Ekin Genç is DL News’ managing editor. Opinions expressed are his own.

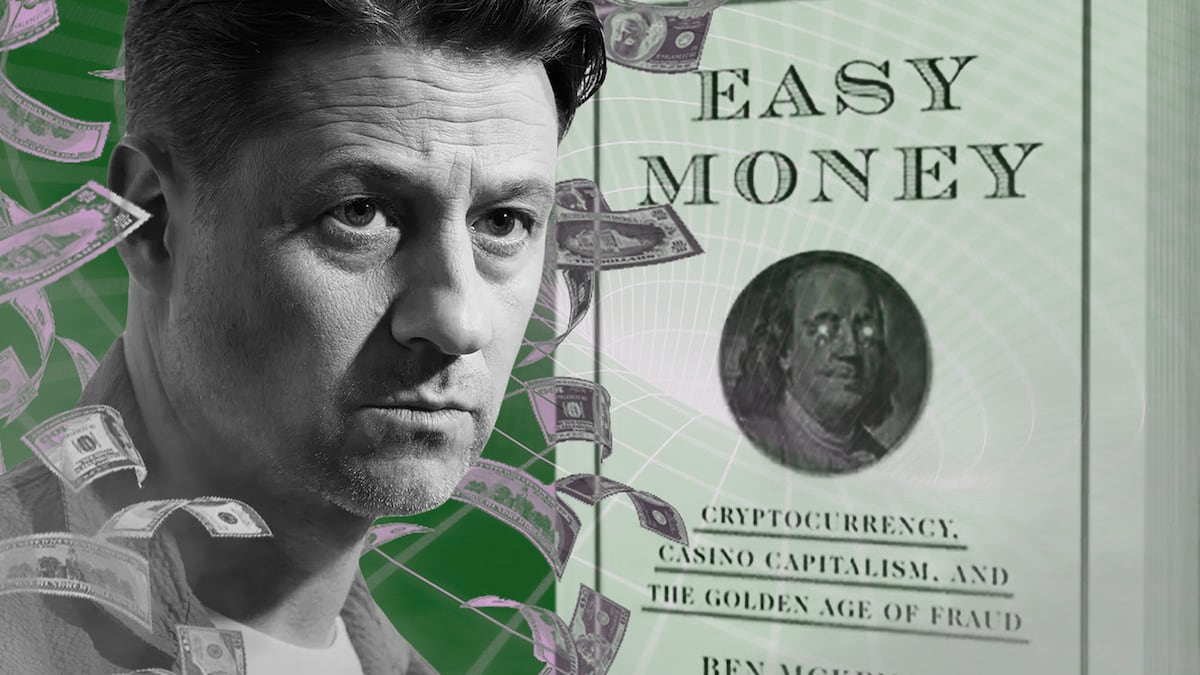

When crypto was soaring, everyone from NBA stars to Hollywood A-listers clamoured to get on the bandwagon. Ben McKenzie — best known for his role in The O.C. — was unique among celebrities in emerging as a vocal sceptic.

With “Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of Fraud,” written with journalist Jacob Silverman, McKenzie recounts his two-year personal odyssey in crypto.

In his narrative, McKenzie starts off as a cautious investor, lured into crypto by a persuasive friend. However, as his reservations mount, he swiftly transforms into what he calls — with a hint of self-awareness — a crypto journalist, beginning the book project as a way to pass the time during lockdown.

The book manages to strike a balance between light-hearted narrative and some serious critique, though it’s not without its shortcomings.

What to make of the timing of the book? I’m not the only one who thinks that this book might have been more pertinent as a cautionary tale had it been released more than a year ago, at the zenith of the market’s uncertainty.

But his cautionary insights, which urge prudence and vigilance against unscrupulous figures and scammy business practices, are not merely relics of past scandals but enduring lessons for surviving — and thriving — in crypto.

Should we see another bull market, the familiar figures and models that have come to characterise past cycles may not be there, but new archetypes will inevitably rise to prominence. They’ll likely bask in fleeting glory, and then implode under their own unsustainable weight, pulling down an unfortunate swathe of investors in their wake.

As crypto veteran Jordan Fish, better known as Cobie, once said, “Perhaps every generation opts out of the previous generation’s Ponzi and instead decides to create its own.”

Ben McKenzie the budding crypto journalist

Although the initial allure of “Easy Money” lies in its stream of consciousness — the first couple of chapters mostly revolve around the idea and process of writing a book on crypto — and the conversational tone throughout, the book takes a sharp turn midway.

McKenzie and his co-author interviewed troubled crypto magnates like Sam Bankman-Fried and Alex Mashinsky before the eventual collapse of the companies they led, FTX and Celsius, respectively.

The decision to interview the doomed execs just before their eventual downfalls proves to be particularly insightful. It’s at this juncture that the book’s true value crystallises and McKenzie inhabits his role as a crypto journalist.

NOW READ: Crypto scammers ramp up grifts by impersonating regulators and law enforcement

In one amusing anecdote, McKenzie tells the story of SBF one day sliding into his Twitter DMs, beginning with “TOTALLY OFF THE RECORD” in all caps. McKenzie notes — as many journalists like to do — that “going off the record is done by mutual agreement, and I never agreed.”

