Even as crypto investors recover from the failure of FTX and a punishing bear market, traditional financial players are increasingly tapping blockchain technology to handle some basic chores. Exhibit A: doling out bonds.

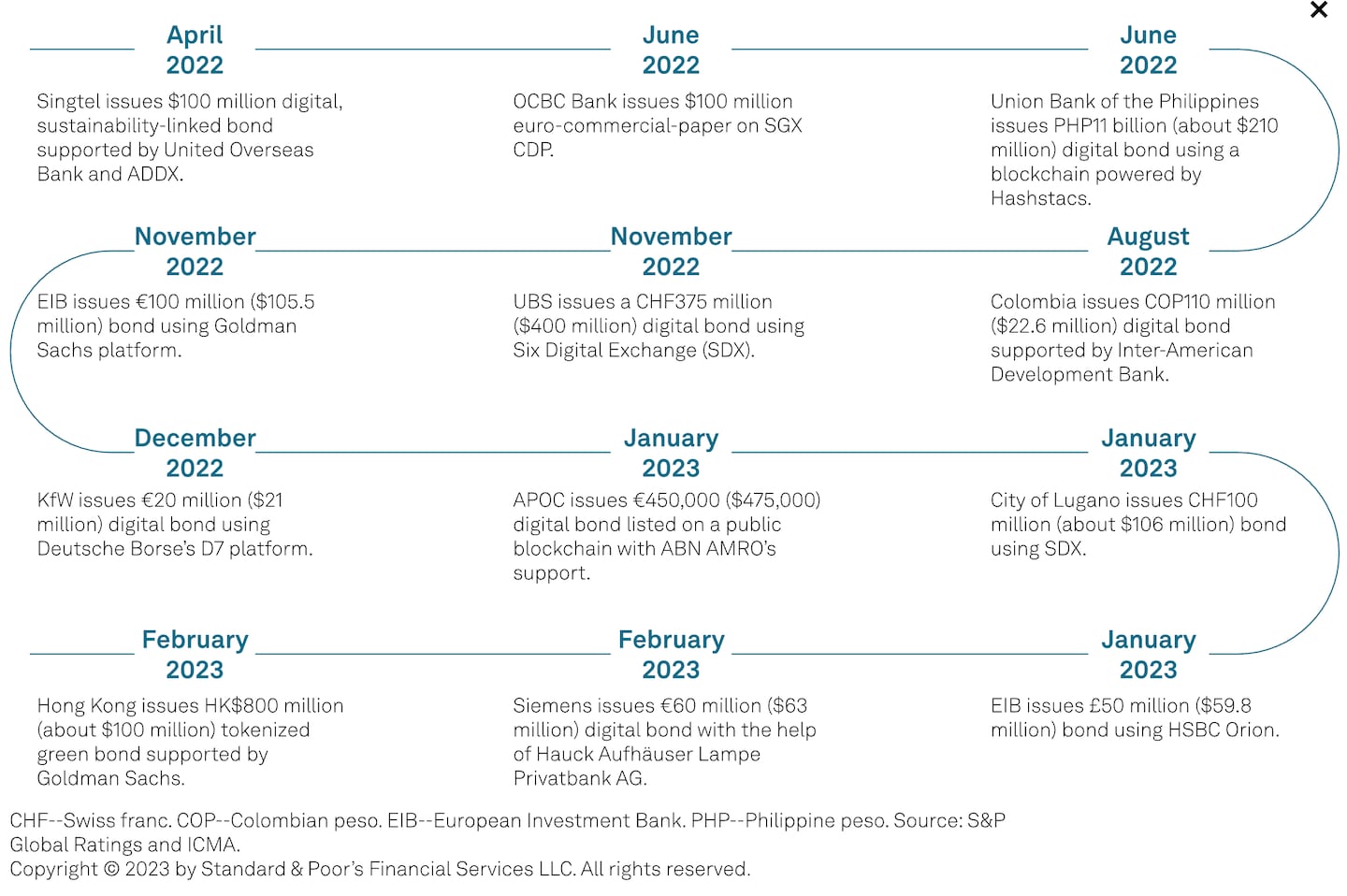

Issuers have distributed more than $1.5 billion in digital, on-chain bonds in the past year, according to an S&P Global Ratings report published Feb. 27. That’s up from virtually zero in 2021, the market research giant said.

Real-word assets

The surge in what’s known as the “tokenization of real-world assets” has revived one of the oldest arguments for the disruptive potential of cryptocurrency technology — the need to overhaul Wall Street’s outdated infrastructure. In the case of bonds, a vital source of finance for corporations and government bodies that’s long been plagued by creaky back office systems, the stakes are titanic — total bond issuance in 2022 exceeded $22 trillion.

“The main attractions of digital bonds are their offer of greater efficiency and security for issuers,” the report’s authors said, “not least due to their use of the blockchain and streamlined issuance processes.”

READ NOW: How the FTX collapse marks the start of a ‘migration’ to TradFi

Investment banks have been experimenting with bond issuance on private blockchains for years with little show for it. Yet a flurry of recent on-chain bond offerings are demonstrating the technology may finally be ready for prime time.

In January, the European Investment Bank issued a £50 million bond ($60 million). On Feb. 16, Hong Kong issued a HK$800 million ($102 million) tokenised green bond. Then Siemens, the German engineering multinational, issued a €60 million ($63 million) digital bond with a one-year term on a public blockchain.

“By moving away from paper and toward public blockchains for issuing securities, we can execute transactions significantly faster and more efficiently than when issuing bonds in the past,” said Peter Rathgeb, Siemens’ corporate treasurer, in a statement.

‘By moving away from paper and toward public blockchains for issuing securities, we can execute transactions significantly faster and more efficiently than when issuing bonds in the past.’

Meanwhile, a number of DeFi protocols, including pacesetters such as MakerDAO and Aave, have embraced real-world assets as a promising new source of growth at a time when the crypto industry is struggling to justify its utility. Last month, Swarm Markets, a crypto exchange based in Berlin, introduced tokenised versions of stocks for Apple and Tesla.

DeFi Threat

In an eye-opening section of its report, S&P characterised DeFi solutions as a “threat” to established bond market players. Yet the authors said traditional financial players are making progress in tapping blockchain technology to maintain their grip on the marketplace.

Outfits such as Goldman Sachs, Societe Generale, and HSBC Orion, a tokenisation platform run by the British banking giant, are moving quickly to bridge the gap between traditional and on-chain systems.

READ NOW: VCs pile into web3 startups in anticipation of $66bn blockchain gaming boom

S&P said this push has benefited from the “reputational damage to the wider DeFi sector,” caused by the cascade of collapses in 2022, including the fall of FTX, which resulted in the indictment of Sam Bankman-Fried, crypto’s poster boy, on multiple fraud charges, and billions of dollars in losses for investors.

“This has enabled established institutions to play a key role in the recent digital issuance, and set the stage for them to maintain control of the evolving market,” S&P said.

In addition to greater speed and efficiency in bond issuance, S&P said digital, on-chain instruments enable fractionalisation, which means splitting a bond into small portions and making it easier for more investors to buy them. Singapore-regulated BondBlox Bond Exchange, for example, offers investors the possibility of buying a digital slice of an existing, traditional bond.

“While it is still early days, digital bonds’ potential in terms of cost, security, and access to new sources of funding is evident,” S&P said. “It is thus not surprising that issuers are testing the market.”