In just a little over a year after the collapse of crypto exchange FTX, Bitcoin is surging to highs not seen since the frothy bull market more than two years ago.

It’s up 40% this year and crossed $63,000 on Wednesday morning.

Some experts say that this rally will be different, and Bitcoin will soon surpass its record high of $69,000, reached in November 2021.

The reason?

The arrival of big players, including $10 trillion fund manager BlackRock. Such institutional investors will drive further rallies, says research firm Bernstein.

“Bitcoin is on an 18-month path to $150,000, led by unprecedented institutional adoption,” Bernstein analysts led by Gautam Chhugani said in a note to clients this week.

Here’s how institutions may give this rally staying power.

Spot Bitcoin ETFs

The January approval of spot Bitcoin exchange-traded funds from BlackRock, Fidelity Investments and other finance giants has helped inject billions of inflows into the crypto markets.

The ETFs are smashing records, bringing in daily inflows of up to $2.6 billion among the nine newcomers.

It's official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Eric Balchunas, an ETF analyst at Bloomberg Intelligence, highlighted a new reality in crypto — that spot ETFs drive Bitcoin activity.

“BlackRock is Godzilla-big,” Balchunas wrote when asked why iShares had performed so well on the day, “with massive distribution, a trusted brand and they are well known in [the] trading world.”

Spot ETF inflows have also seen record-setting performance since the products’ January 10 approval by the US Securities and Exchange Commission.

In a Tuesday X post, BitMEX Research reported over $6 billion in net inflows across all ETFs. US Bitcoin ETFs have a current total value of $43 billion, according to bitcointreasuries.net.

Balchunas views spot ETF performance as a sign of their relevance to Wall Street’s biggest and most well-established assets.

He noted that BlackRock’s ETF is 11th among all ETFs and that it has cracked the top 25 among all stocks. According to Balchunas, BlackRock’s “newbie ETF” has achieved “enough for (even big) institutional consideration.”

Weekday trading and intraday volumes

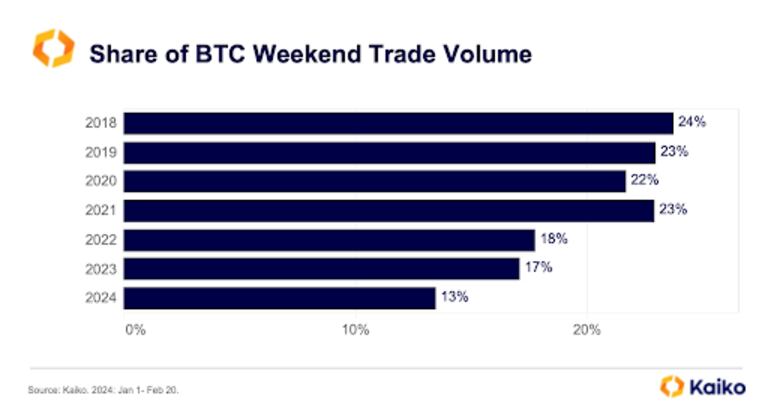

In a Monday report, crypto date firm Kaiko examined Bitcoin’s weekend volume trends since 2018, and concluded that the share of Bitcoin trading on the weekend has declined, meaning more of the trading is taking place on weekdays.

That’s a sign of institutional involvement, Kaiko said.

The share of Bitcoin traded on weekends “has declined significantly over the past six years,” dropping from 24% in 2018 to just 17% last year, the report said.

Kaiko said that part of the reason for the growing gap is because trading has aligned with traditional finance players, most of which operate from Monday to Friday with limited after-hours trading.

“Weekend and overnight liquidity management has always been a challenge for 24/7 crypto markets, creating a mismatch between the operating hours of traditional financial institutions and the needs of large crypto traders and market makers,” Kaiko wrote in its report.

Kaiko also pointed to a rebound in Bitcoin liquidity since the January launch of several spot ETFs in the US drove up volumes.

As volumes increasingly move away from the weekend and into regular business hours, the presence of institutions is clear.

Record-setting “open interest”

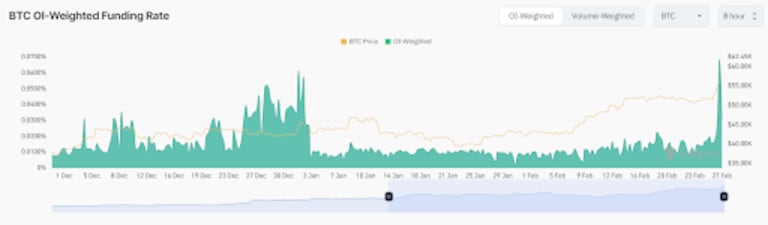

CoinGlass data shows Bitcoin’s open interest-weighted funding rate skyrocketing to all-time highs on Bitcoin perpetual futures contracts, topping levels seen ahead of the January ETF approval.

The institutionally driven Chicago Mercantile Exchange commands the biggest lead in open interest, at $7.8 billion — another indicator that big firms command the rally.

The CME is considered a proxy for institutional interest in crypto as the exchange tends to attract those who seek more regulated platforms.

High open interest shows more traders are entering into contracts, reflecting heightened demand for the contract’s underlying asset.

Earlier this week, DL News spoke to Le Shi, head of trading at market maker Auros, who explained that open interest “can serve as a valuable metric to assess short-term bullish sentiment” in markets.

CoinGlass data shows funding rates are also rising above levels seen before the spot Bitcoin ETF approvals in January.

A high funding rate can indicate significant demand for long bets in the market.

Tyler Pearson is a markets correspondent at DL News. He is based out of Alberta, Canada. Got a tip? Reach out to him at ty@dlnews.com.