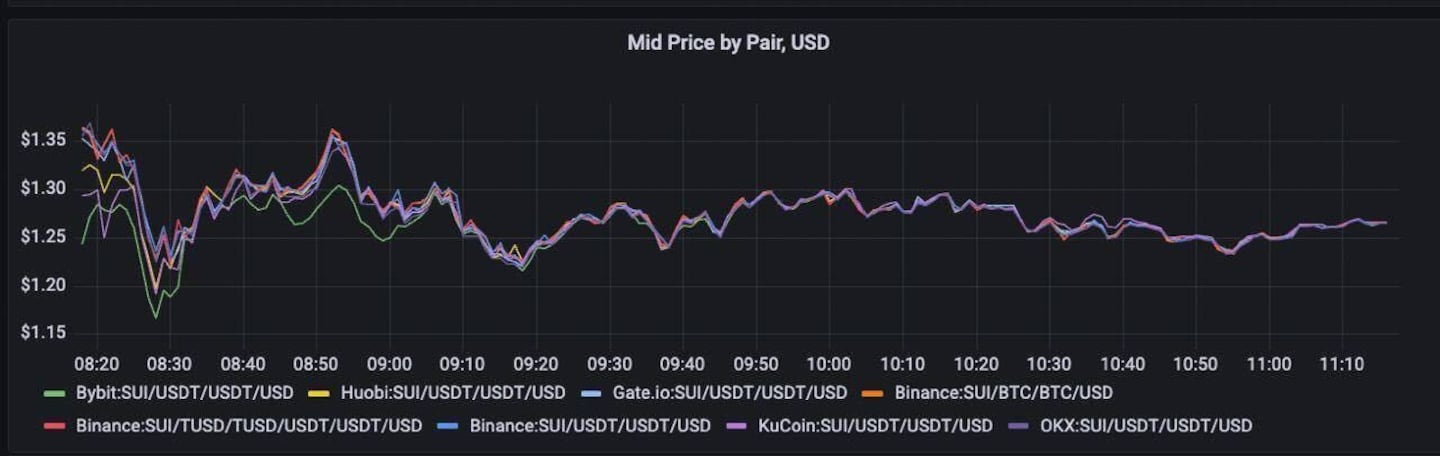

Glass Markets tracked the Sui token launch across eight different trading pairs on six different exchanges. Glass Markets does not have a relationship with the Sui Foundation.

Nevertheless, it seemed to have the intended effect.

When SUI launched, it was trading on Binance for more than $1.80 against Tether, the dollar-pegged stablecoin, according to Glass Markets.

At the same time, it was trading on Bybit for about $1.20 against tether. Within an hour, prices converged across all the exchanges and trading pairs Glass Markets tracked.

The launch “was pretty well done,” Batsinelas said. The convergence in SUI’s price across trading venues “collapsed pretty quickly.”

Tom Dunleavy, a former senior analyst at Messari, agreed. The native token for Aptos, a similar blockchain that went live in October, fluctuated wildly in the days following its debut.

Sui has “been up and down a bit but it hasn’t swung as wildly as you would sort of expect,” he told DL News.

The Sui blockchain is based on Move, a programming language developed at Facebook during the company’s failed attempt to muscle into the crypto industry. Founded in part by Facebook veterans, Sui promises a faster, cheaper, more developer-friendly blockchain.