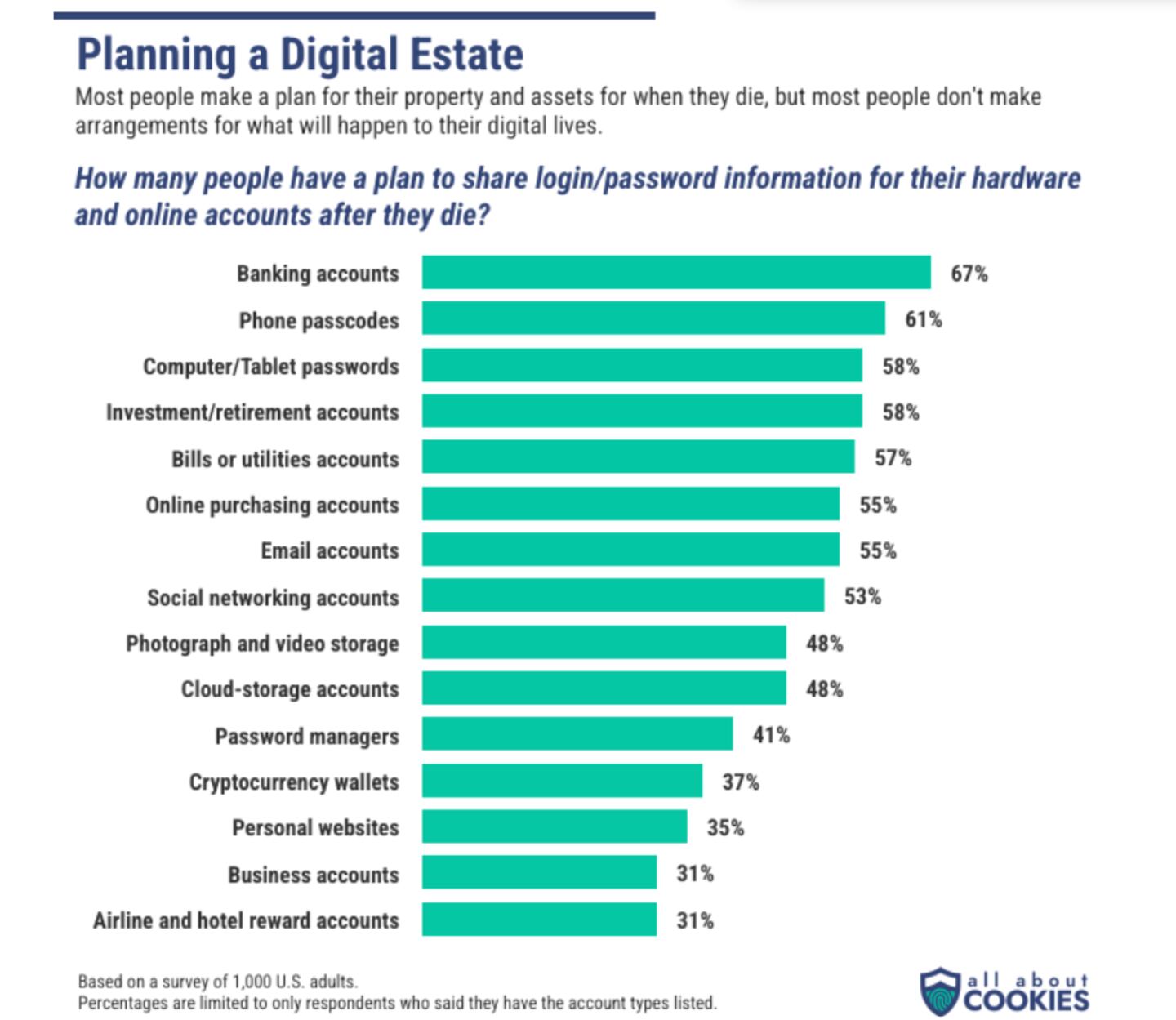

- Only 37% of US crypto holders have a plan to share wallet information in case they die.

- Almost 40% of US adults store their passwords mentally.

- Half of the population has online assets that their partner doesn’t know about.

What happens to your crypto when you die?

That’s the question digital-security firm All About Cookies asked 1,000 US adults in its survey, published on Tuesday — with shocking results.

Only 37% of crypto holders have made arrangements to share their wallet information after they pass away, the firm found.

That means their loved ones could potentially be deprived of thousands of dollars — the median value of respondents’ online belongings was $8,000, according to the report.

Josh Kobert, senior data scientist at All About Cookies, told DL News he was surprised by the data, “given how much time most people spend online and how much of our daily lives exist in a digital space.”

And crypto is only a small drop in an ocean of online assets and data, Carl Öhman, author of the book The Afterlife of Data: What Happens to Your Information When You Die and Why You Should Care, told DL News.

“Taking care of your digital afterlife is naturally an important personal concern to many. Especially if you care about your next of kin. But keep in mind that it is also a political matter,” Öhman said.

“About 2.2 billion people will die within the next three decades alone. Most of whom will be internet users. Whomever ends up controlling their data — today it is basically a handful of tech corporations — will effectively also monopolize the digital past,” he added.

Storing passwords

A cornerstone of the password problem is the storage of passwords.

Almost 40% of US adults store at least some of their passwords mentally, the survey found — meaning they don’t write them down on a piece of paper or use an online password manager.

That means that if they’re incapacitated, or die suddenly, they have no way of communicating their financial information to loved ones.

It also means that almost 40% of holders have easy-to-remember login information that could be “brute forced,” or figured out, by malicious actors.

”Obituaries are public, and there’s nothing stopping a hacker from digitally stalking the deceased,” the report said.

“It’s completely plausible that a hacker could use the information in an obituary to snag stolen credentials on the dark web and hack these accounts before the family has a chance to figure them out,” the report added.

Who do you share your info with?

The issue is compounded by the fact that 50% of respondents said they have digital-asset accounts that their partners don’t know about.

In fact, while 42% of respondents share their login credentials with a spouse, and 23% with children, only 13% share their information with parents and 8% with friends.

“Considering all the singles and roommate situations out there, this low number means that the majority of non-married people haven’t planned ahead,” the report said.

More importantly, 34% of people haven’t shared any information about their digital assets with anyone else. And only 24% of respondents have mentioned their online accounts in their will.

Digital wills “can be just as, if not more important [than traditional wills] precisely because of how much of most peoples’ lives and assets are managed online,” Kobert said.

Tom Carreras is a markets correspondent at DL News. Got a tip about crypto and digital wills? Reach out at tcarreras@dlnews.com