- Markets are in a flux. US equities, bonds, and the dollar are all sinking.

- That should, in theory, create an opportunity for Bitcoin to become a safe haven.

- The reality is more complicated.

Investors are running out of places to hide.

US Treasuries, once a handy haven in times of strife, aren’t looking so safe anymore. Jittery traders are bucking past trends and sending the dollar lower instead of higher.

Indeed, it’s rare for stocks, bonds, and the dollar to all be falling at once. But that’s what’s happening, and its alarming.

Meanwhile, US President Donald Trump’s extreme global tariff policies mean analysts are ripping up their earnings estimates and telling clients that a recession is more likely than not.

How is that playing out in crypto?

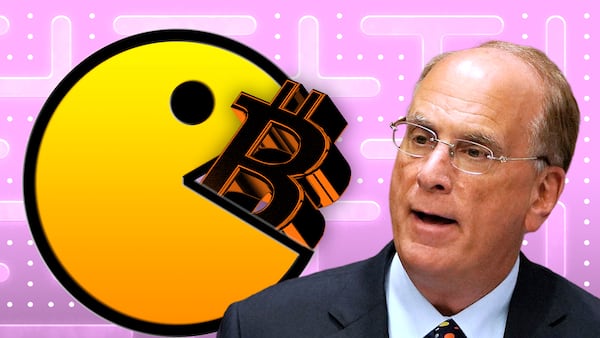

Even though Bitcoin backers, including BlackRock’s Larry Fink, herald it as digital gold, the top cryptocurrency has rarely behaved much differently than a tech stock.

This time, surprisingly, Bitcoin has been holding up relatively well. But only just.

Bitcoin has outperformed the Nasdaq over:

— matthew sigel, recovering CFA (@matthew_sigel) April 7, 2025

1 day

1 week

1 month

Year-to-date

1 year

2 years

3 years

5 years

10 years

You think it’s done?

Bitcoin’s resilience has struck a chord as swings in US assets befuddle market watchers.

George Saravelos, global head of FX research at Deutsche Bank, wrote on Wednesday that the simultaneous drops in the dollar, bonds, and equities means we’re entering “unchartered territory."

“There’s not a multitude of options for investors looking to de-risk in this environment,” Timo Lehes, co-founder of Swarm Markets, told DL News.

Enter the HODLers, or those who pile into crypto no matter the weather.

Core crypto crowd

“The core crypto crowd — particularly those in DeFi — seems reluctant to fully exit,” Lehes added. “They’re more likely to diversify within the ecosystem... rather than abandon ship entirely.”

That may be true, but while they are unlikely to sell, they as of yet aren’t able to prop up the price enough to truly differentiate moves in digital assets from volatile tech stock swings.

It’s difficult to parse analysis among experts who typically trumpet uber-bullish narratives even, and especially, during market routs.

In this extraordinary crisis, with the dollar’s haven status suddenly in doubt, that hasn’t changed.

“I expect dollar weakness to be good for Bitcoin,” said Bitwise CIO Matt Hougan. “A shake-up in the global macro system creates an opportunity for new reserve assets to emerge.”

‘Bitcoin is evolving’

The idea that Bitcoin would supplant the greenback in a shifting world has long been the dream of maxis. Indeed, Satoshi Nakamoto invented Bitcoin precisely to provide an alternative to a financial system that was, 16 years ago, deemed corrupt.

While that original mission has been eclipsed in recent years, it still drives the likes of Strategy’s Michael Saylor, who argues Bitcoin is the answer to a deeply unbalanced US fiscal picture.

The effects of Trump’s tariff turmoil have thrust that idea back to the top of the agenda for many Bitcoin advocates.

“Bitcoin is evolving from a speculative asset into a functional monetary tool — particularly in economies looking to bypass the dollar and reduce exposure to US-led financial systems,” Matthew Sigel, head of crypto at VanEck, an investment firm, wrote in a note to clients.

Hougan agrees.

“The case for Bitcoin is simple: When international dynamics are fraught and global currencies are in flux, where else can investors go for a scarce, global, digital store of value that sits outside the control of any government or entity?”

He added: "Chaos is a ladder" that will propel Bitcoin to a whopping $200,000 this year.

Meanwhile, bearishness and outright fear dominate the rest of the capital markets.

“What do you buy?,” Macro Hive CEO Bilal Hafeez, a macroanalyst and former rates and currencies trader, said on Bloomberg Television today.

“This is the beginning of a much larger crisis, a regime change in markets. I would change all my assumptions about what the safe haven markets are right now. Everyone is going to suffer in this environment.”

Trista Kelley is the editor in chief of DL News. Email her at trista@dlnews.com.