- Riot Platforms' proposed Bitcoin mine gets 'no action' from a Texas county.

- Bitcoin miners have found the Lone Star State a welcome locale, until recently.

- Residents have raised alarms around the industry's hefty energy and water use, as well as noise pollution.

On March 11, four county commissioners took their places in a courthouse in Corsicana, Texas, and delivered a blow to one of the world’s biggest Bitcoin miners.

The Navarro County Commissioners declined to approve a reinvestment zone for Riot Platforms’ newest operation, which would be the largest Bitcoin mining facility in Texas.

Their reason? The commissioner’s office received a slew of emails, text messages and even personal visits from residents opposing the deal, Navarro County Commissioner David Brewer told DL News.

None of the commissioners saw fit to move ahead with Riot Platforms’ request.

“If you want to know my personal opinion about it, I don’t think it’s a good investment,” Brewer said. “I think that they created a lot of controversy out there.”

While Riot Platforms can try again, the decision was striking in a state where municipalities, with an eye on jobs and economic growth, have rolled out the welcome mat for Bitcoin mining outfits in recent years.

Local leaders have deployed the same time-honoured tools they use to attract any industry — reinvestment zones and tax breaks.

Now, something has changed. Texans have been stirred to action. And that’s bad news for an industry poised to expand as Bitcoin gallops into a new bull market.

Outsized consumption

That Bitcoin mining is hitting a wall in Texas, of all places, is odd. It’s a state where residents happily coexist with oil drilling, fracking shale, and all manner of industrial activity.

What’s so objectionable about Bitcoin mining?

There’s been a lot of controversy around Bitcoin mining’s outsized consumption of water and electricity, of course.

But if Navarro County is any indication, some Texans are having a hard time seeing the benefit of doling out precious tax dollars to companies that provide little but headaches in return.

“Even though Texas is number one in Bitcoin mining, they have only created 2,000 permanent full-time jobs in all of Texas,” Jackie Sawicky, founder of the Texas Coalition Against Bitcoin Mining, told DL News.

“There are 15 million working Texans, and they have only created 2,000 permanent jobs. Why are we incentivising them?”

Riot declined to comment before publication of this article. After it was published, Riot sent DL News a statement that it continues to work on the application process for the reinvestment zone.

The company said it would “bring hundreds of millions of dollars in investment and hundreds of jobs to the Corsicana area if we ultimately move forward with our expansion.”

Bitcoin mining supporters say the industry stimulates a great deal of economic activity in the communities where facilities are based.

It takes electricians, plumbers, and other services to keep Bitcoin mining operations up and running, said Taras Kulyk, CEO of the mining hardware provider SunnySide Digital.

“Many detractors to digital mining often overlook the impact on ongoing trades needs,” Kulyk told DL News.

Big plans

Riot has big plans for its Corsicana location, which lies about an hour’s drive south of Dallas.

The operation, sprawling across 256 acres and expected to consume enough electricity to power all 22,078 homes in Navarro County 34 times over, is an important piece of the company’s growth strategy.

It’s also pricey. The mine is expected to cost more than $640 million to construct, according to Navarro County records.

This is why Riot sought approval for a reinvestment zone.

Property taxes, which are set by county commissioners each year, are 0.4329% this year, Commissioner Brewer told DL News. Riot’s abatement request sought to pay just half of that for the next 10 years.

Had it been granted, Riot would have saved almost $14 million over that period in taxes.

There’s nothing controversial about using tax abatements to attract industries. States, counties, and cities use incentives to attract manufacturers, distribution centres, shopping mall developments, and scores of other businesses.

What’s at stake in Texas is whether those deals are really benefiting residents as promised.

In exchange for perks like the zone Riot requested, companies are expected to employ local residents, increase tax revenue, and “strengthen other businesses” in the area, according to the Texas Comptroller.

“It’s an incentive for businesses to locate here in our county,” Brewer said. “They’re going to employ a lot of people, and when they employ them that’s going to help our economy as well.”

He said the completed site is expected to create 180 full-time jobs for local residents.

‘This facility is going to use more water than the candy factory, the glass factory, and the iron smelt.’

— Jackie Sawicky, Texas Coalition Against Bitcoin Mining

Moreover, communities must balance the infrastructure and services that businesses consume with the benefits they provide.

