- Options data shows traders turned bearish after last weekend’s liquidation of $1.5 billion in bullish bets.

- Traders, however, are more optimistic for the second part of the year.

- A significant decrease in leverage means the market is unlikely to see another liquidation cascade in the short term.

Bitcoin’s rocky week kicked off with a 14% plunge, while bullish traders were wiped out to the tune of over $1.5 billion.

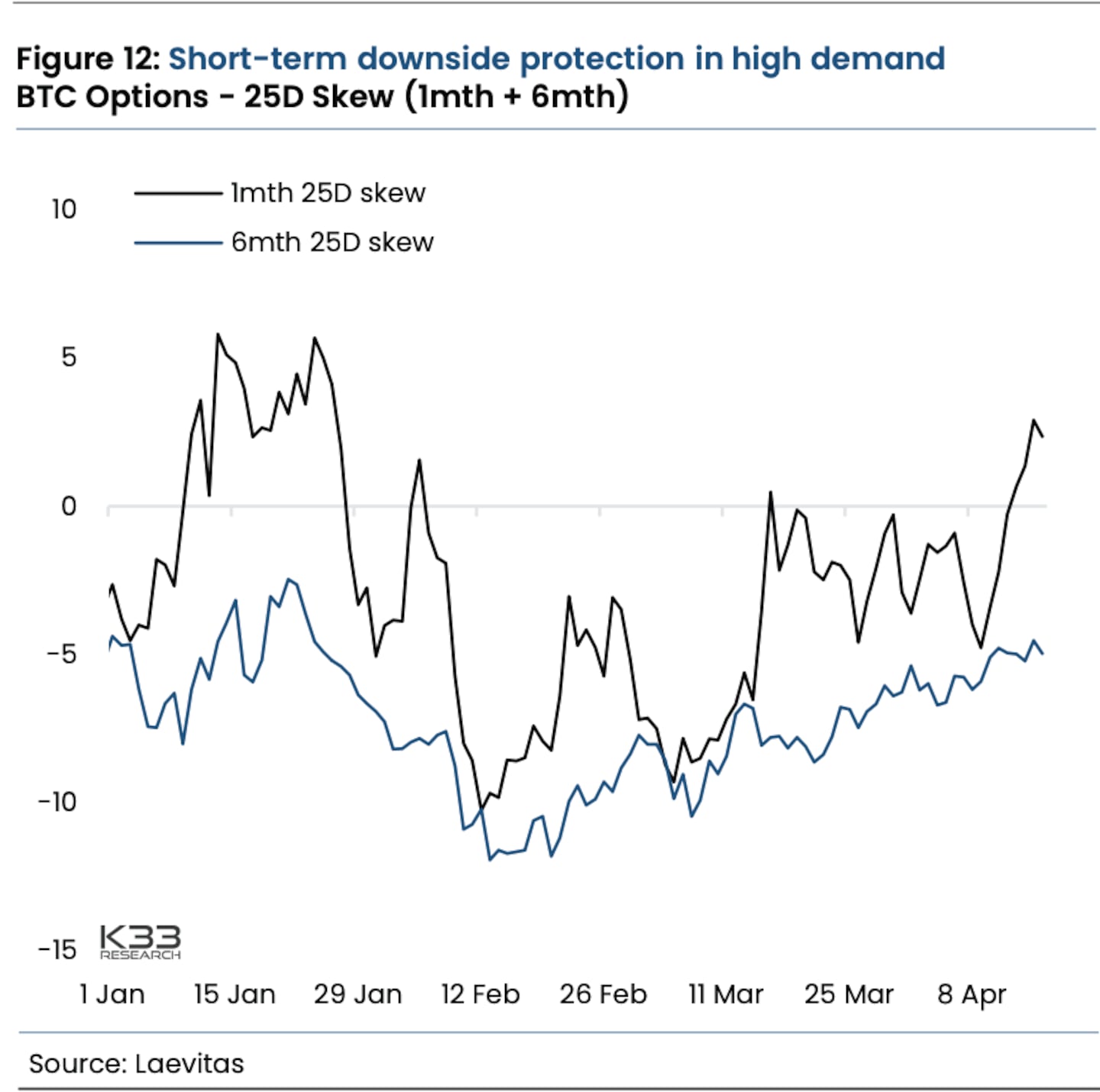

The price is rebounding, but spooked traders have been piling into bearish options bets that protect against further declines, according to Vetle Lunde, senior analyst of K33 Research.

The uncertainty — fueled by Iran’s attack on Israel, as well as by the Federal Reserve’s more hawkish stance on interest rate policy — spurred the highest level of demand for short-term bearish options contracts since January.

But traders are more bullish for later in the year. Skews, a measure of the difference in volatility, are negative for contracts expiring in October — meaning traders are paying more for bullish bets, or calls, than for bearish ones.

That signals more demand for contracts that will pay out when Bitcoin goes higher, K33 found.

Market makers pulled liquidity, while traders rushed to protect their positions as tensions escalated in the Middle East, leading to “a significant wipeout,” Lunde said.

That amounted to more than $1.5 billion in liquidations, with the majority of them occurring on the OKX and Binance exchanges, CoinGlass data shows.

In the shorter term, speculative activity has waned. Two indicators have fallen: funding rates for options called perpetuals and so-called open interest, a measure of the number of contracts outstanding.

The decline of open interest and funding rates lowers the likelihood of further “liquidation cascades,” K33 said.

In other words, the worst may be over.