SBF later meets McKenzie and Silverman in person. At one point, SBF tells the duo, “And Tether, there’s a lot more I could say off-the-record.” Again, McKenzie notes “off-the-record is by mutual agreement; we never agreed to it.”

In one juicy passage, SBF is quoted as describing the Tether execs as “emotional guys” and “weird fucking dudes,” asserting that they are “difficult people.”

McKenzie doesn’t include any response from Tether about SBF’s comments.

These interviews reveal some behind-the-scenes tidbits that even ardent followers of crypto news might find fresh and generally entertaining.

While McKenzie excels at delivering anecdotal insights and a personal journey in crypto, it doesn’t necessarily break new ground in terms of investigative findings.

NOW READ: Molly White’s ‘watch your profit grow’ DMs show Twitter’s impersonation problem goes beyond scams

If you’re a reader who craves revelations akin to those in Laura Shin’s “The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze,” which uncovered the details behind the $11 billion DAO hack in 2016, then “Easy Money” may fall short of your expectations.

Crypto as some sort of online casino

For someone deeply involved in crypto, the instinctual response to a book critical of the industry might be immediate dismissal.

But McKenzie’s observations on the current state of play in crypto aren’t really a stark departure from what seasoned insiders admit in quieter moments.

NOW READ: Malicious actors drained $313m from DeFi in the second quarter

Jaded crypto veterans readily acknowledge that many participants in the industry see crypto as a real-life money glitch — like the book title “Easy Money” implies — and the industry’s casino-like nature.

Just look at some of the top tweets in Crypto Twitter this week — often a good way to gauge sentiment.

Wassielawyer, a pseudonymous legal commentator widely followed in crypto, has recently wondered exactly why that’s the case.

He said he suspects the reason “we have few serious crypto products comes down to the fact that the legitimate use cases of crypto are more relevant in developing countries. Whereas builders / VCs are generally based in first-world countries,” wassielawyer wrote.

“Thus we build casinos and Ponzis instead.”

NOW READ: Arrest of Turkey’s failed crypto exchange boss kicks off hunt for answers

McKenzie is not oblivious to the existence of honest, well-intentioned people and projects within crypto. Early in the book, he acknowledges, “not everyone who works in cryptocurrency has poor intentions.”

But perhaps the incentives and public demands conspire against such nobler pursuits.

Li Jin, co-founder and general partner at crypto VC firm Variant, said in a tweet that she is having “conversations with consumer crypto builders who feel dejected that the only way to grow an app right now seems to be to lean into speculation / essentially building a casino.”

But the implications of such an observation for crypto enthusiasts diverge significantly from McKenzie’s viewpoint.

While McKenzie sees these troubles as indicative of fundamental flaws, many in the crypto industry view the present-day landscape — replete with speculative ventures and casino-like dynamics — as a transitional phase on the road to an industry that lives up to its revolutionary promise.

This difference in interpretation underscores the gap between McKenzie’s more pessimistic outlook and the enduring optimism that many hold for the future of crypto.

NOW READ Recovering scammed assets should be easier with blockchain data but it’s not

They believe that the industry will eventually evolve, shedding its Wild West characteristics to emerge as a stable and genuinely innovative sector.

Inevitably, crypto offers ample fodder for criticism, yet the extent to which one must indulge in criticism becomes a matter of personal discernment. One passage described SBF saying that while he understood McKenzie’s negativity, “100% can’t be the right amount.” In retrospect, of course, this is a bit rich coming from SBF.

Some technical mishaps, but excusable

This book isn’t aiming to be a big-picture, weighty tome.

It isn’t meant to be a technically rigorous exposé of crypto in an attempt to try and prove its logical flaws — in a way messaging app Signal’s founder Moxie Marlinspike did in a famous 2022 post. (Also see Ethereum founder Vitalik Buterin’s response to Moxie here.)

McKenzie says early that the book consists of his “opinion of the events as I perceived them over the nearly two years I spent down the crypto rabbit hole.”

One potential drawback for the tech-savvy reader is that the book does contain several technical inaccuracies. For example, it describes MakerDAO’s stablecoin DAI as an algorithmic stablecoin, a term reserved for unbacked — or uncolleteralised — stablecoins, like TerraUSD that blew up in May 2022.

Algorithmic stablecoins rely on another token printed by the stablecoin issuer and propped up by market forces. DAI is backed — overcolleteralised — by a basket of cryptocurrencies unrelated to the stablecoin itself, a mechanism that helps maintain the stablecoin’s value relatively well.

NOW READ: Ethereum relies heavily on Amazon servers. Here’s why that’s a problem

While such errors might irk the more “degen” readers who are deeply immersed in crypto, can one really fault McKenzie or Silverman for these oversights?

After all, from crypto exchange Gemini to crypto news site CoinDesk, the same error is repeated across our industry. For a fact-checker not well-versed in the intricacies of crypto, navigating this industry can be like walking through a minefield.

But for the general public, these slips are minor; after all, no one’s expecting this to double as a technical manual.

And where McKenzie stumbles in his technical acumen, he shines in his human interest angles.