The cost of Bitcoin’s heavy energy consumption, for instance, is already a major burden for Texans, who have been enduring ever-hotter summers in recent years.

Bitcoin miners in Texas have increased the state’s yearly power bill by $1.8 billion, according to a simulation by data analytics provider Wood Mackenzie. That’s amounted to an average 5% increase in residents’ energy bills.

Never-ending noise

Then there’s the noise issue. Granbury, a town southwest of Fort Worth, has been coping with a constant thrum from a facility owned by Marathon Digital.

The cause is 80,000 whirring, air-cooled computers. Residents say the non-stop din is causing a slew of health problems.

In February, Charlie Schumacher, a company spokesperson, told DL News the firm was not aware of medical issues stemming from the noise. He said the company was committed to addressing the sound problem.

“There are people who are upset by this, and we need to go fix it,” he told DL News.

1.5 million gallons of water

Texans are also anxious over Bitcoin mining’s substantial water consumption.

Last summer, a record number of 334 people died from heat-related causes as temperatures soared. Several counties issued water restrictions for residents in 2023, and this year, state reservoirs are already approaching record lows.

Sawicky, the anti-mining advocate, said Riot’s facility is expected to consume 1.5 million gallons of water a day during the height of the summer. That’s more than other businesses in the area.

“This facility is going to use more water than the candy factory, the glass factory, and the iron smelt,” she said. “We have real industry here in Navarro County. This facility is going to be the number one water user in the county.”

Since the US is now a global leader in Bitcoin mining, the industry’s water consumption isn’t isolated to Texas.

