- Aiden Pleterski has been under investigation for 18 months.

- While bankrupt, he travelled the world and spent lavishly.

After an 18-month investigation and an alleged $30 million ($40 million CAD) in missing investor funds, Canadian authorities arrested self-proclaimed “crypto king” Aiden Pleterski, charging him with fraud and laundering criminal proceeds.

An associate, Colin Murphy, 27, was also arrested and charged with fraud. Both Murphy and Pleterski are Ontario residents.

“In July of 2022, the Durham Regional Police Service began receiving complaints about investment fraud involving a gentleman by the name of Aiden Pleterski and AP Private Equity,” Peter Moreira, chief of Durham Police, said in a press conference.

“It’s alleged that Pleterski solicited funds from investors promising massive profits and also guaranteeing no loss from the original money put out by investors.”

Investors came to the police after they could not access their money, said Moreira.

The Durham Regional Police and the Ontario Securities Commission (OSC) began discussions into the investigation, which was dubbed Project Swan, in October 2022, said Stephen Henkel, a senior investigator with the OSC.

“The size of the alleged fraud was massive and it spanned across multiple jurisdictions,” he said.

The 25-year-old Pleterski made his $100,000 bail and has been released into his parents’ custody. The bail conditions include a ban on posting on social media to solicit investment and handing over his passport, according to the CBC.

Living large and bankrupt

In August 2022, Pleterski’s company, AP Private Equity Limited, filed for bankruptcy.

Despite the bankruptcy, Pleterski continued to travel the world, lavishly spending on cars and at least one flight for a woman in Australia, and launched a fledgling live-streaming channel.

Extensive social media posts show him driving a Lamborghini, attending a boxing match, and soaking in the sights in England.

Meanwhile, investors have been trying to track down over $40 million Canadian — they collectively gave him to invest on their behalf.

Investors expected Pleterski to invest the money in cryptocurrencies and foreign exchange.

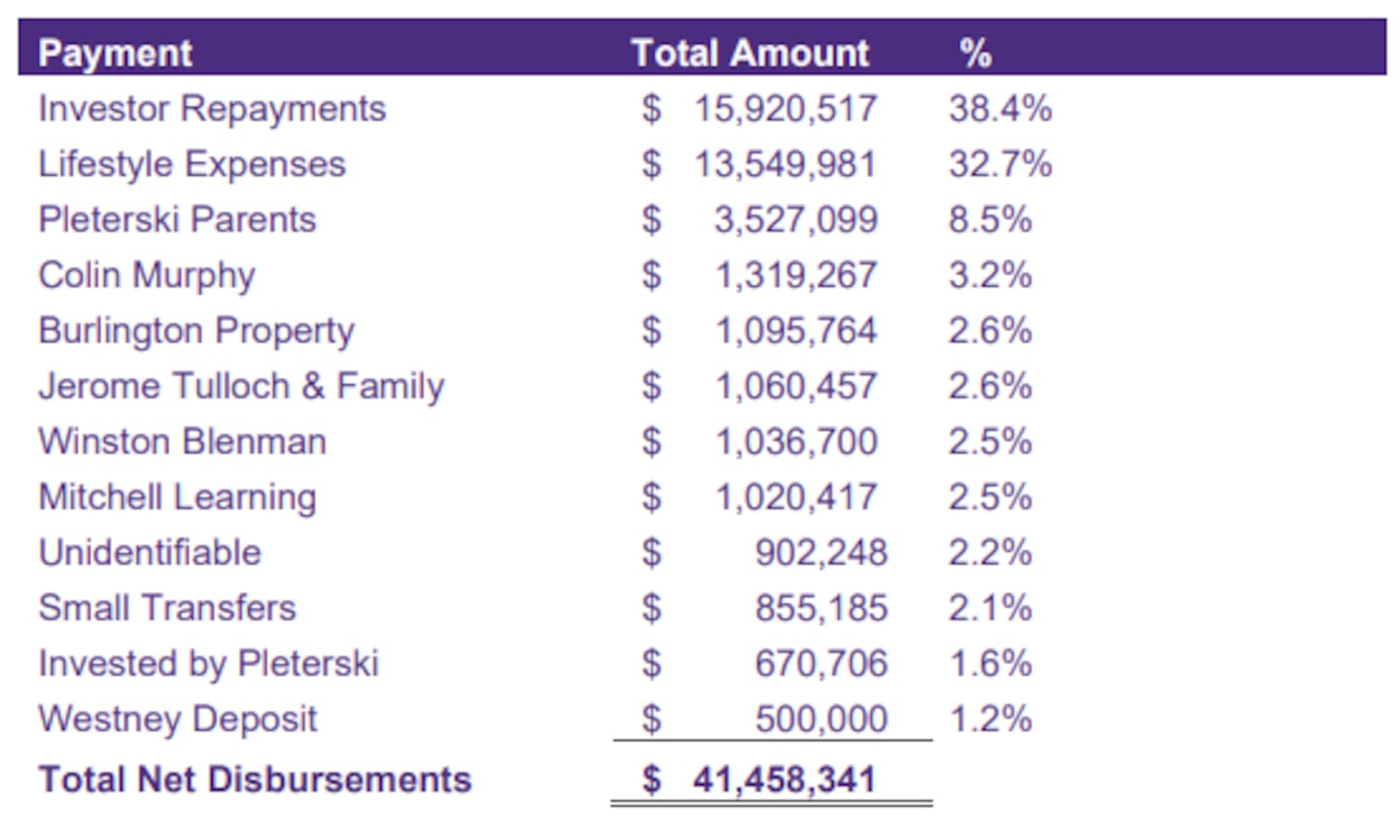

Grant Thornton, the trustee overseeing the bankruptcy proceedings, indicated in October 2023 that less than 2% of the money sent to Pleterski was ever used for investments.

Nearly a third of that money was spent on “lifestyle expenses,” according to the trustee.

Liam Kelly is a DeFi Correspondent at DL News. Got a tip? Email at liam@dlnews.com.