- Pantera Capital outlines its reasoning behind a post-halving prediction for Bitcoin.

- The crypto hedge fund used a market model based on Bitcoin supply to crunch its estimate.

Pantera Capital has joined a growing number of finance professionals this year, forecasting a heady price for Bitcoin now that the halving is over.

The crypto hedge fund re-upped a prior price prediction undertaken a year and a half ago, saying Bitcoin could rise to as much as $114,000 by August 2025.

The prediction reflects growing industry optimism even amid challenges such as inflation worries, Federal Reserve interest rate policy, and the escalating crisis in the Middle East .

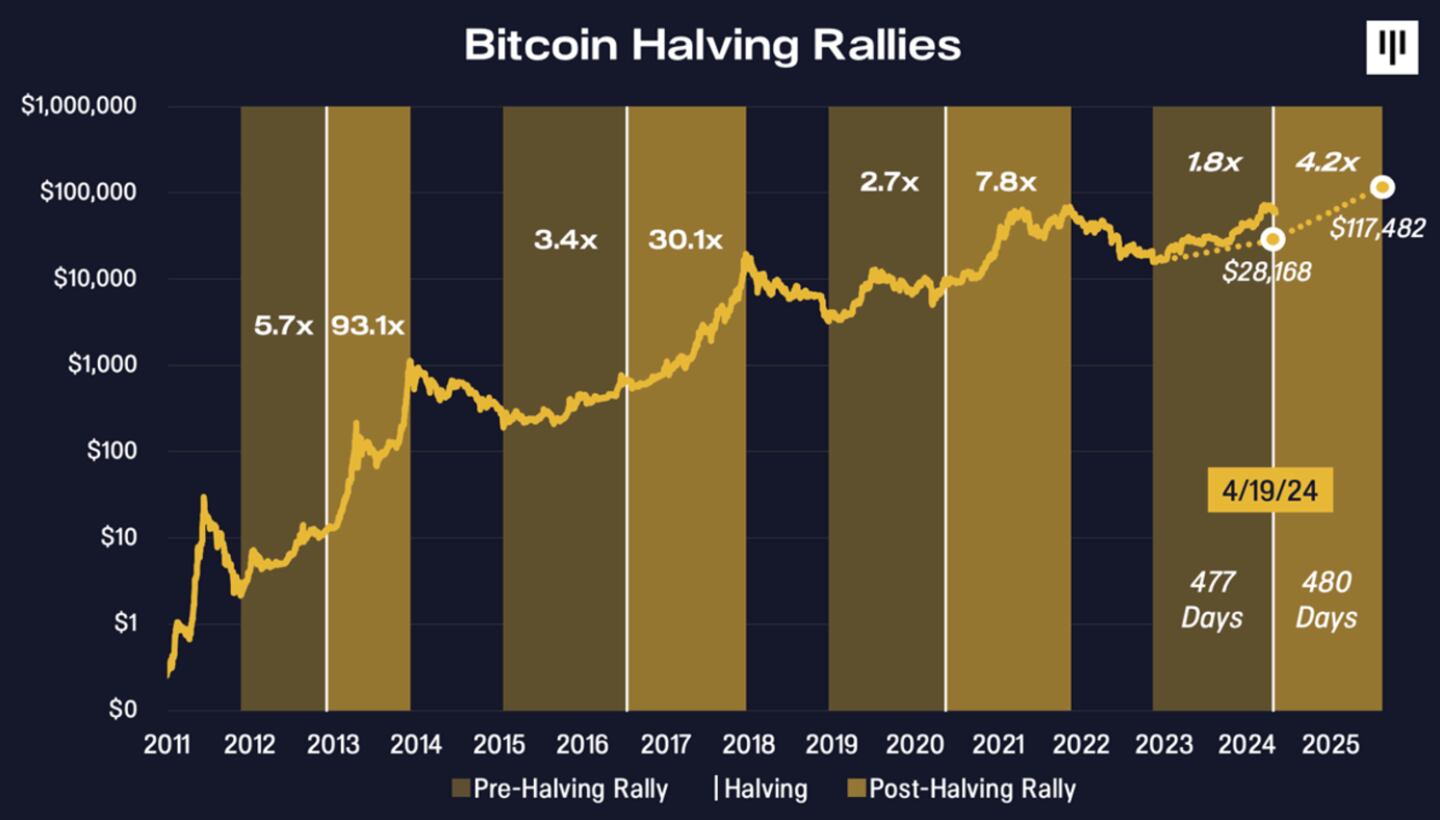

In its 100th letter to investors, Pantera rebooted its November 2022 analysis of Bitcoin’s past performance before and after its recent halving.

Using what’s known as a stock-to-flow model, Pantera gauged the supply of Bitcoin against the flow of new production, which is programmed to be reduced by 50% every four years in halving events.

Changes to the ratio, or the difference between the supply and flow of new production, are particularly sensitive to the halving. In the past, Bitcoin’s price has risen as much as 93-fold..

By analysing both pre-halving and post-halving rallies, the firm found that, on average, prices tend to peak after 2.6 years. That would place current projections around August next year.

While not an exact science, the stock-to-flow model has been a popular tool within the crypto industry as a means to analyse the true value of Bitcoin.

Exceeding gold

Jurrien Timmer, director of global macro at Fidelity, said in February that the world’s largest cryptocurrency could reach a valuation of $1.5 trillion, exceeding that of gold by $500 billion.

He used a variance of the model to show the scarcity and value proposition of Bitcoin compared with gold.

Pantera joins others in making six-figure predictions for Bitcoin, including research firm Bernstein’s $150,000 punt by mid-2025.

Skybridge Capital founder Anthony Scaramucci sees $170,000 or higher next year, while Fundstrat Global Advisors’ Thomas Lee also said it could hit $150,000 in 2024 and $500,000 over the next five years.

Crypto market movers

- Bitcoin fell 2% to $61,000 over the past 24 hours.

- Ethereum is down 0.6% to $2,970.

What we’re reading

- Trump backs crypto in strongest terms yet: ‘I’m good with it’ — DL News.

- FTX Creditors Rejoice — Milk Road.

- ‘Trojan Horse?’ Grayscale Withdraws Ethereum Futures ETF Application — Unchained.

- Donald Trump’s Potential Return Could Boost Bitcoin: Standard Chartered — Milk Road.

- EU mulls adding crypto in €12tn investment market bigger than Bitcoin ETFs — DL News.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.