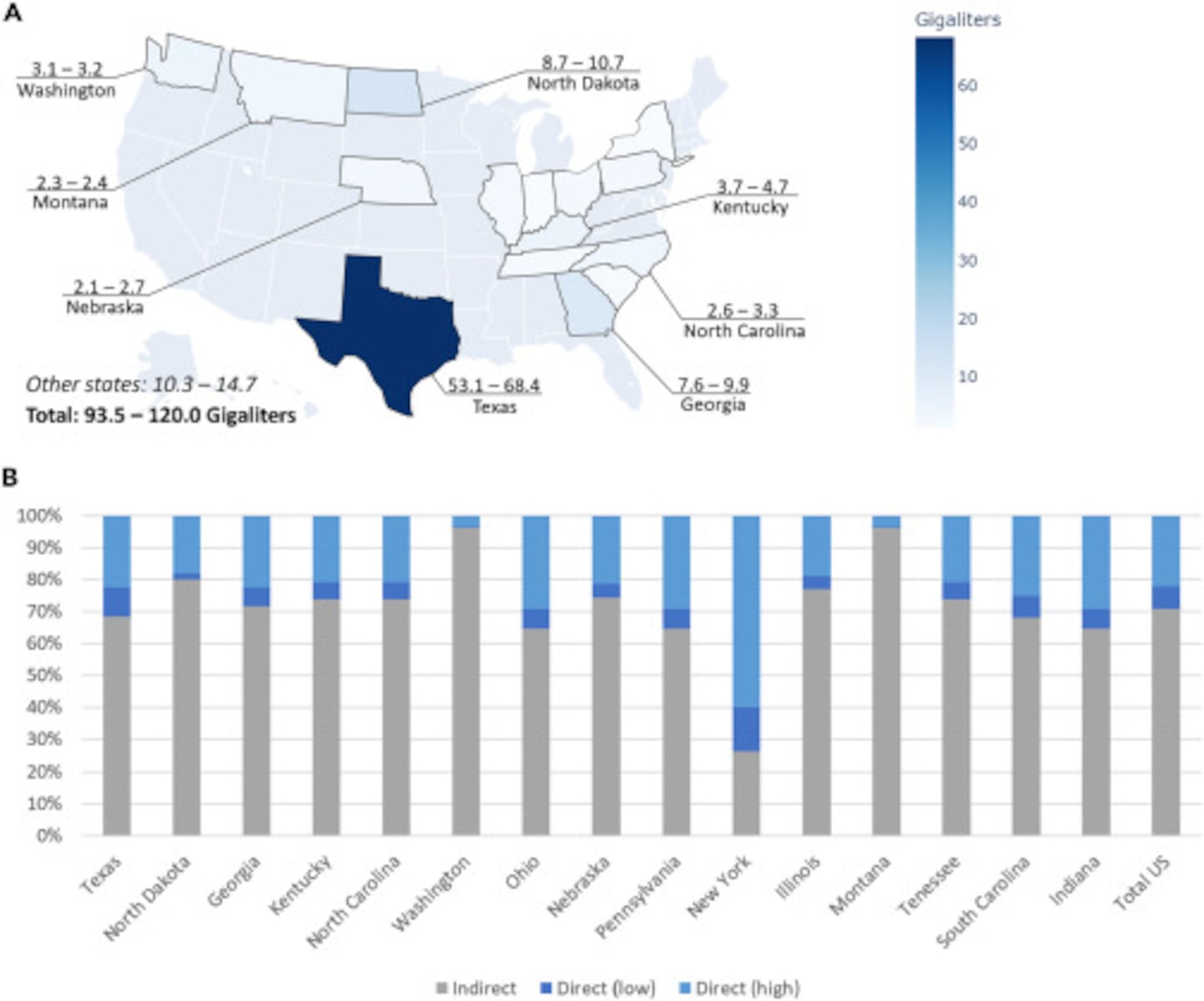

In a November study published in the journal Cell Reports Sustainability, data scientist Alex de Vries said that US Bitcoin miners consumed “an annual 93 to 120 gigaliters” of water via indirect and direct means.

That’s nearly as much water as Washington DC consumes, and the volume is expected to grow after Riot completes its massive Corsicana facility.

Once complete, de Vries’ analysis suggests the total annual water consumption may increase by another 30%.

Indirect water consumption refers to the water needed to generate electricity to power Bitcoin mines, while direct consumption refers to the water used for cooling machines on site.

Water moderates temperatures for both fan-cooled mining outfits via evaporation and immersion mines, which submerge machines in a water and glycol-based solution.

De Vries told DL News that the split between direct and indirect is comparable to traditional data centres.

“Twenty percent of water consumption is direct due to cooling systems on site,” he said. “The majority is indirect [consumption] because of the electricity you’re consuming.”

Social contract

Ultimately, the social contract between municipalities and the Bitcoin mining industry comes down to jobs and economic activity.

The problem is that crypto mining is largely a machine-driven industry with little need for human staff, claims some.

“Crypto mining is certainly not a labour-intensive industry,” de Vries said. “You don’t get a whole lot. It doesn’t generate a lot of extra business, and no one has to be near a Bitcoin mine. It doesn’t matter where the Bitcoin mine is located.”

Riot has a market capitalisation of $3.1 billion and 534 employees, more than half of whom are based in Texas, according to its latest financial filings.

Marathon, which has a market capitalisation of just over $6 billion, has a workforce of 60, according to its annual report.

A typical crypto mine generates around 10 jobs per year, according to an investigation by the non-profit groups Earth Justice and Good Jobs First.

SunnySide Digital’s Kulyk said that a 300-megawatt facility would employ “one to two full-time employees per three to five megawatts,” or somewhere between 60 and 200 employees.

‘If you want to know my personal opinion about it, I don’t think it’s a good investment. They created a lot of controversy out there.’

— David Brewer, Navarro County Commissioner

Kasia Tarczynska, a senior research analyst at Good Jobs First, said that no matter how many jobs a mine might create, it might not help local communities.

“Are these people from outside that come once in a while?” she said. “You create a position, and it’s filled by somebody from outside who flies in once a month and does a little bit of work and flies back to wherever they live. Or is the job for a local community member?”

In a two-page document seen by DL News and shared with Granbury residents, Marathon Digital said it will hire up to 30 local employees for that site, including one community manager, and generate $2 million in annual tax contributions.

Since taking over the site last month, Marathon has hired eight people, four of whom are Granbury residents, a company spokesperson told DL News.

As for Riot, it’s expected to come back for more tax abatement requests, according to commissioner Brewer.

Updated on March 22 to report a comment from Riot.

Liam Kelly is DL News’ Berlin correspondent. Contact him at liam@dlnews.com.