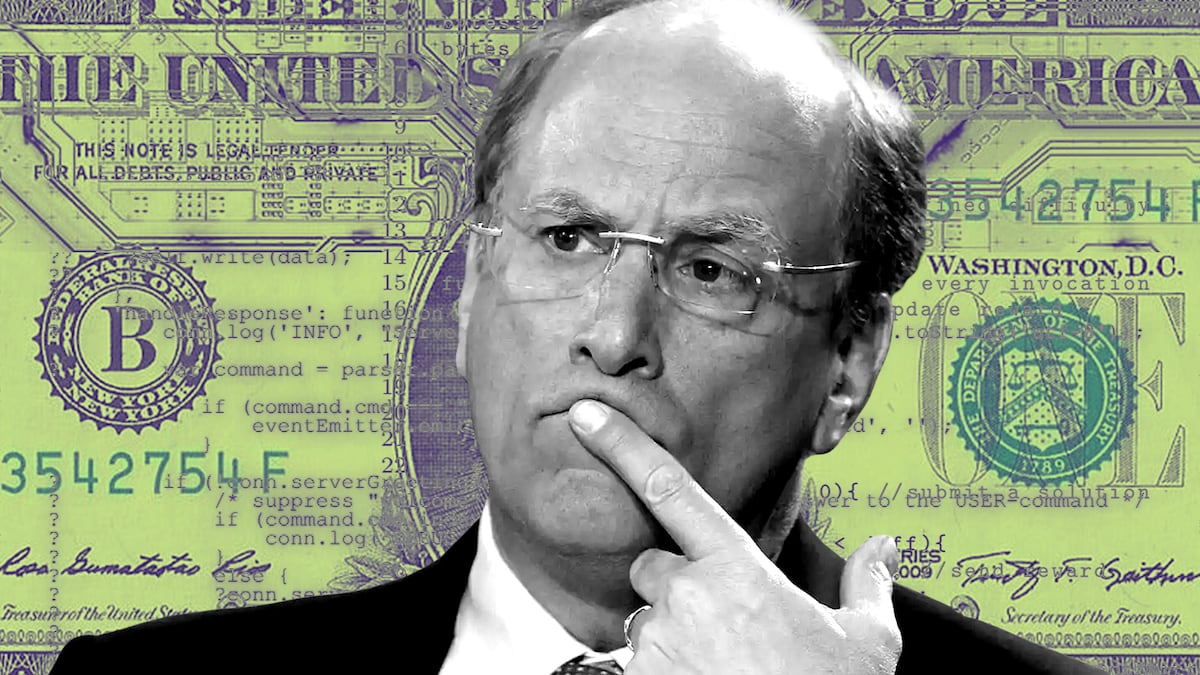

This week Larry Fink, the CEO of BlackRock, the world’s biggest asset management firm, embraced Bitcoin… again. Here’s how the once crypto-sceptical Fink came to be a believer, and how he’s supported a push to make the most valuable cryptocurrency a new mainstream asset class:

2017

- October 3: Fink tells Bloomberg TV that he’s “a big believer” in cryptocurrency, but that the market is rampant with speculation. Two months later, the market crashed and crypto entered a bear market dubbed “Crypto Winter.”

- October 13: In a CNBC interview, Fink says Bitcoin is “an index of money laundering,” and compares hype around the cryptocurrency to the Dutch tulip bulb craze of the 1600s.

2018

- July 16: Fink says BlackRock’s clients aren’t looking to buy crypto, and downplays BlackRock’s interest in the sector until it shows legitimacy and transparency.

2019

- April 3: BlackRock hires Robbie Mitchnick, a former marketing exec at Ripple. Mitchnick is now the firm’s head of digital assets.

- July 19: Fink highlights the need for a better system for cross-border payments, months into BlackRock’s exploration of the viability of Bitcoin and other cryptocurrencies. “I don’t believe we need a new international currency,” Fink tells CNBC, alluding to Bitcoin, “but there is a huge need to bring down the fees” of cross-currency transactions.

2020

- November 20: In a CNBC interview, BlackRock’s Rick Rieder, chief investment officer of fixed income, says crypto is “here to stay,” adding that digital currencies could take the place of gold as a store of value.

- December 1: Following a rise in Bitcoin’s price, Fink warns investors that Bitcoin could render the dollar less relevant. He said during an event hosted by the Council on Foreign Relations: “Bitcoin has caught the attention and the imagination of many people. Can it evolve into a global market? Possibly.”

2021

- January 27: When asked in an interview with Bloomberg Live about the potential for Bitcoin, Fink says, “We’re watching it; we’re enjoying the conversation. But it has not been proven yet.”

- October 13: Fink tells CNBC that he is “more in the Jamie Dimon camp,” referring to the JPMorgan CEO’s bearish stance on Bitcoin’s value. In an interview the day before, Dimon called Bitcoin “worthless.” Fink reiterates his excitement for a potential “huge role” digital currency may play for consumers.

2022

- Feb 9: CoinDesk reports that BlackRock plans to allow cryptocurrency trading on its internal Aladdin investment platform.

- April 7: In a speech at Miami’s Bitcoin 2022 conference, billionaire Peter Thiel lumps Fink in with Dimon and Berkshire Hathaway’s Warren Buffett as “enemies of Bitcoin,” and accuses them of suppressing the asset’s price.

- April 12: BlackRock becomes an investor in a $400 million funding round for Circle, which issues the stablecoin USDC.

- April 13: Fink confirms that BlackRock is researching cryptocurrencies and is becoming the primary holder of Circle’s cash reserves. “We are increasingly seeing interest [in crypto] from our clients,” Fink says.

- March 24: Fink says in a letter to investors that Russia’s invasion of Ukraine could accelerate the adoption of digital currencies, by prompting nations to “re-evaluate their currency dependencies.”

- August 4: Crypto exchange Coinbase announces a partnership with BlackRock to offer crypto trading services to investors on BlackRock’s Aladdin platform.

- August 11: BlackRock announces the creation of a spot Bitcoin trust for institutional investors.

- November 30: Fink reveals that BlackRock invested $24 million in FTX, the failed crypto exchange, and says at an event hosted by the New York Times Dealbook that “it looks like there were misbehaviors of major consequences.”

- November 30: Fink says at the same event that “the next generation for markets … will be tokenisation of securities.”

2023

- June 15: BlackRock files for a spot Bitcoin exchange-traded fund, or ETF, with the SEC for its BlackRock’s iShares Bitcoin Trust. The trust designates Coinbase Custody as its custodian.

- July 5: Fink tells Fox Business that BlackRock is trying to “democratise” crypto by making it more affordable to purchase and trade. Fink predicts crypto will “outshine” global currencies in 2023.

- October 16: In a Fox Business appearance, Fink says BlackRock clients are showing heightened interest in crypto, and attributes the day’s rally to a “flight to quality” amid global tensions surrounding conflicts such as the Israel-Hamas war.

Related Topics